Anatomy of a Tamagotchi Market

Sometimes Yellen gets more than what she wants

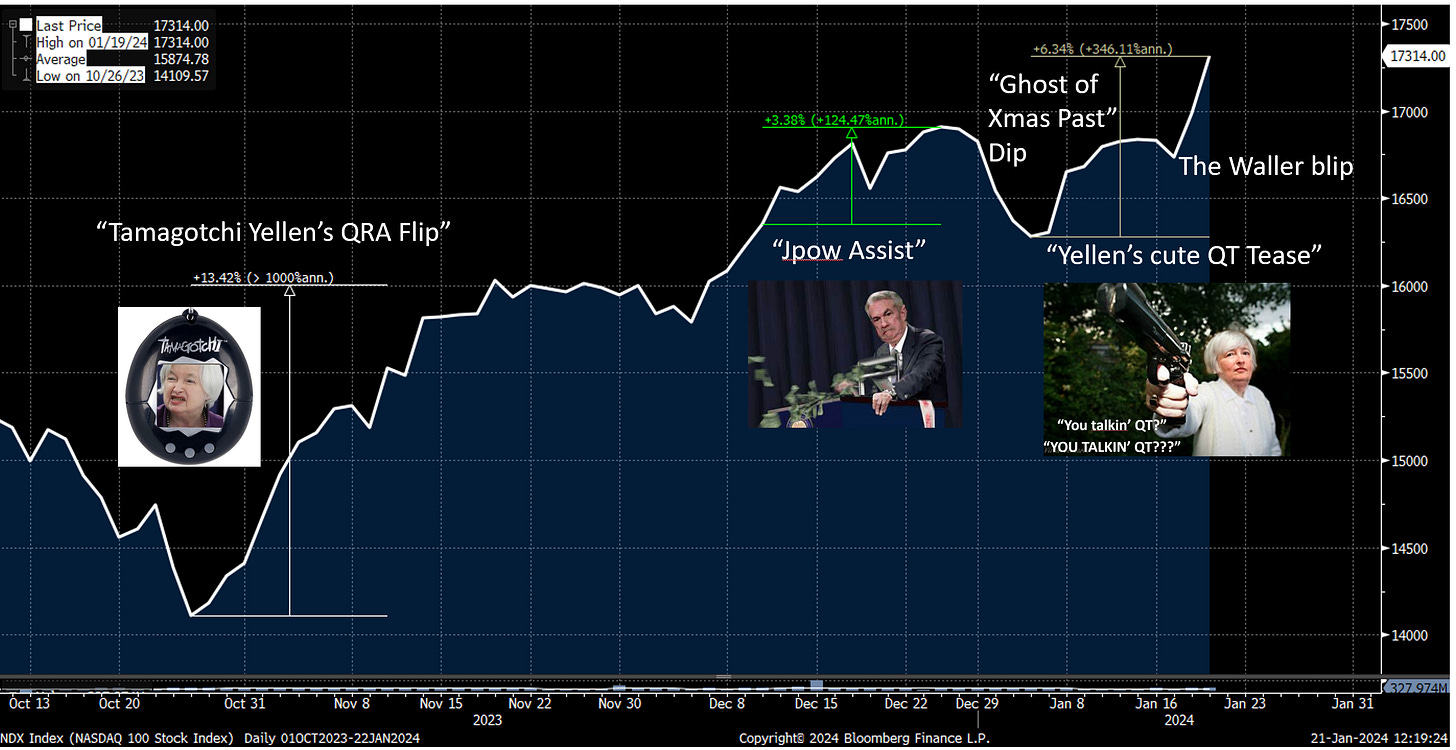

The last couples of days have been so wild, I thought I’d break down how we got here. The masterful visual below should help.

October 30th, Yellen decides to print a ton of bills as part of the QRA and “Tamagotchi Yellen” is born. The Market subsequently has a +13% rally in a month, in a way that only someone with the unholy powers of Yellen can achieve.

December 13th, JPow delivers a Double Whammy with a dovish tone and gives a further +3-4% rally. Nothing like what Yellen can achieve, but respectable.

Jan 2nd, the “Ghost of Bubbles Past" pays a visit to Janet & Jay to tell them to cool down a bit otherwise there would be unintended consequences.

Jan 6th, Tamagotchi Yellen & the Fed drop a bomb with Yellen’s Cute QT Tease where Lorie Logan said that the Fed should slow QT (yes, I know that this is the Fed’s job, come on, play along). The market RAMPED because it matters. Read that Shrubstack, it was a good one.

As I said at the time of the QT tease, what struck me was the “Reaction Function” of Tamagotchi Yellen in that case: the SPX was only down 2% from its all-time-highs and yields were at 4% so why the rush? My conclusion was that she just wanted to have this bazooka in her arsenal for when the timing is right.

So when Waller and the other Fed Bloodhounds were sent to cool off the animal spirits by warning that the market is getting ahead of itself in terms of rate cuts expectations, I got sucked in into believing “they” wanted to cool off things for a bit.

Boy was I wrong.

Add a sprinkle of “Options Expiry” and “Dealers being Short” into the Expiry on Friday, and what was looking like a Double Top turned out to be a Breakout. And to remind ourselves of the now infamous quote:

- What’s the difference between shorting a Double Top vs shorting a Double Top that turns into a Breakout?

- A Margin Call

- Le Shrub, from “Reminiscences of a Shrub Operator”

I’m annoyed with myself that I questioned Tamagotchi even for a few days. But I genuinely thought they were going to be sensible and try to cool things off a bit so they can ACTUALLY cut rates in March.

And then I remembered the whole analysis I did on PLEBFLATION vs WEALTHFLATION:

Does Yellen & Fed really care about cutting rates with market at all-time-highs?

The answer is, NO, not really. Tamagotchi Yellen’s reaction function only cares about Plebflation trending lower and is super happy with Wealthflation trending higher at the same time! Everyone’s a winner!

Tamagotchi Yellen has one last chance to cool things off before the inevitable ramp to Election Date: the QRA on Jan 29th.

If I were her, I’d use this window of market strength to issue a lot of coupons and catch up with my issuance obligations. But I’m not counting on her being sensible anymore and the market doesn’t either. The market monkeys are waiting in the sidelines with “SPX 5000” hats!

As for me, my conundrum is that $NDX reached 17,300 and that’s the target I had in mind back in November.

Never mind that anything outside of Nasdaq didn’t trade particularly well this week. And even a certain AI+robot+car company is down 14% ytd which is more than China, and that’s an achievement by itself! (anyone else notice that?!).

So it’s a tough set-up and results season is just starting. Don’t Be Stupid and don’t let your guard down!

Disclaimer:

This isn’t financial advice. This is the equivalent of reading MAD magazine but for finance but worse: This is the trading blog of a shrub.

Don’t be Stupid. Seriously. How many times do I have to repeat this ….

Love the visuals!

As we approach QRA, one metric to consider is Biden’s approval rating. It really sucks, so more bills please...

I guess the real question is, will they be able to continue to ramp up activity without pushing inflation higher. inflation is going to be a much bigger problem for Biden than the stock market I think