The "Ghost of Bubbles Past" pays a visit to Janet & Jay

The time to buy is when there's Blood in the Tweets

“The time to buy is when there’s blood in the Tweets” - Le Shrub, from “Reminiscences of a Shrub Operator”

Welcome to another edition of Shrubstack, where we partake in surreal activities such as imagining conversations between Janet and Jay, as a way to conceptualize the current trading environment for traders with ADHD and not only. It’s like Monty Python for traders. But not as funny.

PS If you think this is silly and childish, just remember that Janet ate “magic” mushrooms during her last visit in China, and she runs the global monetary system. Therefore, a certain dose of surrealism is needed to figure out what’s going on here!

PART 1: The “Ghost of Bubbles Past” pays a visit to Janet & Jay

Today we introduce a seasonal character in the Shrubverse: “The Ghost of Bubbles Past.”

Let’s imagine that this particular Ghost pays a visit to Janet and Jay during Xmas (If this is too much for you to imagine, you can revisit this Shrubstack after a long night out, it might make more sense then).

The Ghost pays a visit to Tamagotchi Yellen first.

Ghost: “Janet. How many times do I have to visit you, it’s like you never learn! This is getting ridiculous. You need to put an end to this, or you’ll make this bubble worse than 2021, if that’s even possible!”

Tamagotchi Yellen: “Save the Ponzis, Save the Plebs”.

Ghost: “Janet, be serious, you will hurt the Plebs again. They are out there buying crypto again!”

Tamagotchi Yellen: “Save the Ponzis, Save the Plebs”.

Ghost: “Ok since you evidently don’t care about the Plebs, take a look at this chart” <Ghost pulls a chart of the Treasury auction sizes for 2024>

“Janet, you forgot you need to issue 23% more treasuries in 2024? I know what you’ve been doing lately. You eased financial conditions enough to bring down yields below 4% so you can stuff the monkeys with your paper. But if you ease financial conditions even more, you risk easing too much and bonds may sell off again … BEFORE the elections! And that doesn’t suit you, does it?”

Tamagotchi Yellen: “Fine. I’ll take the foot off the pedal just a little bit. Pinkie promise” <Janet crosses her fingers behind her back>

Next, the Ghost pays a visit to Jay.

Ghost: “Jay, I know you are reasonable, unlike “her”, so I’ll keep this brief. That pivot of yours with Janet, has led to “the biggest two-month easing in financial conditions in history, surpassing the announcements of QE1, 2, 3, and so on. The market has priced in 136bps, or 5.5x rate cuts since the start of November.” <chart below per Zerohedge>. I know you mean well, but people are yolo-ing their savings again. At the very least, you should issue a warning, cool them off a bit. Otherwise, next time I’ll send you the Ghost of Arthur Burns to haunt you.”

Jay: “I hear you loud and clear. I’ll fire a couple of warning shots. The next Fed meeting is Jan 31st, but I’ll send a few of my bloodhounds to lay the groundwork”.

Which brings us to:

Part 2: The setup for entering 2024

While others focus on predicting 2024, I focus on predicting January 2024 because sometimes it presents really obvious setups.

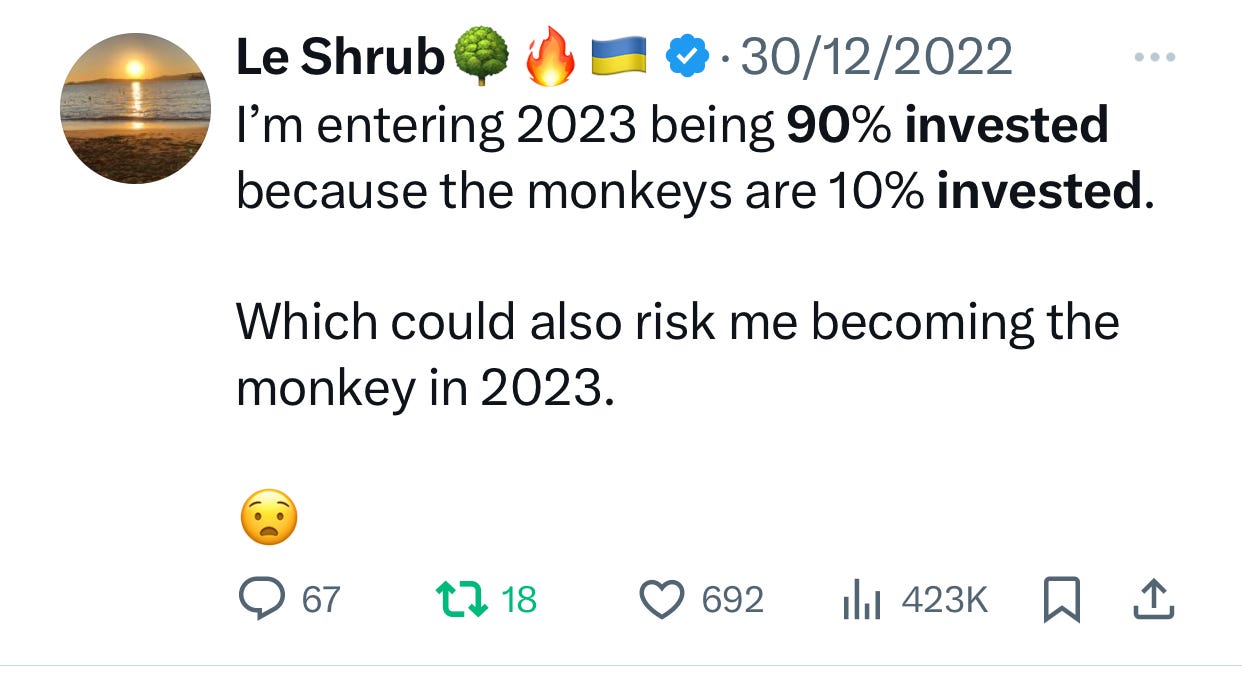

This time last year in Dec 2022 for example, it was obvious that market participants (aka “the monkeys”) were VERY underweight Equities. There truly was BLOOD in those December 2022 tweets! So I came into the new year very heavily invested to take advantage of their re-grossing into the New Year.

This time round, in Dec 2023, it’s like we have almost the opposite setup, with the Chubby Telettubby Automatons (CTAs) now very long, Retail back in the game, Crypto on fire, Biotech M&A through the roof and the Market hitting DeMark technical sell signals as we enter the New year. The chart below is courtesy of my bud @TommyThornton who runs Hedge Fund Telemetry. If you notice, we also got DeMark sell signals in December 2021 as we entered 2022 and that didn’t go well for the complacent longs.

I would of course highlight one very important difference:

In Dec 2021, the Fed had to deal with RISING inflation and now they are dealing with DECLINING inflation (I went through the difference in the setup here in “The Ghosts of Christmas Past” which was a preview of the December Fed meeting).

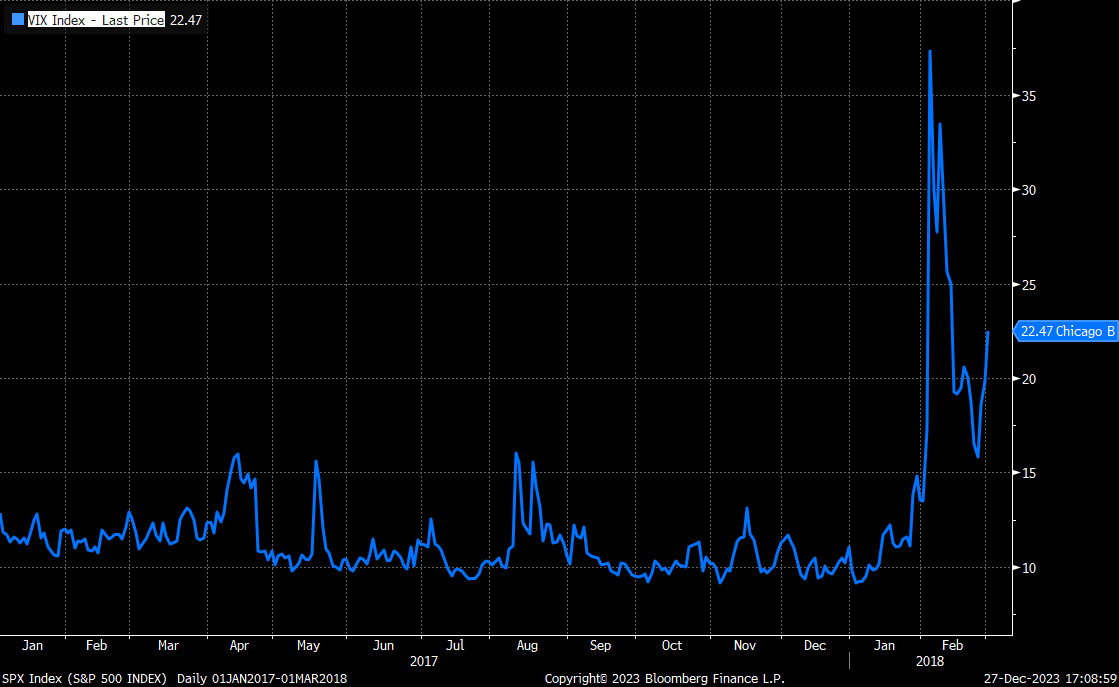

So, I'll put aside the December 2021 comparison for now. Instead, I’d like to remind you of December 2017 / January 2018: In 2017 the market enjoyed a +20% rally (almost comparable to this year) with a steady VIX in the 10-15 range all year, which gave the monkeys comfort to go “all-in” into 2018. The SPX subsequently had a +7-8% climactic rally in January 2018, which concluded with the “Volmageddon” crashfest and a 10% correction.

The VIX chart below at the time. Looks like a Minksy moment that unfolded violently.

Will this time round be like December 2021 or will it be like December 2017?

Frankly I don’t know. And it’s a bet that I’m not really taking so I’m quite relaxed. Most of my equity exposure is in commodity-related stocks and, as per the Prime Broker data, it seems the monkeys don’t like these stocks for 2024 so my portfolio might have a chance.

And the only Market where there is “blood in the tweets” is China. So, I have to remain positioned there accordingly via call options (you can argue that “China Dec 2023” feels similar to “Tech Dec 2022” but it’s a pretty big difference comparing a free market run by a lady on magic mushrooms with a command-driven economy, so let’s not get too far ahead of ourselves!)

Summary for Traders with ADHD:

Tamagotchi Yellen disregards the pleas of the Ghost of Bubbles Past and will remain on a Re-Election Cycle easing binge, determined to "Save the Ponzis, Save the Plebs”.

Jay Powell, at some point, will likely heed the warnings of the Ghost of Bubble Past and will fire a few warning shots that will add volatility. But with Plebflation declining, he’s not particularly concerned either so don’t expect major fireworks from the Fed during a Re-Election Cycle.

The market is flashing sell signals reminiscent of December 2021. But back then we had RISING inflation Vs now we have DECLINING inflation.

Similar to December 2017, the monkeys are getting greedy and complacent enough for a possible climactic rally in January that may end in a sharp sell-off (especially if Jay’s conscience kicks in before the Jan FED meeting!)

Commodities might remain a safe haven since the monkeys are focused on Ponzis, and Janet is sacrificing the Dollar for her Re-Election Cycle easing binge.

“The time to buy is when there’s blood in the Tweets”. And the only market that has “blood in the tweets” into 2024, is China.

Disclaimer:

This isn’t financial advice.

This is the trading blog of a shrub.

By now you should know: Don’t be Stupid.

Like, seriously … Don’t be stupid …

the satirical comedy of a shrub is one of the things I am grateful to have discovered for 2023. Thank you Thank you Thank you.

I am stilll confused. can someone share what yellen did that cause financial conditions to ease? not disputing the point, but no idea what mechanism she pulled.