Tamagotchi Yellen's Cute QT Tease

The Re-Election Arsenal just got bigger

Just when I wanted to move on and focus on better things, the Re-Election Brigade (led by General Yellen) pulls another rabbit out of the hat and draws me back in the macro arena. This time “they” brought out Lorie Logan, the Fed’s plumbing expert, and their weapon of choice this time is “Quantitative Tightening” aka QT, which sounds a lot like “Cutie” but is anything but cute.

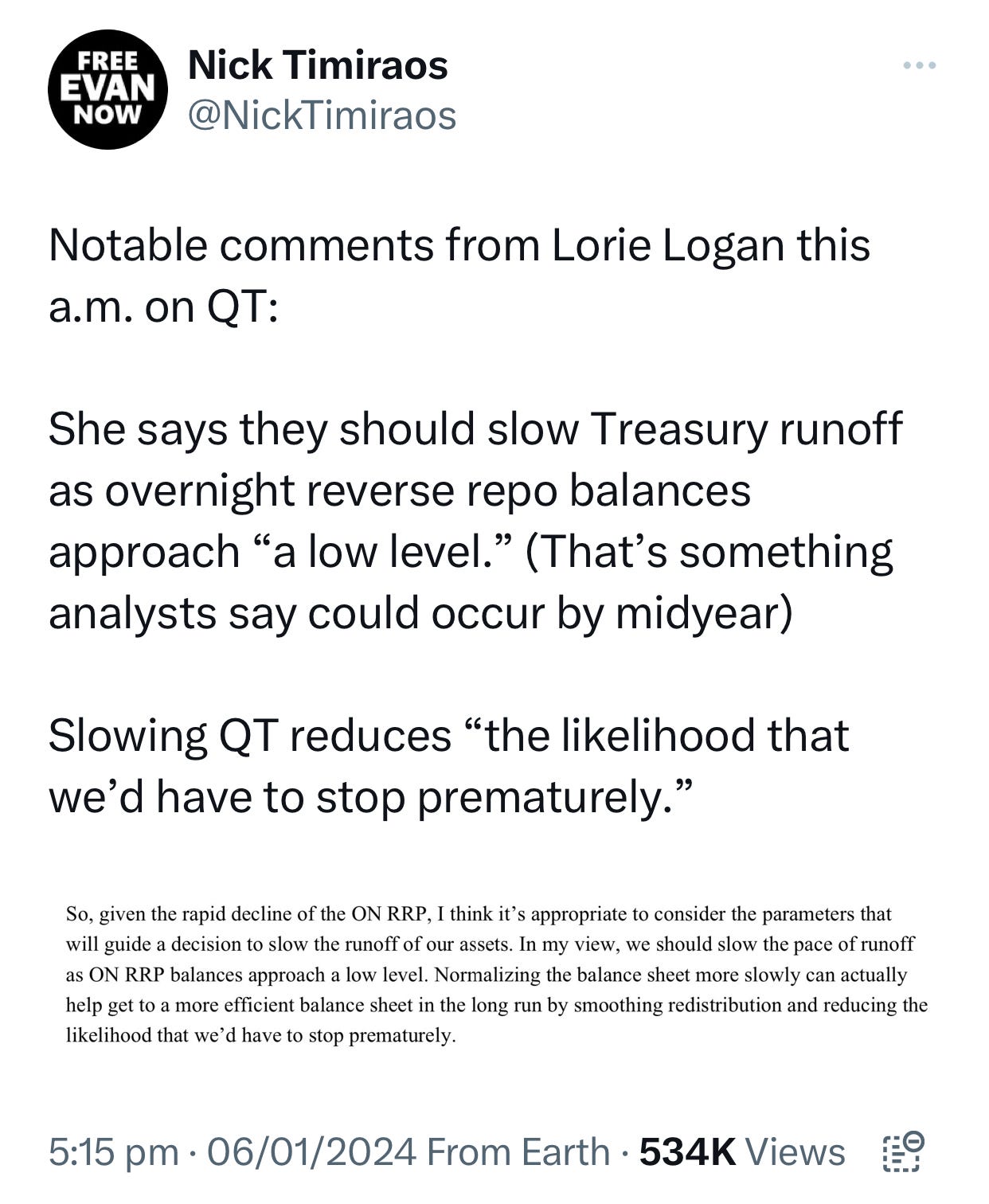

Over the weekend, Lorie Logan said that the Fed should slow QT since the RRP account came down to a low level (the Overnight Reverse Repo Facility, or ON RPP, is basically a measure of liquidity and it came down from $2 trillon to $700 billion):

As a reminder, the Fed’s balance sheet still contracts by $95 billion per month.

The Fed did mention in the December minutes that they are discussing what it would take to end QT. And the market has had a range of expectations that QT would end this summer or even December 2024.

Getting this timing right is a pretty big deal.

For example, as per BofA, if QT ends in June, coupon issuance this year (ie bonds ex-Bills) will be $1.8 trillion. But if QT ends in December, it will be $2.1 trillion. That’s a $300 billion difference. A friendly reminder that the Treasury’s QRA announcement on 1st Nov 2023 (the Treasury’s quarterly refunding schedule), created a massive rally in all assets just because Yellen said she will issue $50bn less bonds than the market expected. So yea, the QT tease timing matters.

When I saw this QT / Laurie Logan / Timiraos combo tweet, various conspiracy theories started circling through my head again. I had to ping my good friend Conks Concoda on a Sunday morning, because he knows more about financial plumbing than any other living being:

“This taper torpedo is 6 months early right? So precisely on schedule for pre-election liquidity boost no?”

KISS. What a legend.

There’s a reason I’m paranoid about this.

But first, let’s remind ourselves of a central character in the Shrubverse: Tamagotchi Yellen (first introduced in this seminal piece: "Wealth-flation vs Pleb-flation" )

“Tamagotchi Yellen” is an elegant (and frankly hilarious) way to visualize the Reaction Function of “Policy Makers” (“Tamagotchis” are those virtual pets that you have to keep “happy” by feeding them just enough food and petting them once in a while):

As long as Pleb-flation is below <4%, Tamagotchi Yellen is “happy”, and she can keep the Fiscal taps running and the Fed can keep monetary policy loose.

But when Pleb-flation rises >6%, then Tamagotchi Yellen is “angry” and has a “tantrum”.

What we haven’t discussed so far is that “Tamagotchi Yellen” is a complex animal and her reaction function doesn’t just rely on a single input such as “Pleb-flation”.

For example, as her action in the November QRA indicates, the input “10 year bond > 5% yield”, is a big red line for “Tamagotchi Yellen” and it merits a strong response.

Which brings us to today.

The first week of the year was rocky for most assets. But the S&P is only 2-3% off its all-time-highs and the US 10 year is at 4% (a whole 100bps below the 5% yield “red line” that it was just a month ago!).

So what exactly was the input to trigger Yellen’s reaction function?

My guess is that she just wants to have this bazooka in her arsenal for when the timing is right.

After all, she’s the Queen of Surprises.

Think about how many rabbits she pulled out of her hat in the past year, managing to inject liquidity in the system DURING QT and WHILE Rates were at 20-year highs:

Drained the TGA (Treasury General Account) and pumped the markets

Tweaked the QRA and pumped the markets

Introduced the BTFP (Bank Term Funding Program) and pumped the markets

The purists among you will scream that this wasn’t Yellen’s doing, it was partly the Fed’s. Does it really matter? The end result is the same. And just name me ONE Wall Street strategist that was banging the drums about the market impact when Yellen was using and abusing the TGA / QRA / BTFP. Not one.

So forgive for being paranoid about this cute QT warning shot that was give over the weekend. History tells us we should pay attention to their cute games!

Summary of Traders with ADHD

Figure out what Yellen wants and you’ll be ok

Disclaimer:

This isn’t financial advice.

This is the trading blog of a shrub.

Don’t be Stupid.

It seems those comments were done already before, anyway the QRA should be the next important appointment https://x.com/thecarter758/status/1743962104275554812?s=46&t=Wy7pOGeSP2o3ZuI2ylzWpw

Will the market price in Yellen’s bazooka in the next 1-2 weeks? I mean risk, such as SPX