August --> September

Plus, New Event Trade!

August is now behind us and it was a wild one: The S&P finished the month +1.2% … with a 9% drop from the all-time highs followed by an 8% rally. Anyone remember the Yen Carry Trade? Those that got margin-called certainly do. A moment of silence for our fallen comrades…

Below is a summary of Shrubstack’s positioning during August:

We prepared for “Election Volatility” in July and for Rotation from Nasdaq to laggards such as the Russell (“What If?”)

We closed the hedges early August and we ran the book 70% long as we urged for NO PANIC on Yen-pocalypse day (“Election Volatility - Addendum”)

We added back hedges in mid-August and assumed the “Fetal Position” that we are still in: High Cash Balance with hedges on (see here for the structure of the Election Hedge)

Now lets review how Wall Street and its Monkeys behaved in August:

Max Long into August (“It’s an Election Year bruh!”)

Panic sold & Margin-called in early August (“We aren’t oversold enough yet for a real bounce” - actual quote by Jim Cramer at the August lows!)

Max Long in late August into September (“It’s an Election Year bruh!”)

Really, it’s a joke. If you think I’m exaggerating, go through the positioning data in the relevant section in “Shrubenstein”. The hedge funds did sell the lows and then had to chase the highs…

Seasonality

We welcome September with open arms, cognisant of the fact that September Seasonality is even WORSE than August…

…even in Election Years when the sitting President is NOT running… (h/t to my buddy Paulo for the chart)

…and a friendly reminder that “Election Volatility” usually has two bouts of volatility…one in the Summer and one just before the Election. Worth reading the piece again!

Why does “Seasonality” play out in September? There is a simple reason:

“Seasonality” is just another way of saying that the monkeys are back from vacation”

- Le Shrub

This dynamic shows clearly in the Credit Markets:

September is usually the 2nd biggest month of the year for corporate bond supply, with $135bn of issuance on average in the past 4 years (source: BofA)

Unlike the Equity Monkeys, who usually get margin-called during the Summer months, the Credit Monkeys do like to take proper Holidays and there is a backlog of new paper that waits for them when they come back after Labor Day. As a result, the Credit Market does tend to have a pretty bad September AND October, as the new paper gets digested.

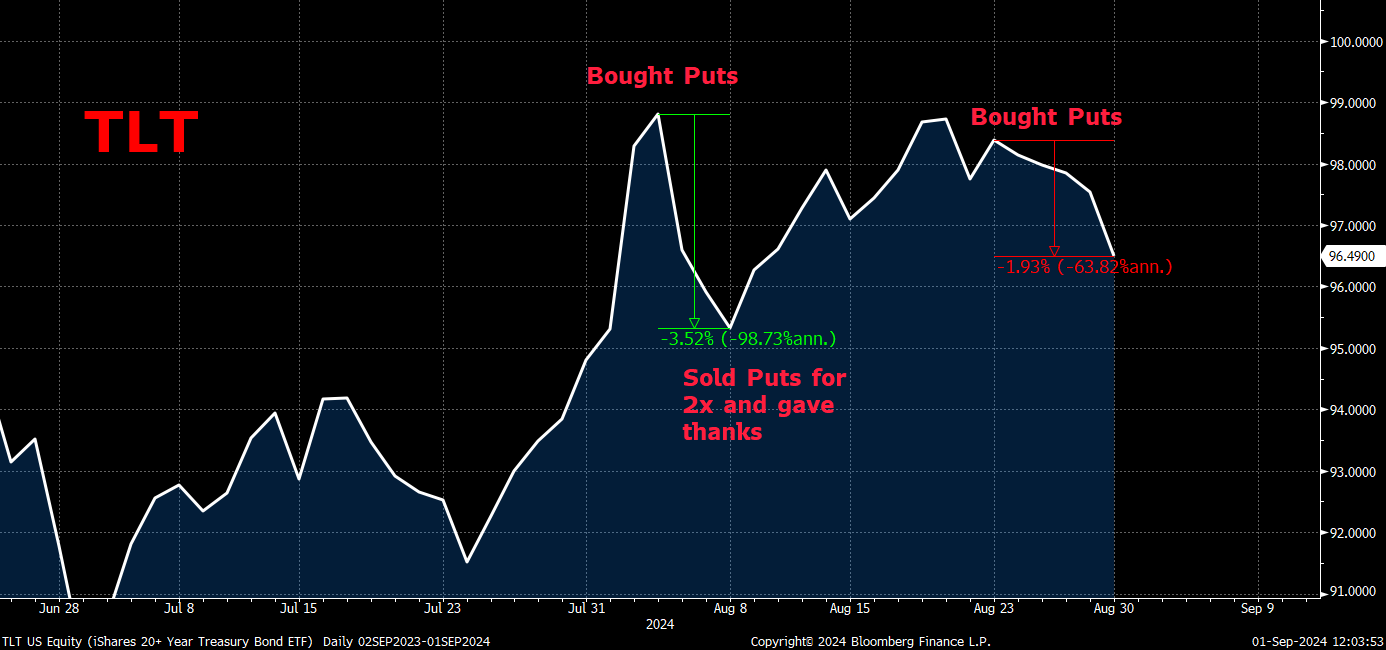

Take a look at the Seasonality chart of TLT (Ultra-long Bond ETF) and note that during the last 10 years, there were only TWO out of TEN instances of positive returns for TLT in September and also in October!

Reminder that we bought TLT puts again, since it neared $100..again….

TLT is already down 2% since. But what could be the catalyst for a bigger move down?

How about another….

Fake Jobs Report, Incoooooming!!!

On September 6th, we will get the Non-Farm Payrolls for August. This time round, the Policy Makers’ Dilemma becomes even stronger:

Do they report strong data so that Kamala / Biden stand on the podium to take credit for the strong jobs market?

Or do they report weak data, just before a key Fed meeting, so that the Fed can kickstart the Rate Cutting Cycle with no hiccups?

Seasoned Shrubstack readers would guess by now that the answer is: “Why not Both?”

Here’s how “they” can “fake” the jobs data with style:

“Private” Payrolls will probably come in weak (ie non-government jobs)

But “Total” Payrolls will probably come in strong because of… “Seasonal Adjustments” (i.e. a made-up adjustment that lifts up the total number)!

Watch it…

Reminder that this is a parody publication, so it would be hilarious if it actually plays out that way!

September: New All-Time High or “Sell the News”?

The question we get most often is whether the Market will reach a new All-Time-High or “Sell the News” at the first rate cut.

Once again, the correct answer is: “Why not both?”

After all, that’s the most hilarious outcome and the Market does have a sense of humor!

Here’s how:

The Fed Meeting is on Sept 18th and even my barber knows they will cut rates (incidentally, he is still long NVDA and I’m not joking)

Monkeys NEVER sell before a major Event (They think they are smarter than the other Monkeys and that they will get a chance to sell first)

Then the Event takes place and all the Monkeys will rush to sell at the same time

This is the Way of the Monkey!

…which is precisely what happened on 18th September 2007! In a previous post with my buddy Eliant, we presented the similarities of 2024 with 2007, as per below:

We make it clear that 2024 isn’t 2007 but it’s a good illustration of a “Sell the News” event!

NVDA - Sell the AI News!

Speaking of “Sell the News”, NVDA results are finally out of the way, and, as we anticipated, the major winner was Kenny G (aka the Market Makers): Billions of dollars worth of Option Premium evaporated as NVDA finished the week close to the “Max Pain” level of $120 (the level where most options lose money).

The results were great but the Stock lost 7% on the print. If you want to know the reason it sold off, please read the “Way of the Monkey” thought-process from above…

I find it utterly ridiculous that there were even “Nvidia Watch Parties” taking place around the World, so that the monkeys could watch the results in troops. I bet you that the After Parties sucked…

AI Gets a Major Milestone: its first AI Fraud!

NVDA’s results weren’t the most important news in AI last week:

On August 27th, our favorite psychological short, SMCI, was attacked by Hindenburg for accounting manipulation

By the next day, SMCI delayed the filing of its annual report

Ironically, in the movie Terminator II, on August 29th 1997, Skynet becomes self-aware and starts a nuclear war that annihilates most of humanity.

I think we need to re-write that storyline: