Shrubenstein

Missing Jobs! Jackson...Hooooole Review! Positioning Data Update! Trump Trade 2.0! Rotation Trade 2.0! Bagholder Trade Update!

Today’s Shrubstack feels like Frankenstein’s Monster; an amalgam of random themes, both micro and macro, that normally wouldn’t fit together:

Missing Jobs & other Conspiracy theories

Jackson….Hooooole Review

Positioning Data Update (Monkeypox Part II)

Trump Trade 2.0 (or is it 3.0?)

Rotation Trade 2.0

and finally an update on our Event-driven trade, affectionately known as the “Bagholder Trade”!

We have created a Monster! And we like it…

The Missing Jobs

On Wednesday, the Bureau of Labor Statistics released their annual benchmark revision of employment data* (*Every year, the BLS conducts a revision to the data from its monthly survey of businesses’ payrolls, then benchmarks the March employment level to those measured by the Quarterly Census of Employment and Wages program).

The revision suggests that there were 818,000 fewer jobs in March 2024 than initially reported.

To put this into context, this is 25% of the annual job formation, and constitutes the largest downward revision since 2009!

Another way of looking at it, when spread through the prior year, the monthly job gain from April 2023 through March 2024 was 173,500 versus 242,000...

We found the comments around this revision quite hilarious. One genius economist downplayed it and said that “this is really just a counting issue”. No kidding buddy…they counted it wrong, we know….he must be yet another economist who flunked his Mafs test…

Policy makers also came out to to share their “wisdom”:

*BOSTIC: PAYROLL REVISION DIDN'T REALLY CHANGE JOBS VIEW MUCH

Hey Bostic, it didn’t really change our view either….you know why? Because we’ve been highlighting that the data is nonsense for a while now.

We wrote a whole piece on Non-Farm Payrolls here, where we go through all the made-up stuff like the Birth-Death Voodoo adjustments, which are responsible for most of these revisions. So yea, this revision doesn’t really matter…

What we actually find shocking is that Policy Makers still try to have a dogmatic view of the economy based on such bad data. As my old boss used to say: “Junk In, Junk Out”.

We look forward to the next set of downward revisions for the period April 2024 through March 2025….With 2024 being the Election Year, we should be ready for a proper shocker. Too bad we won’t get those revisions until August 2025…

Human vs Machine!

For us, the real story from Wednesday’s BLS revision was that the data was delayed by 30 minutes, which is quite unprecedented.

While everyone was waiting for the data to come out, whispers were spreading out across trading floors that the number was “818k”, which eventually was proven to be correct.

So how did some traders find out the number before the actual, delayed print?

It turns out that one Investment Bank Analyst, simply picked up the phone, called the BLS, asked for the Revision number, and was given it! Ask and you shall receive!

I find this so perfect…in this Age of Algos, the winner came out to be the practical thinker who picked up the phone and made the call…Someone should give this person a promotion!

Meeting Expectations!

On Thursday, Initial Jobless Claims were released and they came out at 232k. The consensus estimates were calling for … 232k.

How could Wall Street consensus nail this number to the tick? These monkey economists can’t even accurately forecast the time they wake up in the morning!

It reminds me of the good ole days when Companies would call up Wall Street’s sell-side analysts before results and just give them the EPS number, and the sell-side analysts would pretend to their clients that they themselves forecasted that EPS number and then the company would report and the number would come in-line and everyone would come out looking great!

Something like this happening here? Maybe economists also just pick up the phone and get the number before!

I’m going to stop here with Conspiracy Theories, otherwise I’ll end up in a dark place. Ok, just one more…

Jackson ... Hoooooole

Which brings us back to Jackson Hole!

Against this backdrop of Made-Up Data, the “Fed Woodstock” took place this week and to none’s surprise, Powell confirmed that the Rate Cutting Cycle will begin.

Powell made sure to highlight the Fed’s Dual Mandate, that the Fed would do “everything we can to support a strong labour market as we make further progress towards price stability”.

…which means that the Market Monkeys read it that the Fed has now shifted to a Single Mandate of supporting the labour market and who cares about inflation…after all, Monkeys can’t multitask!

The Fed Funds Futures are now pricing a 35% probability for a 50bps rate cut in September and are pricing 100bps of rate cuts by December 2024.

Meanwhile, 5 out of 6 of Powell’s Jackson Hole speeches saw the S&P 500 drop 7.5% in the next 3 months…

This should be fun to watch…

Positioning Data Update (Monkeypox Part II)

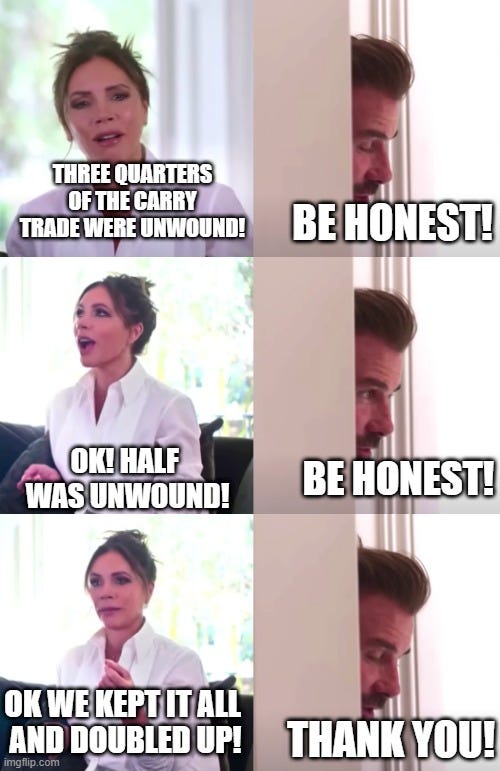

In the previous “Monkeypox” piece, we analysed the flows and behavior of various Market Participants during “Yen-pocalypse”. We summarized the conclusion in a Meme, where we half-joked that the Market Monkeys, rather than cut risk, simply doubled up:

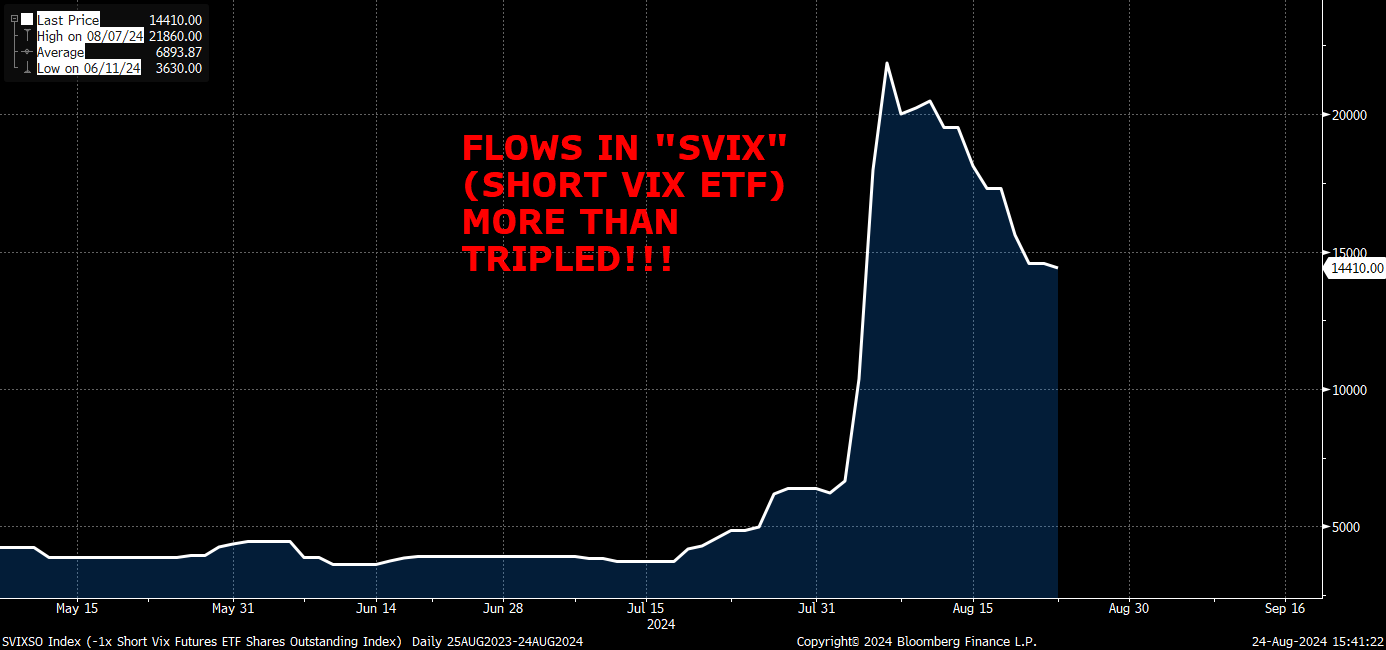

Shrubstack would like to issue an apology. As a parody publication we joked that the Monkeys doubled up. The chart below shows the flows into SVIX, the “Short VIX” ETF favored by retail investors. It indicates that, in fact, the short-Vol Monkeys didn’t just double up…THEY TRIPLED UP!

Once again, we apologize and promise to be more imaginative next time as to the lengths that the Monkeys will go to pick up pennies in front of the steamroller….

Surely it’s only retail that added risk right? Right?!!

Not so fast. Everyone continues to add risk: