The Realization of Cannibalization & Other Red Flags

Max Stupid accelerates

Only a week ago, I was lamenting that we were missing “Max Stupid” as a necessary ingredient to call this Market a proper Bubble (“Did someone eat the cherry on the AI cake?”).

Then all of a sudden, the monkeys listened and delivered! As a market observer, I give thanks.

We started documenting some of these “Max Stupid” occurences in the previous Shrubstacks:

ARM short-squeeze (Was this the beginning of the end?)

Sam Altman raising $5-7 trillion.

LYFT mis-reporting margin guidance by 10x sending stock +65%, UBS’ NVDA analyst claiming lead times coming down “substantially” is bullish, Bezos selling billions like no tomorrow (“Happy Vol-entine’s Day!”)

“Nvdia Cubs” ripping +50% on old news that Nvidia owns stakes in them (“Yellen, Mother of Tamagotchis”)

“Max Stupid” escalated into a crescendo to end the week and a few Red Flags were issued along the way.

RED FLAG #1: INFLATION IS NOT DEAD!

This was a key week that may have created a shift in Macro Narrative, so I will go through the events again:

On Tuesday, the CPI came in hot: Core CPI annualized at +4.8%, with Core Services annualizing above 10%. I went over the analysis in “Tama-Gotcha!” but to summarize: The whole point of the reaction function of Tamagotchi Yellen is that she can do as she pleases as long as Pleb-flation is low. But once Pleb-flation rises, then her hands are tied. I went as far as to say, that this is Market is now safe for Shorting. The market proceeded to drop 2% from its highs.

In the meantime, Yellen tried to sooth the markets that she is still under control: In a statement reminiscent of Marie Antoinette’s “Let them eat cake”, Yellen told the American people that the price of Eggs has come down so they shouldn’t worry about a thing. Since we all know that Americans live only on eggs, I guess it’s all good.

On Wednesday, we had Volantine’s Day, aka VIX expiry day. I said on that day that “I fully expect some relief in the markets due to the VIX expiry dynamics to be confused by the Market Monkeys as “the market digested the CPI” and “an all-clear to add risk” (“Happy Volantine’s Day!”). The monkeys obliged and by Thursday the market fully retraced the losses from the CPI print.

On Thursday, we had a big miss in Retail Sales, recording a 0.8% decline mom compared to a 0.2% expected decline. The monkeys took it as positive, as if a retail sales miss would miraculously cut rates. Nonsense.

By Friday, the market forgot about inflation. And then we got a HOT PPI print: PPI ex-food and energy was up 0.5% mom compared to expectations of 0.1% (which annualizes to 6%) and inflation expectations stayed elevated. The Market gave up some of its gains into the close.

Friday’s Options Expiry may have been keeping things together better than otherwise. True price discovery may come next week.

Why did I bother to go through this recap? Because Inflation is back on the agenda, which means Jerome Powell will need to keep his Hammer close by to smash any resurgent expectations of rate cuts any time soon.

To be clear, I am not a believer in a second wave of inflation any time soon. But as I said multiple times, the Tamagotchi’s sneaky move to take over monetary policy from the Fed has eased financial conditions, against the Fed intent and purpose. As a result, the Fed cannot start easing now through rate cuts. It’s as simple as that.

Just to make it clear in meme-format for Traders with ADHD:

RED FLAG #2: SuperMicro? Super Gamma-Squeeze more like

SMCI, the tier 2 poster child of AI madness after NVDA, has been on an exponential climb since the start of the year, crossing +270% YTD return (it’s only February!).

The Reddit crowd went wild on the name, pushing the RSI of the stock to 97. As per The Kobeissi Letter, “there is only ONE company in history that has managed to mark a daily close with a daily RSI above 97. Which company was it? It was Gamestop (GME), on January 27th, 2021, the day before the stock peaked in the "meme stock" rally.”

I put the chart of GME and SMCI together for fun (I don’t go out much). Both stocks managed to be 40x baggers, though GME’s ascent was faster and aided by the heavy short interest. What I will say is that SMCI is actually delivering growth (revenues will likely triple over next few years), whereas GME was a covid boredom play. But the outcome for both was the same: It was a Gamma Squeeze driven by people who have no clue and couldn’t care less what the company does. So I’m adding this high up to the Max Stupid list.

On Friday, there was a wake-up call to the Redditt crowd with the stock dropping 25% from the highs of the day. I joked around in the Shrubstack chat that SMCI will fail once it crosses $1,000. The theory was that Monkeys like round numbers so when SMCI hit a big round number they would likely rush out all at the same time to take profits. And boy did they rush out. They rushed out and got body bagged. There are a few sad stories on Twitter and Redditt of monkeys blowing up, but I won’t share them here as I want to keep the content kids-friendly.

I will also add that GME stayed “stupid” for more than a year. So if SMCI is actually delivering strong growth (unlike GME), I wouldn’t exclude that the stock stays in a (very) wide range, like GME did in 2021.

In fact, here’s one scenario that can play out:

SMCI is now at a $44bn market cap and the biggest component of the Russell by a factor of 4x. Incidentally, and ironically, the second largest company in the Russell is another Micro-named company called MicroStrategy at $10bn.

SMCI will likely get added in the S&P 500 in March

Remember when Tesla got added in the S&P and created a buying frenzy?

The passive funds will HAVE to buy the stock on index inclusion, REGARDLESS of the price. The market monkeys may get another shot at this one.

Maybe that was the incentive behind the Gamma-squeeze all along. But shame on me for suggesting that Wall Street plays games with these things …

The obvious important take-away is this: When a darling AI stock goes parabolic, and then the parabola breaks, that’s a major WARNING SIGN that some momentum names are running out of fumes.

RED FLAG #3: The Return of Masaponzi Son and the New Kid on the Block

Sam Altman seeking to raise $5-7 trillion to transform the Semiconductor Industry was definitely up there on my Max Stupid list. Sam even tweeted afterwards: “Why not 8?” as if $7 trillion isn’t real money in a post-Tamagotchi world. Why not Sam…

But what topped it for me, was Masaponzi Son feeling threatened by the new Kid on the Block and coming out with a bold plan to raise $100bn for a chip venture to compete against Nvdia. Apparently, he wants $70bn of that money to come from the Middle East, because they did so well from the $100bn Vision Fund. Not…

Masaponzi Son coming out of the shadows and actually getting attention, qualifies to me as peak Max Stupid and sends alarm bells (my bud PauloMacro had exactly same thought independently).

The only thing that would be more concerning in my book, would be Scamath launching a new SPAC. If that happens, I’m selling everything.

In any case, lets cherish the thought of Altman Son making fun of Masaponzi Son for his “lowly” ambitions of raising “only” $100bn.

RED FLAG #4: Psychological Shorts

Bill Ackman is one of the world’s greatest investors and anything but stupid.

On Thursday, after Herbalife plunged 30% to its 14-year low on poor results, Bill tweeted: “It is a very good day for my psychological short on Herbalife”. Bear in mind, it’s been 6 years since Bill covered his Herbalife short.

Now why is this on the Max Stupid list?

I see it like this: Bill is a great investor. I actually think he is Max Smart, because he walked away from such nerve-racking and, frankly, pointless activities such as shorting and only engages in “psychological” shorts from the looks of it.

But it shows how numb the market has become to shorting individual names, that the world’s greatest investors discuss “psychological shorts”.

2008 = Big Short

2024 = Psychological Short

Maybe it’s for the best.

RED FLAG #5: THE REALIZATION OF CANNIBALIZATION

So far, this market has been carried by the AI theme:

The Nasdaq is up 860 points on the year and NVDA/META/MSFT/AMZN account for 717 of those points.

The Russell is up 34 points for the year and SMCI accounts for 26 of those 34 points (h/t @jasongoepfert)!

Now let’s be honest with ourselves:

MONKEYS DON’T CARE ABOUT THE CPI! (or any economic data as a matter of fact).

If you wanted any further proof: on CPI day SMCI closed +2% and NVDA closed flat.

Therefore, a hot CPI isn’t enough to derail the AI excitement.

AI itself is a secular trend, a game changer, and a Game of Emperors (h/t Gavin Baker). (I wrote in “Did someone eat the Cherry in the AI Cake?” about the incredible growth of the Hyperscalers).

Therefore, Red Flag no.5 is a pretty big one in my opinion, because it affects the Emperors that carried the market so far:

RED FLAG No.5 = THE REALIZATION OF CANNIBALIZATION

2 events took place that triggered me:

On Thursday, conveniently a few minutes before the close, a headline hit that Apple is readying “an AI tool to rival Microsoft’s Github Copilot”

On Friday, OpenAI (Altman Son’s vehicle) unveiled SORA: an advanced AI model that can create realistic video footage from text instructions. Imagine typing out a description, and Sora brings it to life as a video.

SORA is very impressive, as well as the speed at which the new technology is evolving.

But look at the share price performance post-announcement of the Emperors and the minions:

MSFT -0.60%, AAPL -0.80%, GOOG -1.5%, ADBE -7.4%

Wouldn’t you expect a wild rally in AI-driven stocks on a day that such a great advancement is announced?

Or did the Market just realize that there is Cannibalization from this new technology?

I tried to think about it simply: I currently use Microsoft Windows, Google search, META’s Whatsapp, Apple iphone, Netflix, Adobe’s Photoshop.

But in the future, will I be paying for Apple’s copilot, Google’s copilot, Microsoft’s copilot, META’s copilot etc?

I will probably still be using my original setup but with some AI features embedded and upgraded from the original, PLUS I will be paying for one copilot. I’m going to bet that it will be the Apple one because I carry my phone with me all the time.

Anyway, I digress, and I’m not a Futurist. I’m not even a Technologist, I only try to read the markets and here’s what I’m thinking:

The AI Profit Pool is a massive one and it’s growing. You should be excited for the opportunities that will arise.

BUT as this profit pool is growing, there will also be cannibalization amongst the Generals and the Minions. Maybe the Market got the first sniff last week.

I’m visualizing it like a Snake eating its own tail, but it’s an AI snake so I will call it SNAIKE for fun. I did say I don’t go out much.

Summary for Traders with ADHD

There are 2 Worlds out there: The Market-ex-AI and the AI Market. This week we got Red Flags for both:

HOT CPI is a Red Flag for the Market-ex-AI

The Realization of Cannibalization is a Red Flag for the AI Market

A Red Flag doesn’t mean the end of the World. It just means awareness, vigilance and flexibility is required.

It is also implied that this Market has been “Marked Safe for Shorting” / hedging / taking chips off the table or whatever you want to call it, as long as you acknowledge that this could be just a dip in a secular trend. One can also take the simple and easy view that there will be volatility along the way, accept any temporary drawdowns and so be it. I took this view with several of my holdings, so each to their own.

Year of the Dragon starts with Green Shoots

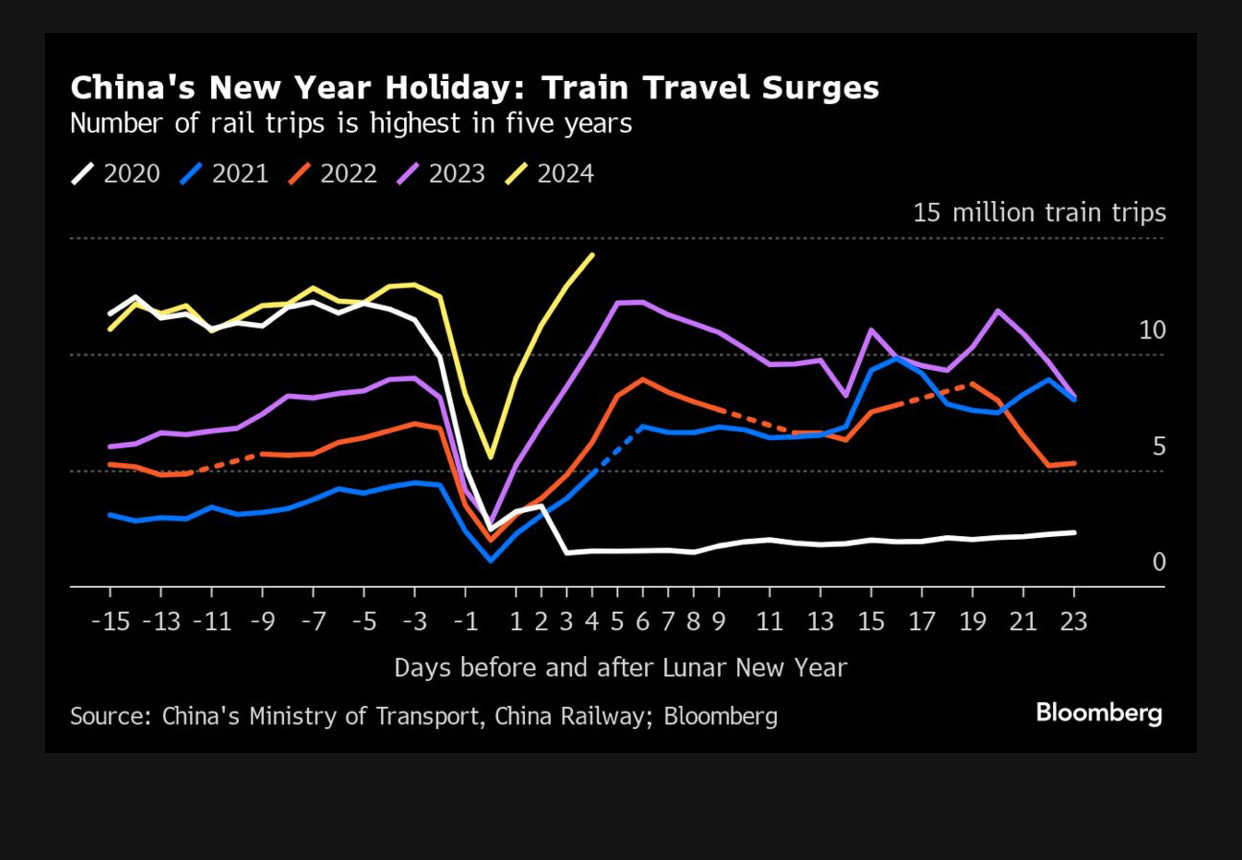

Let’s end this piece on a positive note. Anyone seen the China travel data from the holiday period?

Rail Travel is now above pre-covid levels and +61% from a year earlier (ok they had Covid restrictions but still).

Expenditures on Meituan’s online platform were +36% yoy.

Macau reported 1m visitors, highest since 2017 and mainland visitors were 77% of that.

Transactions made overseas by Alipay users were +7% from 2019 levels.

Beijing saw holiday spending +64% from 2019 levels.

With regards to China, my playbook remains as per the Chinese Policymakers’ Reaction Function:

“The Safe Word is HSI 15,000. As long as that holds, I remain long”

(The playbook has been given here and the market is up 9% from that level)

Disclaimer:

This isn’t financial advice. This is the equivalent of reading MAD magazine but for finance but worse: This is the trading blog of a shrub.

Don’t be Stupid. Seriously. How many times do I have to repeat this ….

SHRUB STOP TALKING ABOUT CHINA YOURE GONNA JINX IT

In 1999, the "big players" of the time were still competing HARD to win their respective fields. It was early days for the internet...They were fighting and investing to win and become the incumbents (and make money)

TODAY, arguably they have won, as they print tens of billions of dollars every year - NOW what they are trying to do is not get outraced by others, and so they try to stay in the forefront of the AI rush.

For me this can mean one (or a few) thing(s), they will throw and throw cash to stay ahead, pumping up the whole space in the process.. As I explained here: https://www.philoinvestor.com/i/141061987/reflexive-bubble

Conclusion: We've got a lot of balls in the air, and I don't know what will happen when the music stops.

Conclusion 2: This should be fun.