Did someone eat the Cherry on the AI Cake?

What happened to Max Stupid?

As expected, the Monkeys finally got their “Spoo 5,000” hats and they couldn’t be happier. And it’s only been 2 days since I wrote the last Shrubstack “$724m is worth 35x more in the Metaverse” whereby I lamented that AI free cash flow is worth 35x than coal free cash flow.

Yet here I am today, penning a new Shrubstack to argue that we are not in an AI Bubble just yet.

Something is bothering me. Stocks are obviously extended, and I did say we will run up to SPOO 5,000 and then flash-crash, which is entirely possible given positioning. But I feel like we are still missing the “Max Stupid” as my friend PauloMacro would say.

I think my readers are old enough to remember the 2021 SPAC / Crypto / Everything bubble. Now THAT was Max Stupid.

Back then, any SPAC would go up on deal announcement, any sh*tcoin would 10x, Cathie Wood was the High Priestess, people actually worshipped Scamath and Masaponzi Son was yolo-ing billions into Nasdaq call options. Remember when C3.ai IPOed and stock opened +100% giving it a $10bn valuation, only because its ticker was “AI”?

Fast-forward to today, and the “AI exuberance” has so far been contained mostly in semi-conductor stocks and the Mag 7. For example, the ARKK ETF has been flat since Jan 2020 and chopping around during 2022-2023 whereas the Nasdaq doubled.

That just tells me that the money has been flowing mostly to the Generals and not as much in the ARK-special Ponzi sector (though there’s still plenty of that around).

Are the Magnificent 7 a Bubble? Let’s dive in.

Magnificent 7: Valuation & Earnings Momentum

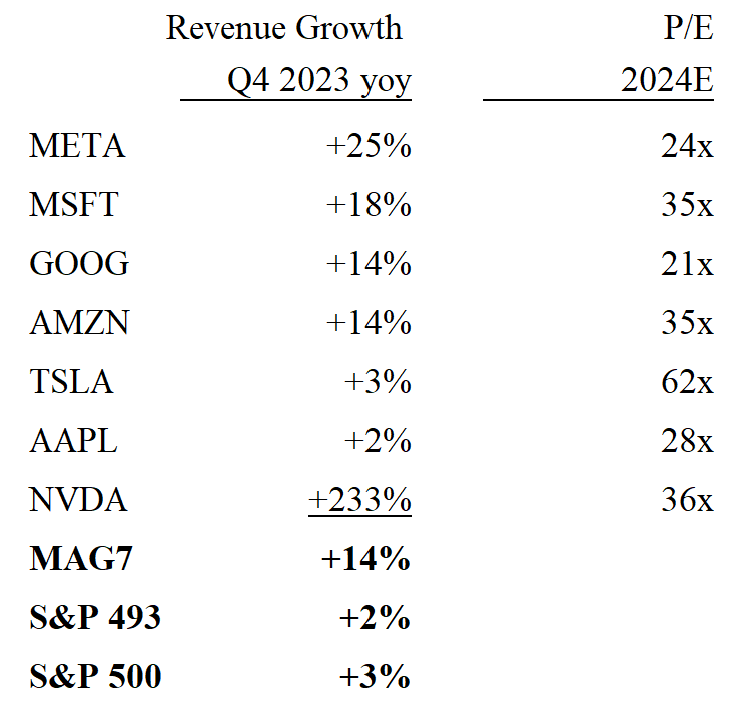

The Magnificent 7 have now reported with the exception of NVDA. What is striking is the top line growth of these behemoths is still going strong, with the exception of Tesla and Apple.

The Valuations themselves are high, but not ridiculously high (The one that stands out again is not NVDA as everyone on Twitter complains about, but Tesla. Elon better start building that Robot!).

The Hyperscalers’ yoy growth is actually RE-ACCELERATING. That’s just impressive for a business such as AWS that has a $100bn run-rate. The chart below is from the excellent Bg2 Pod by the Altimeter guys, Brad Gerstner and Bill Gurley. Brad spoke to the AWS CEO who said that the Cloud is a multi-trillion dollar opportunity, WITHOUT AI (starts from 35 min or so).

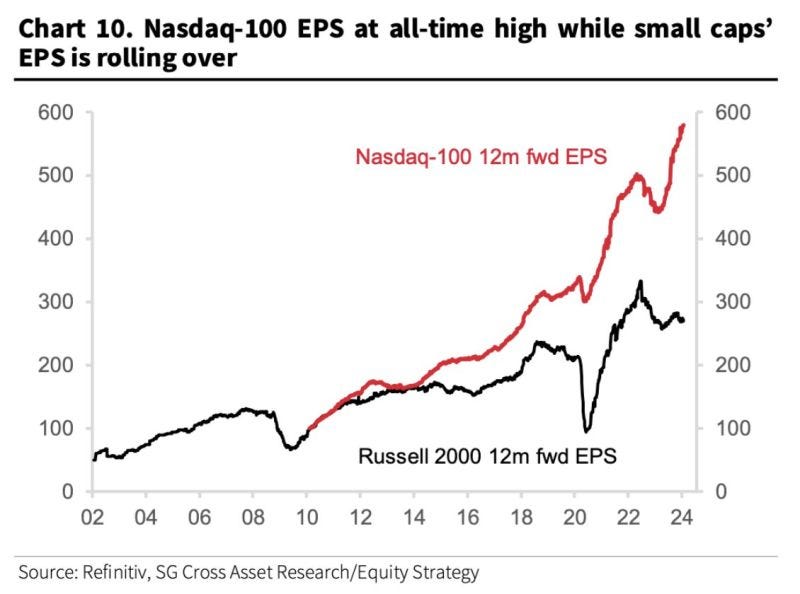

And then there’s the Relative Earnings Momentum. Compare the Nasdaq’s EPS growth vs the Russell’s and frankly you can understand the crowding into Tech compared to Russell names, or God forbid, CRE-exposed regional banks!

Another way to think about the Mag7 dominance was more eloquently said by Gavin Baker (@GavinSBaker), the CIO of Atreides Mgmt, and one of the deepest thinkers and nicest people in the investment community:

If Tech was a Game of Kings, “AI is now a Game of Emperors”: to double the performance of an algorithm, you need 10x more data and compute. Only companies like MSFT, GOOG and AMZN can play this game.

So let’s conclude that the Mag7 may be expensive, but they are as dominant as the Roman Empire and that means they are NOT “Max Stupid”. And the investment alternatives are not that much better, unless you like coal stocks.

Where’s the Max Stupid? The Case of the Missing IPOs

To conclude that the Money will stay at the Mag7 is like arguing that the Market Monkeys who got burned in 2021 have learned their lesson and are only buying the actual Winners of the AI Race…

As a practicing Monkey Psychologist, I find this impossible, and I refuse to accept that this is how the story ends. There are some basic SHRUB AXIOMS that have remained infallible to this day:

Wall Street always finds a way to maximize its own profits

Greed always takes over

A Monkey and his Money are soon parted

To be fair, this week we have started to see some (early?) signs:

ARM +50% on results, valuing the co at 36x Sales

PLTR +30% on results, valuing the co at 19x Sales on a +20% top line growth (because the funny-haired guy said he sees “onslaught” of AI interest from customers. And then he proceeded to sell $21m of stock after results. Legend)

Sam Altman said he wants to raise TRILLIONS of funny money to fix the semi-conductor industry.

Remember the $100bn Softbank Vision Fund? Maybe the Top in the Market will be when Sam Altman actually raises the $1tr Ponzi Fund!

Which brings us to the real missing part of the bubble: Where are all the IPOs? As per the Shrub Axiom above: “Wall Street always finds a way to maximize its own profits”. So why isn’t Wall Street lining up the companies to IPO?

I have a theory.

There’s one thing that has changed over the years: the VC industry has grown to be MASSIVE. There are now $2 TRILLION of AUM “trapped” in Venture Capital, a lot of it underwater by pretty bad deals that took place in 2020-2021.

With the growth in VC, what has also grown is the army of bankers and funds that want to take a piece of the action. Let me explain:

When there’s an IPO, the under-writing banks can make 3-5% in fees if they are lucky. And then they make a few bps for every trade they execute in the secondary market. So the “real money” is a one-off, made during the IPO. The secondary trading is not really making anyone much money.

Now look at VC. There are fat fees in EVERY secondary transaction that the banks / funds facilitate. You want to get out of your Softbank-backed Ponzi? Good luck finding a buyer. But If someone does find you a buyer, they’ll charge you 3-5% for that. Heck, in the good times they’d even charge you a performance forever!

Mark-To-Market vs Mark-To-Ponzi: why suffer the fate of long/short hedge funds getting destroyed in the market when you can manage the marks of your investment as you wish, and the money still keeps flowing in? Staying private is as simple as that!

Case in point: the Poster Child of AI, OpenAI, raised at a $100bn valuation in the PRIVATE markets.

So maybe the “Case of the Missing IPOs” is as simple as that the VC funds, the Banks and the brokers just have it too good being in a NON-mark-to-market “Safe Space” and taking fat fees in the process.

But I still refuse to think that this is how it ends. There are big funds that may need liquidity (Even Softbank IPOed ARM in the end, so they can raise money to yolo 0dte Nasdaq calls. Each to their own). Which brings us to the other Shrub Axiom: “A monkey and his money are soon parted”.

That’s why I fully expect IPOs to hit the tape eventually, and maybe that’s when we hit Max Stupid. How does Max Stupid look like?

I want to see Softbank offload crap at their in-price (lol)

I want to see Proximity.ai IPO at $100bn

I want to see Sam Altman actually raise a $1 trillion fund from the Saudis

I want to see Cathie Wood on CNBC every week and ARK outperforming the Nasdaq!

I want to see Scamath launch a new SPAC

I want to see Monkeys cheer the false prophets again!

When some of the above meets the requirements, then we have reached Max Stupid. Otherwise, we are just dealing with overbought markets in a secular trend of a new technology that may change the World, for better or for worse!

Investor Corner

The Gavin Baker panel was inspiring, and it also gave me a good investment idea. Just listen to Gavin from 25:00 min onwards. I really don’t want to spoil it as I want readers to actually listen to someone who knows more about this than 99% of Twitteratis combined. And the conclusion is that once you delve deep into this sub-segment of AI beneficiaries, the companies are not that expensive either and have a long runway (which provides further proof that there’s still areas to make money on the long side in AI, without chasing the obvious winners).

Disclaimer:

This isn’t financial advice. This is the equivalent of reading MAD magazine but for finance but worse: This is the trading blog of a shrub.

Don’t be Stupid. Seriously. How many times do I have to repeat this ….

Interesting perspective

Le Shrub has nailed it once again... I am deep into this arena professionally and what everyone has seen is only a snowflake on the tip of an iceberg. Almost all traditional organizations are absolutely gobsmacked with confusion on it (what is it? should we? how can we benefit?, etc.) and are now paying eye-watering $s for just discussion services (in the past 3 weeks I have 4 new contracts where I got to choose who, how much and how often I let them involve me). Ferraris rolling off the assembly line, only a few driving instructors, and almost everyone still wondering if they should get a Learner's License while the race has already started or simply playing Fast and Furious in the arcade for fun