Tamagotchi's Last Stand

+ AI Narrative Shift

EPILOGUE - Tamagotchi Tears

July 24th, 2024. Biden dropped out of the Presidential race just a few days ago. The Market is in turmoil. The Nasdaq is down almost 4%. The young trader looked in shock as his screen was full of red candles. He panicked and didn’t know what to do. Luckily, his mentor was by his side. The old-timer (36-years-old), had seen it all.

“What are these red candles?”, the young trader exclaimed!

“Those are Tamagotchi tears…”, his mentor proclaimed…

He then elaborated: “You see…Candlestick patterns were conceived 300 years ago by Japanese rice traders. In Japanese trading folklore, Tamagotchis were Policy Makers with Reaction Functions. They were attached to their Master …not like a dog to its owner, but more like Darth Vader to the Emperor. And they did everything possible to keep their Master in power.

But once their Master was gone, the Tamagotchis were in distress. They were lost. They would become like Ronins; Samurais who lost their Master. And their distress would cause Market Turmoil as they shed tears of pain…like Red Candles…”

The old-timer continued: “Yellen is Biden’s Tamagotchi. She did everything in her power to get him re-elected. Now he’s gone. And those Red Candles you see on your screen…those are Tamagotchi Yellen’s tears…”

The young trader listened in amazement and burst out: “How do you know all that?!”

The old-timer sat back and said calmy: “I read Shrubstack…”

HOW IT STARTED - A Tamagotchi is Born

Back in December 2023, we introduced Tamagotchi Yellen in the Shrubverse as a way to simplify and visualize the Reaction Function of Policy Makers. With 2024 being an election year, we presented the Policy Makers’ playbook in a very simple way:

The Policy Makers would do everything in the power to get their Candidate re-elected …and If he doesn’t get re-elected, who cares, at least they would get their friends rich along the way!

After all, “It’s not about the President we didn’t elect, but about the Wealth we accumulated along the way"! (“The Re-Election Cycle”)

As silly as it all sounds, this Playbook turned out better than the rest of the Wall Street playbooks (RIP Mike Wilson, RIP Marko Kontranovic):

The Policy Makers literally threw everything they had to the Economy and the Market to get their Candidate re-elected and the S&P is now +15% YTD.

Yellen went as far as hijacking the US Monetary Policy, by financing the deficit with a high % percentage of Bills, which dampened the tightening effect of the Fed’s QT.

We wrote about it here, citing my good friend’s Stephen Miran’s excellent work on the subject.

Stephen took it a step further and teamed up with Nouriel Roubini to publish an academic paper, where they are effectively calling out Yellen for manipulating Monetary Policy by using the QRA and the % mix of Bills vs Coupons.

Yellen even came out on Bloomberg to reject the claim of the two academics:

I have to admit I enjoyed this a little more than I should…

HOW IT ENDED - Tamagotchis Don’t Fear the Reaper

But how does it help us with our trading?

On Monday 29th July, the Treasury updated its borrowing requirements for the quarter to “only” $740bn, which is “only” one Tesla or “just” 1/4 of an Nvidia.

The mix of issuance (% Bills vs Coupons) is coming up on Wednesday 31st of July (QRA).

This is “Tamagotchi’s Last Stand”.

Now that she got called out, will she fall in line and issue less Bills?

Now that Biden is gone, will she “normalize” issuance and make the market shed more “Red Candle” Tears?

I’m sceptical that this QRA will be of importance. Yellen did guide previously that coupon issuance will remain flat for the next couple of quarters, so I can’t imagine any surprises.

But I would like to remind of the Tamagotchi’s Reaction Function:

“Re-Elect our Candidate” or “make our friends rich in the process”

The former is over, but the latter is still in play.

That’s why I care as much about who will be the next Tamagotchi as I do about who will be the next President!

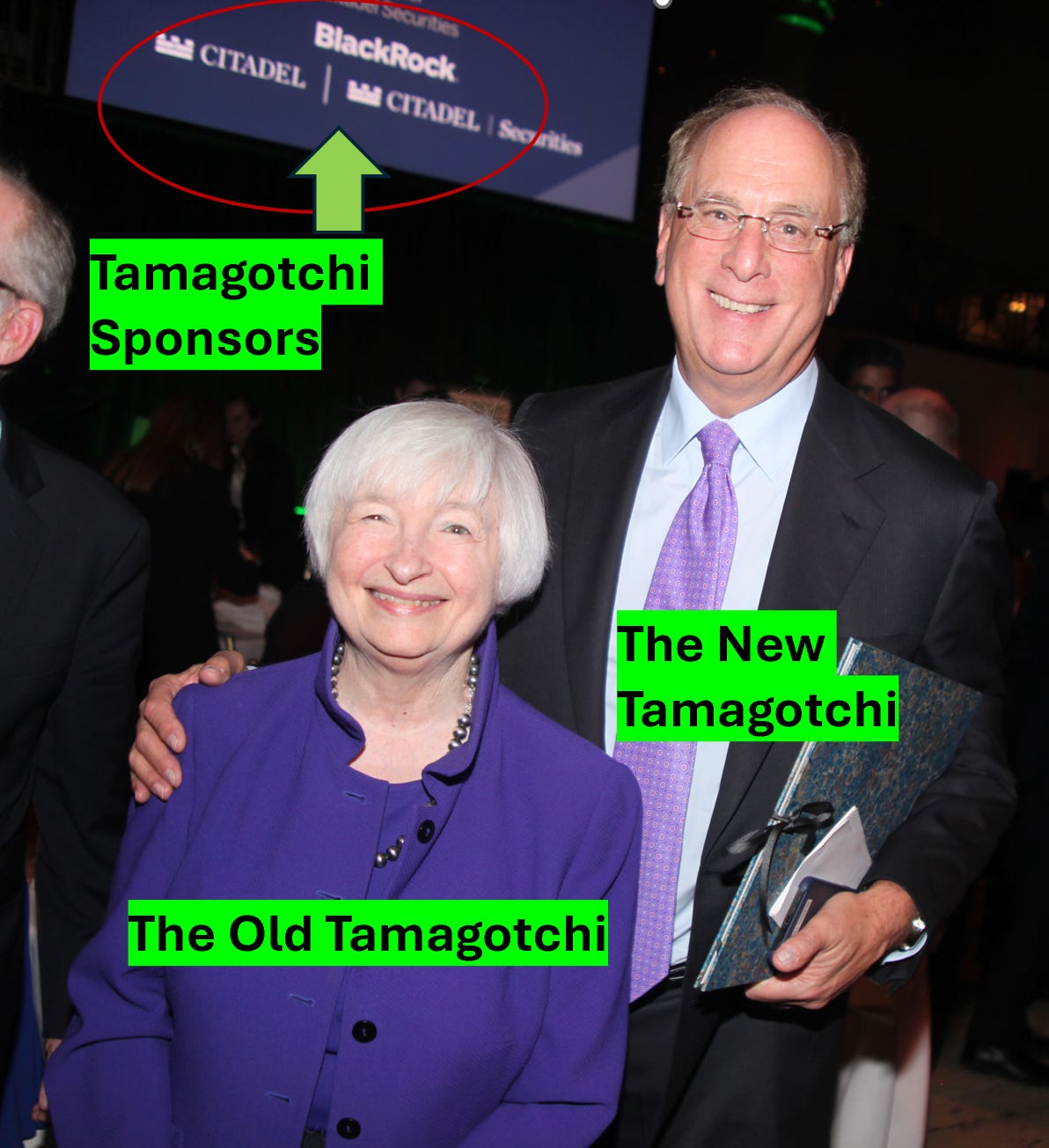

But who are we kidding. The New Tamagotchi is just the Old Tamagotchi…same Sponsors, innit!

“All our times have come, Here, but now they're gone

Seasons don't fear the reaper, Nor do the wind, the sun, or the rain

We can be like they are, Come on, baby, Don't fear the reaper”

The Fed

With the Tamagotchi’s hands tied, the Fed could be a more interesting event this week. What struck me is that the probability of a rate cut for the September meeting is now 107%!

Translation: there is a 100% probability for a 25bps rate cut and a small chance for a 50bps rate cut.

Therefore the question I want to ask is:

“What if” the probability for a 50bps rate cut increases in the next few weeks?

There are NFP data on Friday so I would be closely watching those too…this week will be so weird!

AI Narrative Shifts

Speaking of “weird”, the narrative around AI is just getting weirder imho.

To start with, Elon accused Google of election interference after Google autocomplete for “Donald” would yield more “Donald Duck” than “Donald Trump”. Meanwhile Elon’s Twitter-X algo has a “For You” tab that bombards me with a ton of anti-woke narratives when all I care about is Finance Memes!

All those trillions in AI Capex and all we will end up with are biased AI models:

woke-AI by Google-types and joke-AI by Elon-types!

The only guy I would trust with an AI model is Deepmind’s Demis Hassabis. Deepmind is owned by Google but Demis is from my home country of Cyprus, so I have to trust him more than the rest and if that’s not the most biased comment I don’t know what is. I guess my point can be summarized by my old boss’s comment about models and their inputs:

“Junk In, Junk Out”

Meanwhile, the search for AI’s elusive “Return On Investment” continues:

At their latest results, Google’s CEO effectively admitted they have to over-invest in AI because the risk of under-investing is greater (this is a Game of Emperors after all). What I found surprising is when the CEO said that these assets have “long, useful lives”. Really? In that case, why do they need to buy the newest Nvidia chips for $40k each after buying the previous ones a year ago? Maybe when a CEO says “long, useful lives” he refers to the annual bonus cycle? Or the lifespan of a fruitfly?

Then there was a weird rumour that in the next set of Nvidia’s results, Jensen will present test cases of how clients make money using AI. Amazing! People can make money using AI?!!! This is so Old School, I love it!!!

On a different note, anyone else notice how Nvidia’s competition is heating up?

Amazon is trying to reduce its reliance on Nvidia by developing its own chips…

…and now Apple is using chips designed by Google rather than Nvidia “to build two key components of its artificial intelligence software infrastructure for its forthcoming suite of AI tools and features, an Apple research paper published on Monday showed”.

This is a story as old as Capitalism: when a company makes super-normal profit, the others will try to get a slice of it. The incentives are even larger when these competitors happen to also be the customers, spending billions of their own money on chips every quarter!

Good time to re-read “A Boomer’s Review of Nvidia - Part Deux”! It’s Pulitzer-worthy, but sadly shrubs are not eligible to enter the competition…

Nvidia is a great company but we know how this will end...

If only there were any signs…

Disclaimer:

This isn’t financial advice. This is the equivalent of reading MAD magazine for finance but worse: This is the trading blog of a shrub.

Don’t be Stupid. Seriously. How many times do I have to repeat this ….

Hahaha, Tamagotchi Tears. Brilliant! 😂

This is fantastic