Tamagotchi Reboot

Once in a while, you need to reboot your Tamagotchi!

I wasn’t intending to write another Shrubstack on Tamagotchis but my friend Stephen Miran (@SteveMiran) penned this incredible piece about “the stealth politicization of monetary policy” which my own bias translated to “How the Tamagotchi infiltrated the Fed”. So here we go again.

Please read the article, three times minimum. The link is here. I will try to simplify it for traders with ADHD. It’s a tough call but if someone can do it, it’s a parody account from Twitter.

“This is a story of how a Tamagotchi managed to creep into the monetary policy of the Fed”:

On one hand, the FED does Quantitative Tightening (QT) by increasing the net amount of bonds in the market, thus removing liquidity from the hands of the monkeys. They do this to tighten monetary policy.

On the other hand, the Treasury needs to issue paper to fund its Fiscal Policy.

In theory, “QT is supposed to be technical and run on auto-pilot”

Also in theory, the Treasury has an implicit guideline to issue a mix of 80% bonds and 20% bills

<Enter the sneaky Tamagotchi>

If the Tamagotchi wants to get monetary policy looser, all it has to do is tweak the mix of issuance to more bills than the 20% implied allocation

So any monetary tightening done by the Fed, can by offset by the Treasury! Awesome.

(FYI, in the last QRA print the Tamagotchi went wild at 58%! She probably thought she was Evita Peron or something)

A fair question to ask: why doesn’t the Fed also change their pace of QT? Well here is the genius part. Who was Fed Chair before JPow? None other than the Tamagotchi herself. And here’s what she said about QT back then: it would be like “watching paint dry”! So they fixed the QT pace to automatic, so Yellen can go wild on the Treasury issuance. In case you haven’t figured it out yet, Janet is a Genius, NO QUESTION!

BUT WAIT THERE’S MORE! Take a pause and read on:

The Fed has this Reverse Repurchase facility (RRP), where they borrow overnight from market monkeys. They borrow using short-term paper.

But the Treasury also issues short-term bills.

So if the Treasury issues more BILLS, the Fed’s RRP facility has less demand and it DRAINS more quickly.

And as the Fed’s facility is drained, the Fed is then forced to reduce QT faster than they may have liked. All because this is what Janet wants. And as we know by now: “What Janet wants, Janet gets”

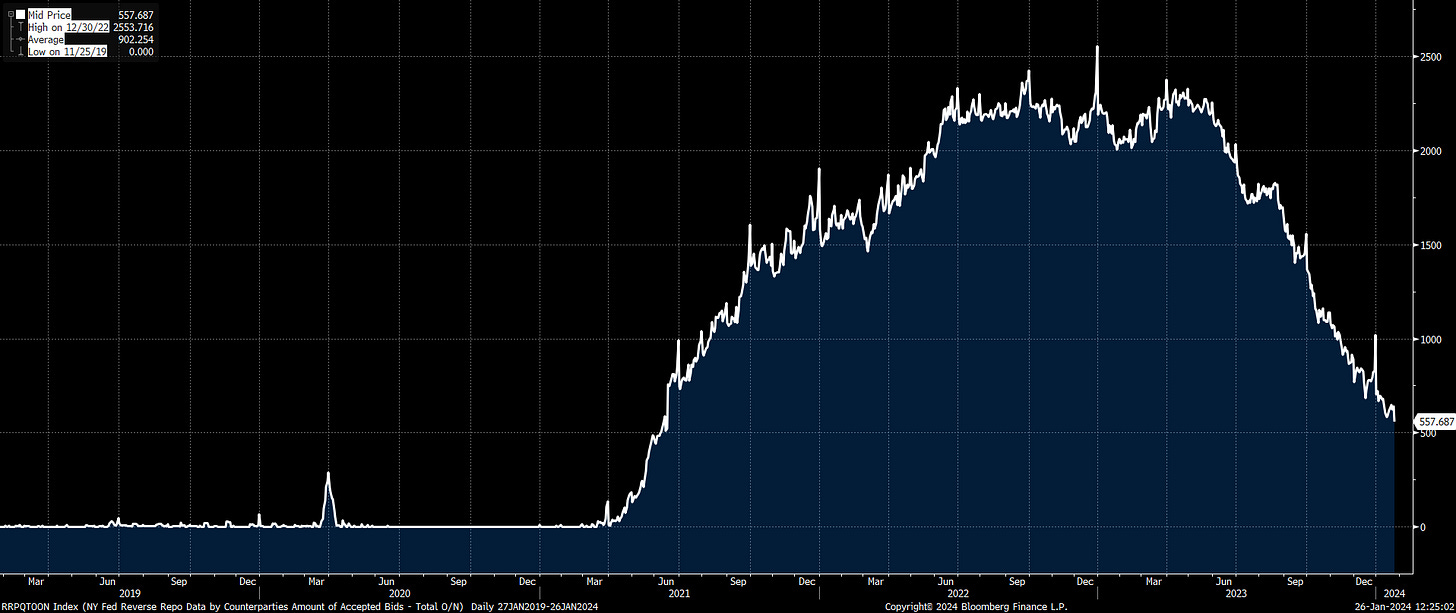

Incidentally, the chart below is how the RRP looks like. It’s down by nearly $2 TRILLION IN A YEAR!!!

To recap: the Treasury (aka Tamagotchi Yellen), achieves 2 things by issuing a high % of Bills:

a) Dampens / Neutralizes the QT done by the Fed

b) Forces the Fed to taper QT

As Stephen more eloquently puts it:

“This is an abomination: monetary policy under the control of fiscal authorities…

… Allowing Treasury to set monetary policy is extremely dangerous”

I see it like this: this Tamagotchi is out of control.

I don’t think we are the only ones who figured this out. Apparently there are whispers in Washington and growing discomfort about the games that Yellen is playing, especially during an election year (I have no way to confirm this but I would love to hear more about it).

There is one way for Yellen to silence her critics: The new QRA comes out next week and if she uses a sensible mix of bonds and bills, then that might do it for now. She can then go as wild as she wants during the inevitable Election ramp in Q3 2024!

Heck, the market might even like it and go even higher. The monkeys will argue it’s bullish that Yellen isn’t on an Evita Peron - Argentina path anymore!

Now I don’t know who has the guts to reboot this particular Tamagotchi, but good luck to him / her. Maybe it’s a job for the next administration, by which point Nasdaq will be at 30k and after all this Wealthflation, then Plebflation will come back roaring and we are back to square 1. But let the others worry about it, right?

PS The last 2 QRAs moved the markets a lot. The irony for me would be if none cares about this one, as long as Yellen has rebooted herself to a sensible range!

Disclaimer:

This isn’t financial advice. This is the equivalent of reading MAD magazine but for finance but worse: This is the trading blog of a shrub.

Don’t be Stupid. Seriously. How many times do I have to repeat this ….

Any serious investor, curious souls, learners would be well served to read this amazing summary from the Shrub and then go read the full piece from Stephen....well done - again! Please keep up the writing - is tremendously valauble to many IMO....

Brilliant! Thanks for the cliffnotes for those of us who suffer deeply from ADHD