"Save the Ponzis, Save the Plebs" - Part 2

The Price to Pay for Salvation

I hope you didn’t miss Part 1 of that Piece. If you did, you probably lost money this week so my condolences.

To summarize Part 1:

“Imagine this for a new TV series: a super-powered Yellen with time travel abilities comes from the future and visits the Fed officials with a menacing omen:

“Save the Ponzis, Save the Plebs” “Save the Ponzis, Save the Plebs”

Let me translate this to those of you at the back: “If you want to turn the economy and save those jobs, then you have to pump liquidity in the system and it doesn’t matter if the Ponzis go to the moon again!””

Well, it seems that the Fed listened to Yellen from the Future. They chose to save the Ponzis in order to save the Plebs.

Last night, December 13th 2023, while the Market Monkeys were anxiously waiting for the Fed, I knew the game was rigged already. How could a lone shrub know this? Because Yellen came on CNBC. And she said she expected inflation to reach 2% by the end of 2024. And then she said that as inflation moves down "it's in a way natural that interest rates should come down somewhat … Real interest rates would otherwise increase, which can tend to tighten financial conditions".

Well there you go. Yellen laid out the play book of how to save the Plebs. Just hide behind the Mafs, which go like this:

Nominal Rates - Inflation = Real Rates

As Inflation goes down but Nominal Rates stay flat, then Real Rates go up (try it on a piece of paper, Mafs isn’t that hard!).

Yellen basically told the Fed to keep Real Rates at or below 2% (and by that I mean, BELOW 2% please, we got an election coming!)

And Powell obliged. He came into that press conference and transformed himself from Jerome the Grinch of 2022 to Jerome Santa of 2023 and with a one-two punch he saved the Ponzis in order to save the Plebs.

The markets cheered.

The guy on CNBC was so emotionally touched, he called this “a historic meeting” which gave him “goosebumps” !

The Ponzis cheered even more. My Ponzi du Jour in this race has been Biotech (XBI ETF) and I wrote about it here (“Rosemary’s Baby”). It’s up +30% since. In case you want a summary of why it went up, let me re-hash the meme of that piece:

So the Ponzis have been saved.

It’s easy to sit back and rejoice and assume 2024 will be an easy year as the Fed will deliver their promised 3 rate cuts as per their dot plot. I wish it were that easy. The market likes to overshoot in both directions an the only thing I’m sure about Wall Street is their greed and exuberance in these situations. So take a look at how many rate cuts are priced in for next year. The table below shows the date of every Fed meeting and the probability of a rate cut (shown with a -ve sign). There is now an 83.3% probability of a rate cut for March 2024! And there’s even an 18% probability of a rate cut in January 2024! I mean … cmon. The Market Monkeys were calling for 10% 10 year yields forever like a month ago!!!

And while the Fed was guiding for 75pbs in cuts for 2024, the market is already thinking about 150bps in cuts.

My conspiracy theory was that Yellen wanted the Fed to cut rates in March / latest in June, just in time for the impact of the rate cuts to be felt by the time the Elections start in November. But the Market Monkeys jumped the gun and played along to the next level already! Not that Janet would mind, mind you!

So we moved from “Saving the Ponzis” to “Lets feed those Ponzis and make a new bubble again, it was so much fun last time!!!!”. Hakuna Matata :/

In the midst of all this, and while everyone is NOW focused on the Ponzis, there is one topic that many are ignoring.

In order to Save the Ponzis, a price needs to be paid, a blood sacrifice if you will.

This sacrifice seems to be the Dollar, at least until the ECB and BOE get dovish-er than the Fed, which is almost inevitable at this stage.

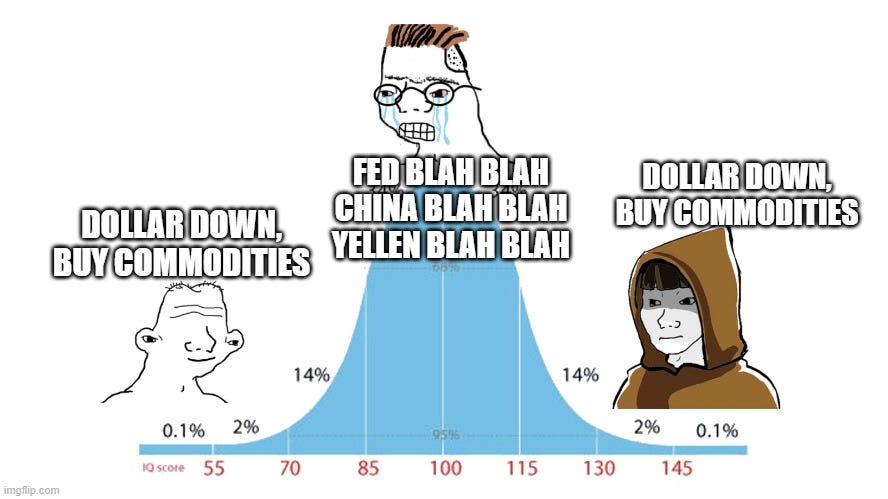

My Pavlovian reaction is:

“Dollar Weak, Buy Commodities.”

So I added a decent position in Commodities / Mining Stocks, which is now bigger than the Biotech position (which I kept but reduced). I have room to grow this position by 3x if I want, just so I am clear.

The risk of this trade is that China / global growth stall. I’ll think about it more during the Holidays.

But for now I will leave you with the new Meme to pin on the wall:

Disclaimer:

This isn’t financial advice.

This is the trading blog of a shrub.

Don’t be Stupid.

I can't believe this newsletter is free

One commodity that will glow above all others - no, not the shiny Yellen, er, sorry - YELLOW metal, but the one that'll glow forever, uranium. Supply/demand for exisiting nuclear power plants is completely out of whack and favors demand for years to come!