Grift Arbitrage™️II - Crypto Edition

Ponzis on Parade: Bitcoin Treasury Companies, Stablecoins & More!

“They rally 'round the family, with a pocket full of shells… Bulls on parade”

- Rage Against the Machine

My highest conviction view remains that this is the Golden Age of Grift aka GAG™️.

Grift Arbitrage™️is the most elegant way to profit from such Grift, focusing on trades that offer low downside and “GAG” Upside.

If you haven’t read “Grift Arbitrage - Part I”, cancel your Netflix and get on with it!

We were early with this theme, having put on our first “GAG” trade back in December 2024, which is up +60% since (“One Last Yolo - Part II”).

But we don’t think this Theme is over just yet.

In this next instalment, we dive into the griftiest of grifts and look into Crypto-related Grift Arbitrage trades.

Finally, we present our updated “GAG Portfolio” as well as offer a warning about an upcoming “Meme Top”.

Crypto Treasury Companies

By now, we have established it’s all stupid. As long as we remember this, we will be OK.

Somehow, for the dumbest things I’ve encountered in finance, there’s always a horde of Wall Street evangelists that try to justify stupidity by embellishing it with fancy terms and narratives.

This next pocket of exuberance is so stupid, that of course it needed a fancy term: “Bitcoin Treasury Companies” !

It all started with Microstrategy, MSTR, the grand-daddy of this Ponzi Scheme … errrr, sorry, “Bitcoin Treasury Management” Scheme.

We previously wrote about MSTR back in December 2024, which incidentally marked the Top for the stock:

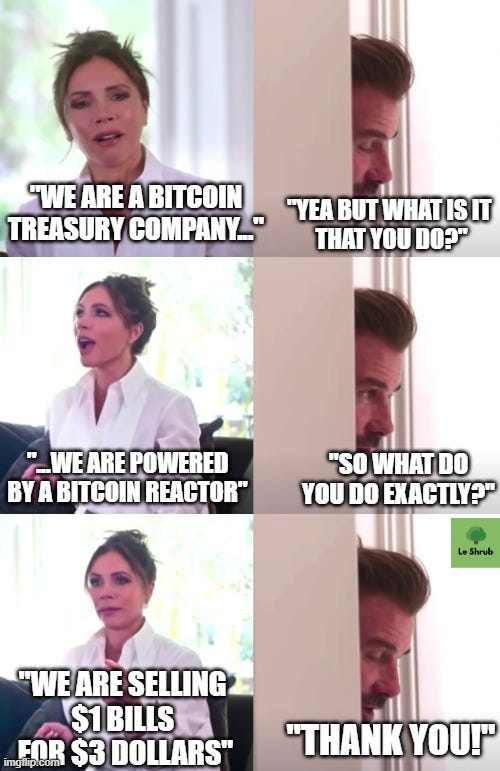

In summary, MSTR traded as high as 3x NAV, which enabled Michael Saylor to issue equity and debt to buy Bitcoin. In his words: “We are selling $1 Bills for $3 Dollars”. Here is the Meme Summary of the situation:

MSTR is now trading at a more “conservative” NAV of 1.8x (lol).

This didn’t stop a new cohort of demonic offspring from flooding the market faster than beanie babies in the ‘90s.