Diary of a Madman - by 0dte Osbourne

What Next?

This week the S&P closed down -1.6%, the Nasdaq closed down -0.6%, TLT closed down -1.2% whereas Platinum closed up +5% :)

Beneath these seemingly small moves, the week was wild and I’m sure it drove mad quite a few people & monkeys.

As a way to recap the week, I will share my trading Diary with you:

MONDAY: “The calm before the storm”

Literally nothing happens. I write an update on GEO Group to keep myself busy.

Portfolio doing fine. I trade nothing meaningful.

NDX and TLT both finish the day FLAT. Platinum closes up +3.8%.

TUESDAY: “The day before CPI Day”

Even though Commodities were on a tear in March, the whole of Wall Street is expecting a “Cold” CPI print (i.e. inflation lower than expected). Consensus is for a 0.3% MoM CPI print, but “whisper” numbers are even lower than that (“Whisper” numbers are a Wall Street gimmick where monkeys whisper each other their own expectation and they reach a consensus of their own; by definition it’s a “monkey consensus” so it’s really worthless).

Naturally, Wall Street wants to be positioned for this “whispered” low CPI print, so they buy calls on anything that moves.

On the day, I wrote a piece called “Inflation Commemoration”, where I said how I was positioned:

“As for me, I’m keeping my portfolio invested in real assets. Because by the time Tamagotchi Yellen finished her beer in China she printed $4m, making her the Fastest Gun in the West and the Far East!!!”

Portfolio doing fine. I trade nothing meaningful.

NDX closes the day up +0.4%, TLT closes up +0.9%, Platinum closes up +1.4%.

WEDNESDAY: “CPI DAY!” aka “It’s never been more over!”

The CPI came in HOT HOT HOT at 0.4% MoM vs expectations of 0.3% MoM.

There is Panic in the Street!

“How can all the Economists get it wrong?! How can the “whisper” number be so off?!”, said the Bull Monkeys.

“Lol! Did you not see the commodities being on fire all of March?!”, said the Bear Monkeys.

NDX Futures and TLT are both down 2% in the pre-market.

After all, three hot CPI prints in a row means that Yellen and the Fed can’t continue with their shenanigans so easily (regular readers know that Tamagotchi Yellen’s Reaction Function short-circuits when inflation gets closer to 6%).

I feel like a monkey myself now: “Why didn’t I buy some Puts just in case? Or did I believe the “whisper” number too?”

To make things worse, the PPI (Producers Price Inflation) is coming tomorrow and that one FOR SURE will be hot hot hot given the rise in commodity prices! And there’s also a 30-year bond auction!!! It’s never been more over…

I get a rush of adrenaline to “trade”! I don’t know what, but I feel I should “trade” something!

“Maybe I should buy puts on Gold to protect my Platinum position. Maybe...”

Instead, I sit down, and I write this piece called “I DON’T CARE!”.

I loved writing it and it helped me to keep focus on the Big Picture. Please read it again. I thought it was great, but I’m biased :)

Portfolio doing “NOT fine”. I trade nothing meaningful.

NDX closes the day down -0.9%, TLT closes down -2.2% and Platinum closes down 1.5%.

THURSDAY: “PPI DAY!” aka “We are So Back!”

PPI comes in COLD!!! PPI “ex-anything-the-Plebs-need” came in at “only” 0.2% MoM!

What a plot twist that was. How can it be? Commodities were literally on fire all of March! It’s as if the data are cooked and the game is rigged. But wait. The data WERE cooked! (we already know the game is rigged, don’t be silly).

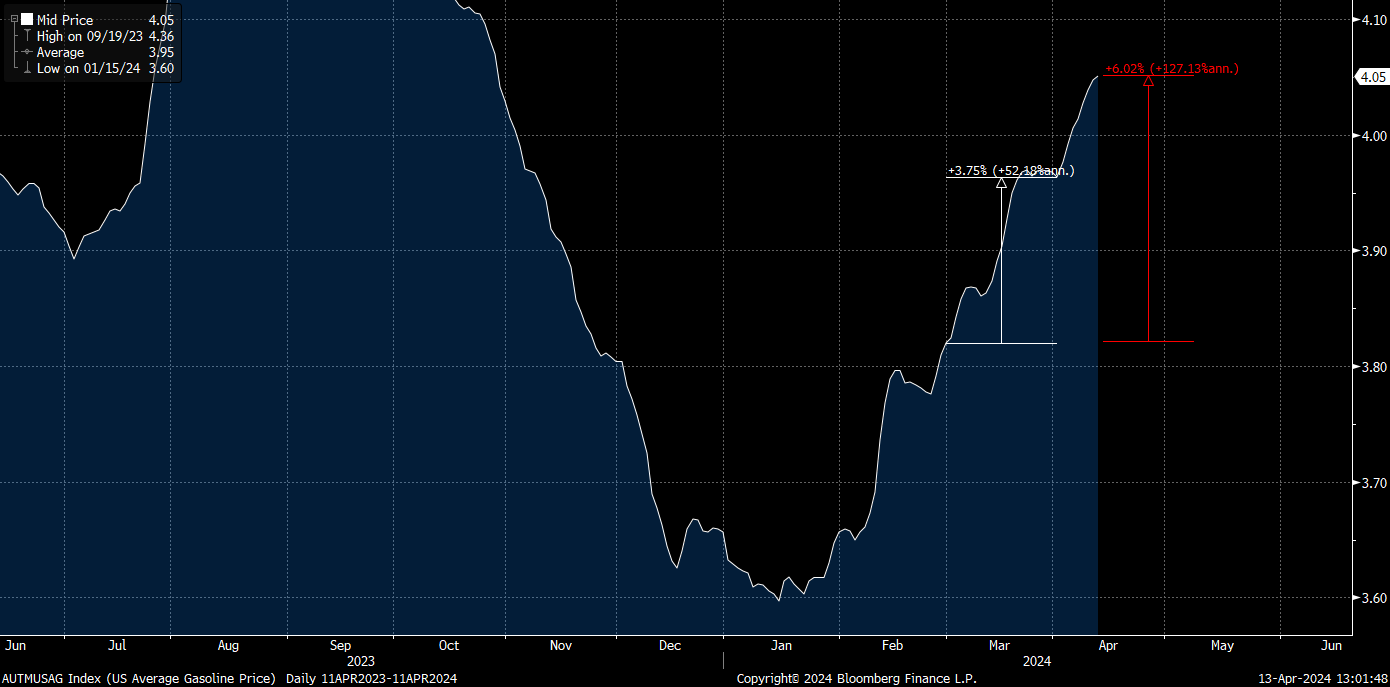

In the PPI MoM breakdown, Gasoline price was shown as DOWN -3.6% MoM:

I check Bloomberg: the US Gasoline Price is UP +4% for March and +6% from end of Feb until today.

I then check the gasoline impact on the CPI print from the day before by going straight to the BLS source (US Bureau of Labor & Statistics). For the CPI, gasoline was UP +1.7% in March.

But the beauty is in the detail: “they” admit that in March, GASOLINE PRICES WERE UP 6.5% BEFORE SEASONAL ADJUSTMENTS! From the BLS report:

The gasoline index increased 1.7 percent in March. (Before seasonal adjustment, gasoline prices rose 6.4 percent in March.) LOL! As if the Plebs wouldn’t notice that the gasoline price is up! To my American friends, next time you go to the pump station to fill up your car, please ask for the “seasonally adjusted price of gasoline”!

Well, the Plebs may have noticed that the data is cooked but the Market didn’t.

The market opens up +0.4%. “This is stupid” I think. The market then drops back to flat. “That’s more sensible” I think.

But then we get another plot twist:

Biden comes forward and proclaims: “Well, I do stand by my prediction that, before the year is out, there’ll be a rate cut”. And just like that, the regime shifts from Forward Guidance to “FORWARD BIDENCE!” (cool piece, you should read it).

The monkeys love it. The Market loves it.

NDX rallies +2% from its lows. TLT is still down 30bps on the day and doesn’t buy the “cooked” data. A 30-year bond auction doesn’t help, as Yellen stuffs the Bond Market with more paper.

I’m itching to buy puts. I often wonder if “THEY” are stupid or if “they” think WE are stupid. But today, it seems that everyone is just playing along with this Charade.

I decide to do nothing. After all, my portfolio is doing just fine.

NDX closes the day up +1.7%, TLT closes down -0.4% and Platinum closes up +1.9%.