2024 - A Year in Meme Review

From the "Memes that Make Money" series

The Portfolio is up >60% for 2024 (+66.97% at the time of writing, but who’s counting).

What I’m most happy about is that throughout 2024:

I’ve been using a laptop and a mobile phone (Microsoft Surface Pro, so not even a real laptop)

I haven’t used Excel once for modelling a company

I have only used the “corner of the FT” or a “back of the envelope” for valuation purposes

I didn’t use leverage and kept on average a 20-30% cash balance

I used hedges at key spots and actually made money on shorts

I did a lot of mistakes but they didn’t hurt me e.g. Platinum went nowhere, Noble Corp is down the toilet and I had quite a few puts and calls go to Option Heaven.

I wrote more than 150 Shrubstacks (!), which was infinitely more fun and better than going to therapy😂

I took the kids to school every morning

I’ve been reviewing the trades of 2024 and, upon doing so, I noticed that some months were very quiet, some were good but some were great. In fact, “Super-Performance” was “lumpy” and the REAL money was made in June-July and September-November.

What was the secret of of that “Super-performance” then? One word.

MEMES!

Yep…while Wall Street tries to sound smart, we just use Memes. After all, once you realize it’s all nonsense, it starts to make sense…

I’ve been reflecting on the most profitable Memes of the Year…

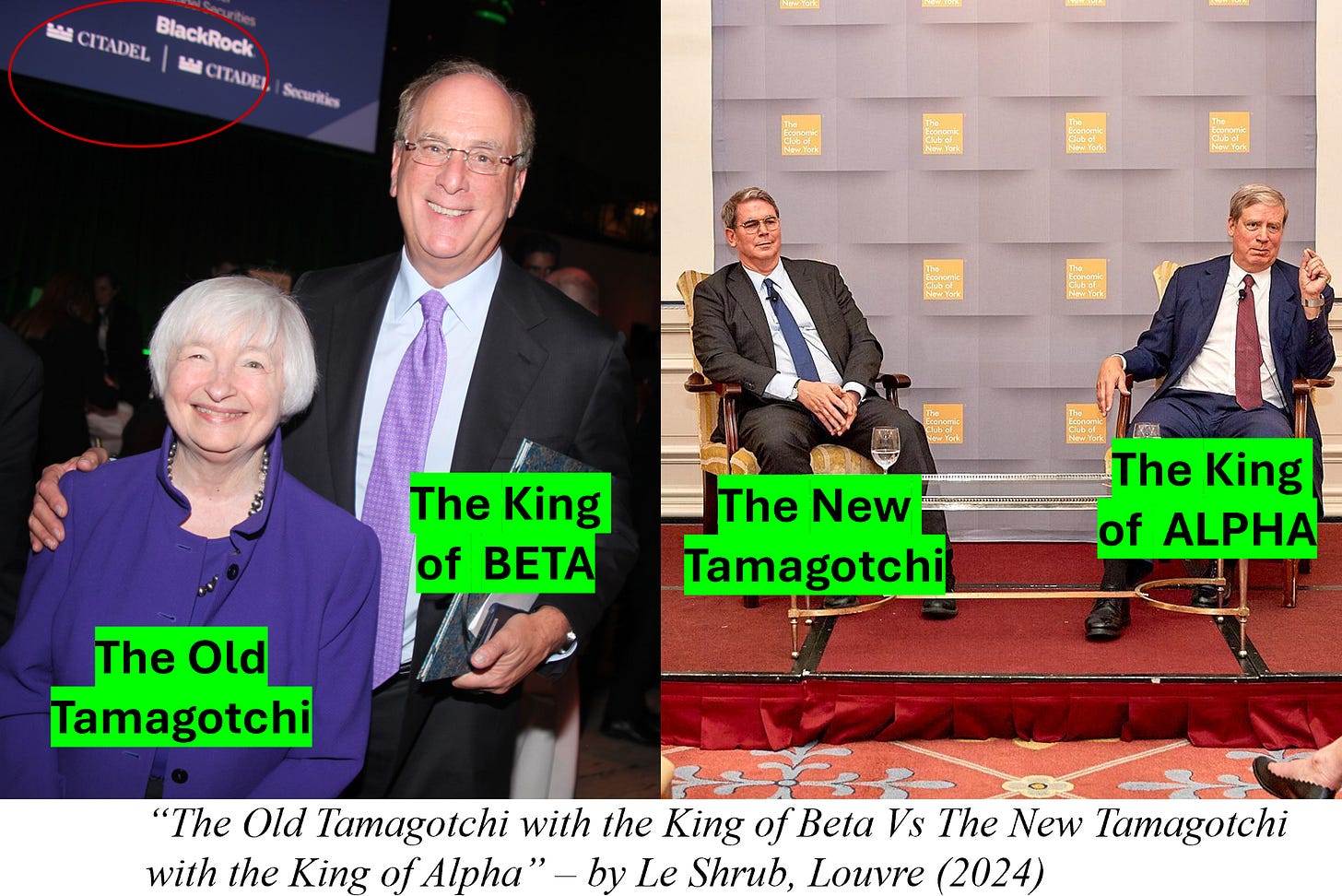

Tamagotchi Yellen

Honestly, the only thing you needed to figure out for 2024 was that a nice old lady was actually the financial equivalent of a Bond villain, who hijacked the monetary policy of the most powerful nation in the world in order to pump the Markets to get her guy re-elected (“Tamagotchi Reboot”).

Too far-fetched? Who cares. The S&P finished the year +24%, the Nasdaq +30% and our faith in the Tamagotchi’s unholy power kept us long throughout the year. We give thanks to Tamagotchi Yellen, we will miss you.

China - “The Safe Word is HSI 15,000”

Back in January 2024, the Chinese Stock Market was getting destroyed and it was a very lonely time to be buying Chinese Stocks. Thankfully, we figured out the Reaction Function of the Chinese Policy Makers (aka the Chinese Tamagotchi), which ended up being as simple as this:

“ HSI = 15,000 —> ACT!!!”

i.e. the HSI Index below the 15,000 level was the Chinese Policy Makers’ pain threshold which triggered them to do “stuff” and defend that “Red Line”. And “stuff” they did: They cut the RRP and they launched Stock Market rescue programmes, such as not allowing some funds to sell - those “evil sellers” had it coming (We wrote about it here: "To Stop Falling Chopsticks, you need a Tamagotchi").

We enjoyed a nice 30% rally in the HSI and we gave thanks. More importantly, it set us up for a bigger trade in September…

Rotation - “What If?”

The first half of 2024 felt like liquidity was getting sucked out of the Market and funnelled into Nvidia. Back in June 24th, we posited the question:

“What if” someone just turns the taps the other way round… and liquidity flows from Nvidia to the rest of the Market?

The Russell vs Nasdaq spread then rallied by >16%, its Greatest Outperformance EVER! We gave many thanks for that one…

There are two supporting Memes which deserve commendation, given both Jensen and Trump reinforced the Rotation…each in their own way!

The Fed Pivot & the China Stimmy Pivot - We give XieXie!

This trade was building nicely over a month, but when it worked, it exploded:

Back in August, my buddy Eliant and I posited the question “What If?” the Fed pivots (again) and prioritizes Growth vs Inflation?

Then in mid-September, we asked again “What if” it’s time to buy Cyclicals, since everyone was so bearish?

Back in September, there was a raging debate whether the Fed would cut by 25bps or 50bps. Me and my buddy Paulo were dumb enough to stick our necks out and call for a 50bps cut in our “Fly on the Wall”.

Then after the 50bps cut, we highlighted that there was another Catalyst ahead and that it could be a “Biggie”, where we asked “What If China starts stimulating too?”. So we loaded up with Calls on Chinese Stonks (I wrote at the time “I’ve had this sneaky conspiracy theory that China was waiting for the US to start cutting rates before they went bigger in their own monetary and fiscal stimulus”)

China then unleashed a Stimulus package a few days later, and what followed was the Biggest Rally in Chinese Equities EVER, with the FXI rallying by +40% over a couple of weeks!

Our calls ended up being multi-baggers, we closed the trade when Goldman upgraded Chinese Stocks to Overweight and we gave XieXie!

“I just love it when a plan(t) comes together!”

Trump Trade

The “Trump Trade” was a beauty, as well as the accompanying Meme:

Prison stock Geo Group returned 3x, Fannie Mae prefs returned 4x, the Rotation trade got a new hope, though commodities did “meh”.

Lets see how “Trump Trade - Phase 2” plays out for 2025…

Honorable Mention - Theory of Rolling Ponzis

“The Theory of Rolling Ponzis” deserves a mention. It goes something like this:

“The Market Monkey has a one-week horizon and will buy everything related to the Ponzi du Jour, before moving on to the next Ponzi”

We made proper money on Quantum Computing Ponzis, though we were too trigger happy and left too much money on the table.

Next time, I should keep some as a runner. Maybe something to remember as we enter the Golden Age of Grift™️.

Wrapping it Up

I’m certain that 2025 will not be as straightforward. In fact, our latest piece titled “PTSD” is meant to get our mindset ready for hedges and shorts to protect our capital in what could be a tough year.

After all, we have a new Tamagotchi. We analysed the “Anatomy of the New Tamagotchi” here and one thing is for certain:

If the Old Tamagotchi was about BETA, the New Tamagotchi is about ALPHA.

The Meme below is already hanging in the Louvre:

The good news is that we can prevail as long as we keep our head clear and remember some basic axioms:

“Once you realize it’s all nonsense, it starts to make sense”

“Don’t Be Stupid”

“We Give Thanks”

Wishing you all a Happy, Healthy & Prosperous New Year! Thank you for reading!

🌳🥹🙏

Disclaimer:

This isn’t financial advice. This is the equivalent of Monty Python for finance but worse: This is the trading blog of a shrub.

Don’t be Stupid. Seriously. How many times do I have to repeat this ….

Taking kids to school everyday is so much satisfying. One of the ultimate flex. Few.

New subscriber, enjoyed the 2024 recap. Congrats on a great year. Would love to see a big picture asset allocation post going into 2025.