2008 = RMBS, 2025 = AIBS* - Part II

Credit where Credit is Due!

Our latest piece around AIBS™️ aka “Artificial Intelligence-Backed Securities” (also a clever pun for “AI - BS”) triggered interesting reactions, including an offer from Netflix for the rights of the “Big Short - Part 2”. For the role of “Le Shrub”, they are considering other famous members of flora, such as one of the two ferns from “Two Ferns with Zach Galifianakis” and my American cousin George W “Bush”.

Sorry for the dad joke, I’m in an excited mood. Credit events tend to do that to me. Anyway, you can read up the previous piece here:

The whole point of the parody around AIBS™️is to highlight that the malinvestment in AI is leading to hundreds of $ billions of DEBT financing being put to work.

Eventually, Debt has to be repaid, unless you are the US government! When that’s not possible, we end up with Bad Credit and Credit Losses.

THIS is how Cycles sometimes end!

I see many investors jumping around like little monkeys to call the Market a “Bubble” based on valuation ratios reaching “never-before-seen-levels-since-1929”.

I got news for you. Valuation hasn’t mattered for a long time. But you know what always mattered? CREDIT, and Lenders getting their money back! Lenders will simply stop lending once Credit turns sour. That’s how the party ends.

Debt-fuelled Cycles end up the worst:

US Subprime in 2008

US Shale in 2015-16

China Real Estate

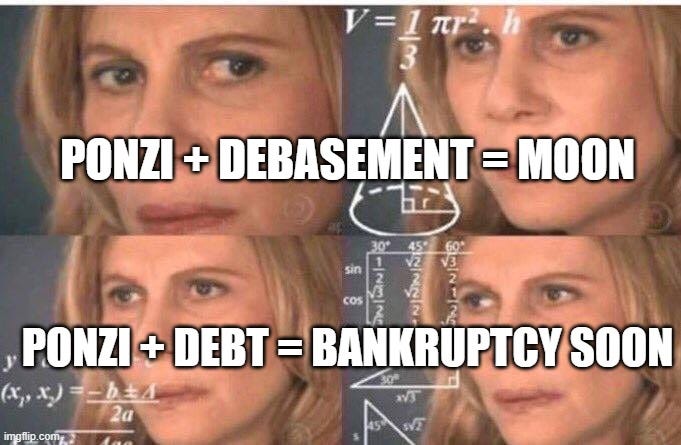

My point is, you can ride Ponzis all you want, but once DEBT enters the Equation, the whole thing becomes FRAGILE.

I guess we need a meme for this. Hang this in the Louvre:

It’s worth noting from the above examples of debt-fuelled cycles that they can go on for longer than we expect. When it comes to Credit, there are a lot of tricks to play, a lot of levers to pull.

Don’t forget what Sam Altman said in his latest blog:

“Later this year, we’ll talk about how we are financing [the AI Infrastructure]; given how increasing compute is the literal key to increasing revenue, we have some interesting new ideas”.

From our side, all we have to do, is keep a watchful eye for any signs of stress.

Some cracks are appearing…