"What if?"

Yet Another Pivot

This Fed does like to Pivot. After all, Pivoting is a feature of the System, not a bug!

Since Powell was appointed Fed Chair in 2017, there were a few notable pivots worth mentioning:

Dec 2018: Even though the Fed raised rates in the meeting, it signalled a more patient approach with further rate hikes, amid signs that the economy was starting to weaken. At the time, Trump urged the Fed to move cautiously “before they make another mistake.”

Dec 2021: After going on all year that Inflation was Transitory (spoiler alert: it wasn’t), the Fed announced that it would speed up the end of QE and would raise rates sooner than expected.

Dec 2023: Two weeks before the Fed meeting, Powell said that “it would be premature to…speculate on when policy might ease”. Then at the Fed meeting, Powell said that “rate cuts are something that begins to come into view”.

Aug 2024: “The time has come” to lower rates…

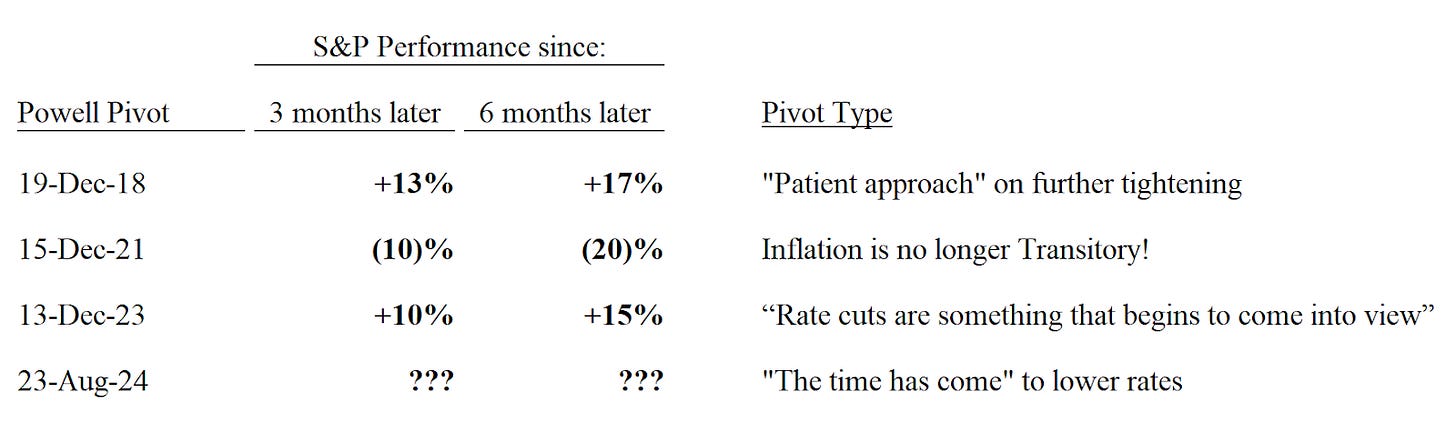

Each Pivot had its own consequences. The table below shows the S&P performance from the day of the Pivot to 3 months and 6 months later:

50bps vs 25bps

A key debate about the current Pivot is whether the Fed will cut by 25bps or by 50bps. The chart below (h/t CharlieBilello) shows the quantum of the first rate after a hiking cycle and it indicates that one should be careful what they wish for:

- A 50bps cut is usually associated with weakness in the economy and the forward returns of the Market are abysmal…

2007 vs 2024:

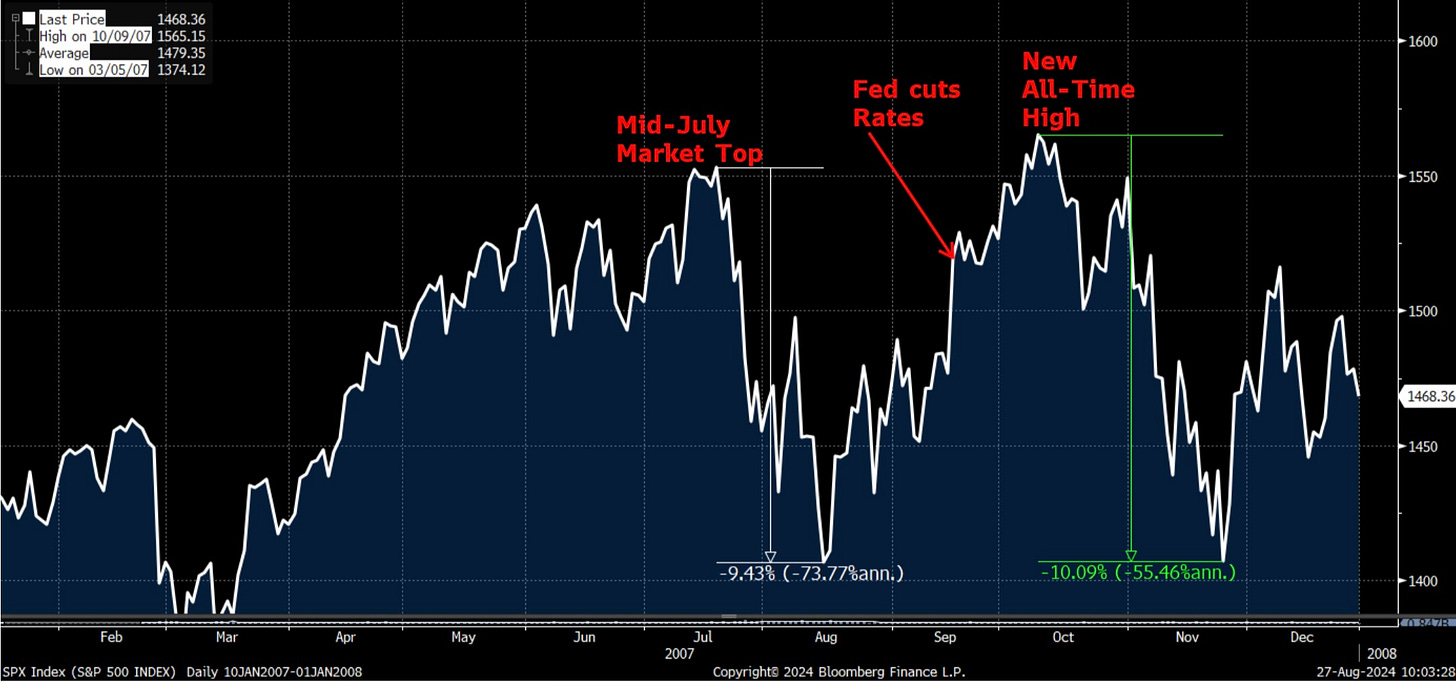

Speaking of which, the one period that comes to mind when we compare to today is 2007. Our friend PauloMacro just wrote a great piece on this, sharing the same thought.

There are some earie similarities.

As @Brett_eth notes here that we present in table format:

There is a certain degree of Recency Bias in comparing with 2007 so it’s worth highlighting some major differences:

2024 is an election year and the Re-election Brigade is out in full force to keep the Economy and the Market going

2007 Subprime Crisis was a credit crisis with an over-leveraged banking system, which is not the case today