Wealth Destruction, Klaus & The Easter Bunny

As if we didn’t have enough “Trade War” headlines, JPow came out on Wednesday with a sledgehammer to deliver a hawkish message:

Trump’s tariffs are “significantly larger than anticipated”…and can lead to “higher inflation and slower growth”

Jerome, my man, don’t be embarrassed to say the “S” word:

“Slower growth” = STAG and “Higher inflation” = FLATION, and that makes:

It’s not like you can hide it from the data anymore:

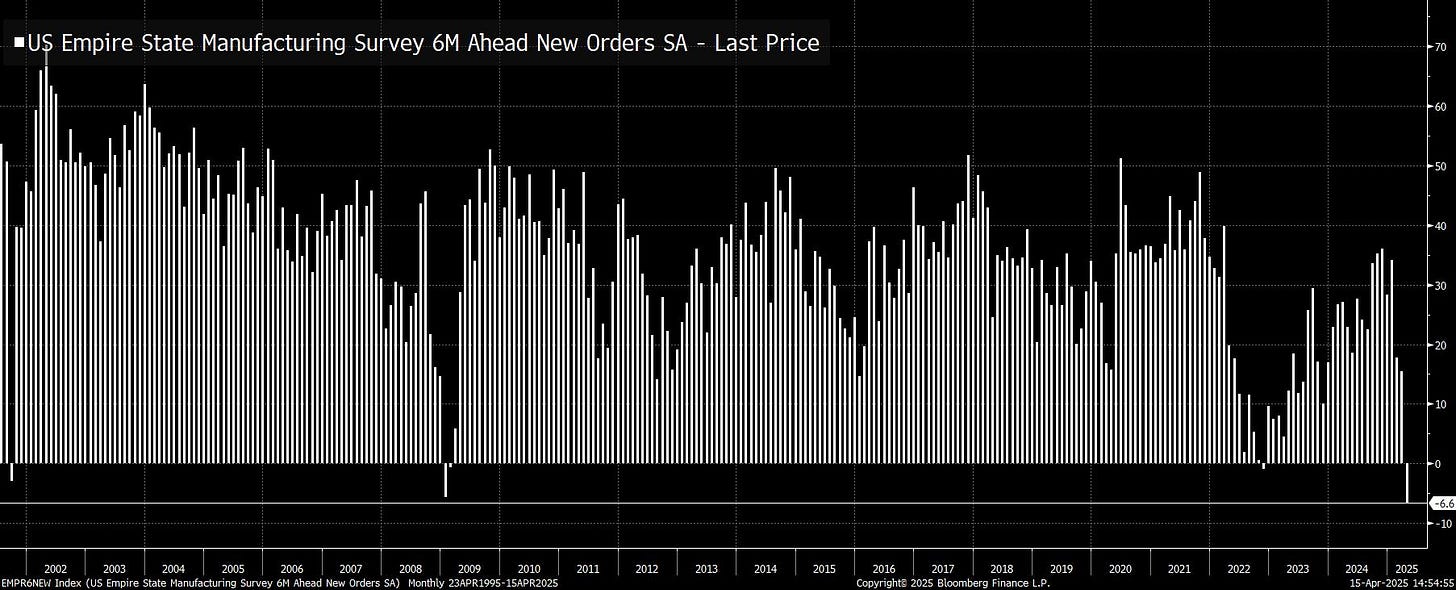

Empire Manufacturing Survey New Orders (6 months ahead) is at its LOWEST level EVER, lower than Covid and the GFC. I thought the tariffs were supposed to spur manufacturing activity right? RIGHT?!

Inflation Expectations are picking up. This is 1-year ahead expectations, so I guess we can throw the word “transitory” out of the window…again!

Incidentally, that Inflation Expectations chart looks great. Not sure I want to be short that chart…which means I ain’t buying no Bonds, because why would I? The Penny Bond Promoters need a better pitch…

Putting it all together, and I have some bad news:

The Easter Bunny is not coming this year: it was “Made In China” so it had to get “Tariffed”…