The Pain Trade

When Inflation Becomes a Meme / "Election Volatility" Playbook Update / "Pain Trade" Playbook

A couple of weeks ago, we presented a simple Playbook, calling for Rotation in the Markets:

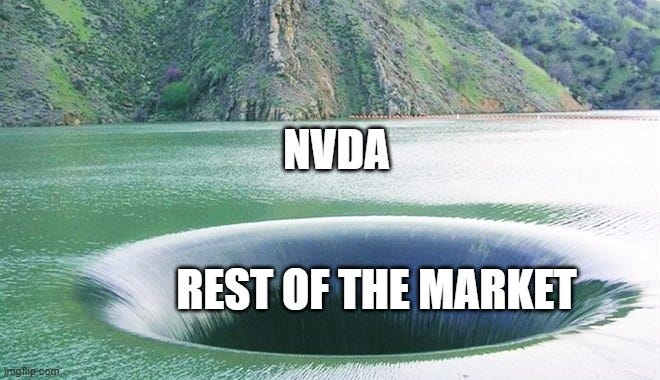

“What If” the Market rotates from the Winners (e.g. Mag7) to the Losers (e.g. Russell)?

“What If” liquidity reverses from Nvidia and flows back to the rest of the Market, where it belongs?

On Thursday, the Russell / Nasdaq spread recorded a +6% gain, the strongest since January 2021. On Friday, the spread gained a further +0.5%. The Breadth was also very positive.

Some called it Rotation. Some called it an Unwind.

We just gave thanks.

When Inflation Becomes a “Meme”

Given it’s a Meme Market, it was only appropriate that the trigger for the Rotation was a “Cold CPI”. After all, we’ve been rallying all year in anticipation of rate cuts as inflation calms down…at least in the made-up excel spreadsheet of a junior analyst in the US Bureau of Labor Statistics.

The series of Events this week was quite interesting:

First, the Market had a strong rally into the CPI, fuelling suspicion amongst investors that the CPI was leaked beforehand. Shrubstack gave an alternative explanation: “Since the data is fake anyway, it’s quite easy to leak them!”

Then, the CPI ex-anything-that-the-Plebs-need came out at +0.1% MoM, the lowest reading since 2021.

But something interesting happened next: The Market DIDN’T GO UP on the news! (that’s when we bought Nasdaq puts)

The Monkeys’ Playbook so far had been that as Inflation cools off, you just need to own Nvidia and the rest of the Mag7 and short the Russell.

But a “cold CPI” triggered a “Sell the News” type event.

The Nasdaq sold off 2.2% while the Russell rallied by +3.6%

“They” (aka “the Re-election Brigade”) must have panicked: “How can a “Cold CPI” cause a Market Sell-Off?”

But “they” had a solution:

If a “Cold CPI” caused a Market Sell-Off, maybe a “Hot PPI” will cause a Market Rally!

Lo and behold, the PPI on Friday came HOT! Not only that, but the Revisions came in even HOTTER, just in case the Monkeys didn’t get the memo to give the Nasdaq that extra boost!!!

The Market responded accordingly, with the SPX trading intra-day to a new All-Time-High as if to celebrate the sheer nonsense of it all.

But a late-day Dump was a nice wake-up call to the Monkeys that we are entering into Summer Volatility…

This charade with the Inflation Data is really getting out of control. I can imagine a future where “they” produce CPI prints on demand, with the winning print going to the highest bidder! A McDonald’s but for grifters if you like; It may be an innovative way to reduce the deficit!