The Bright Side of G.A.G.™️

aka "The Golden Age of Grift"; "Rosemary's Baby" Re-Re-visited!

“My Word is My Bond”, the saying goes, meaning that “One will always do what one has promised to do”. Given how badly Bonds have been trading lately, I’m not sure this motto has the same meaning anymore.

UK Gilts in particular have been a disaster, which is ironic in that “My Word is My Bond” happens to be the motto of the London Stock Exchange. Maybe they should consider changing it to something more contemporary, like “My Word is My Ponzi”.

While we are at it, maybe James Bond should also be renamed to James Ponzi:

“The name is Ponzi. James Ponzi. Agent Double-O-Seven-Per-Cent-Yield”.

And the word Bondage suddenly got a new meaning…

Ok, I will stop with the dad jokes now, since it’s all a joke anyway. I’m sure Shrubstack readers have figured this out by now.

The funny part is that when people start panicking about Bonds, usually marks a local top in Yields, until the next time they panic about Bonds.

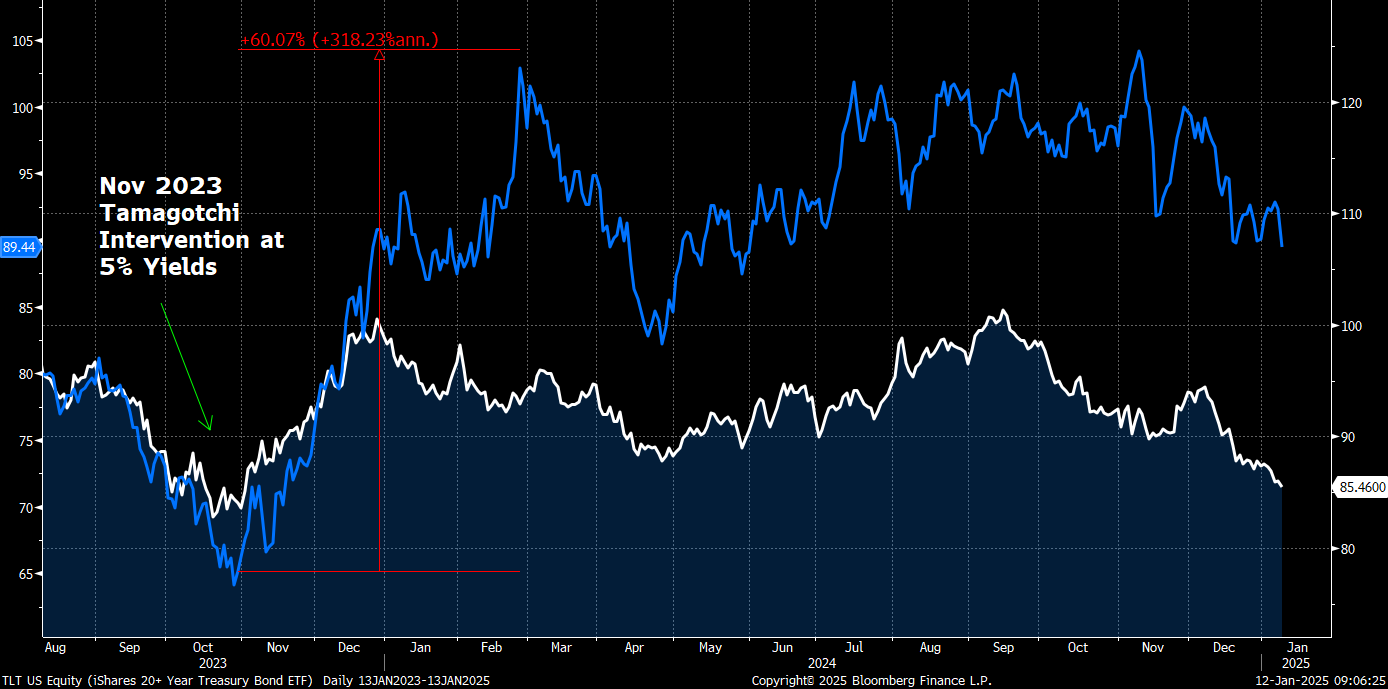

According to “Shrub’s Law of Large Numbers”, the US 10-Year Yield will gravitate towards 5% like a magnet. But as we are heading towards the 5% level, we are getting close to “Tamagotchi Intervention” territory. Unfortunately, the new Tamagotchi has yet to take the driver’s seat and remains to be seen how he will react when tested with higher yields. I hope Tamagotchi Yellen left him the Instruction Manual on the desk, and didn’t just take it with her…

In any case, with a 5% yield on the 10-Year, the incentives are to patch things up, as always, and I wouldn’t be surprised if “they” stop the bleeding around there, with their usual bag of magic tricks.

How do we profit out of this?

The simplest way is to buy some Bonds or upside calls on Bonds (e.g. on TLT, the ultra-long Bond ETF).

But when it comes to Bonds, I’m more interested in playing upside through Biotech aka “Rosemary’s Baby”: the unholy offspring of Cathie Wood and TLT. Given it’s a rate-sensitive and cash-burning sector, the name is appropriate.

When we first introduced “Rosemary’s Baby”, we included the Meme below as the “Summary for Traders with ADHD”. Given XBI, the Biotech Sector ETF, enjoyed a +50% rally, we have filed the Meme under “Memes That Make Money™️”.

In fact, XBI had a positive divergence from TLT over a one-year period: since Yellen’s intervention in Nov 2023, TLT has been flat whereas XBI enjoyed a +60% rally…

…this is including the panic of RFK coming in, that we dispelled in the piece “Rosemary’s Baby - Revisited”.

Biotech Setup into 2025

Biotech could have an interesting setup into 2025 for a few reasons:

As per above, IF Bonds stabilize, then Biotech will benefit

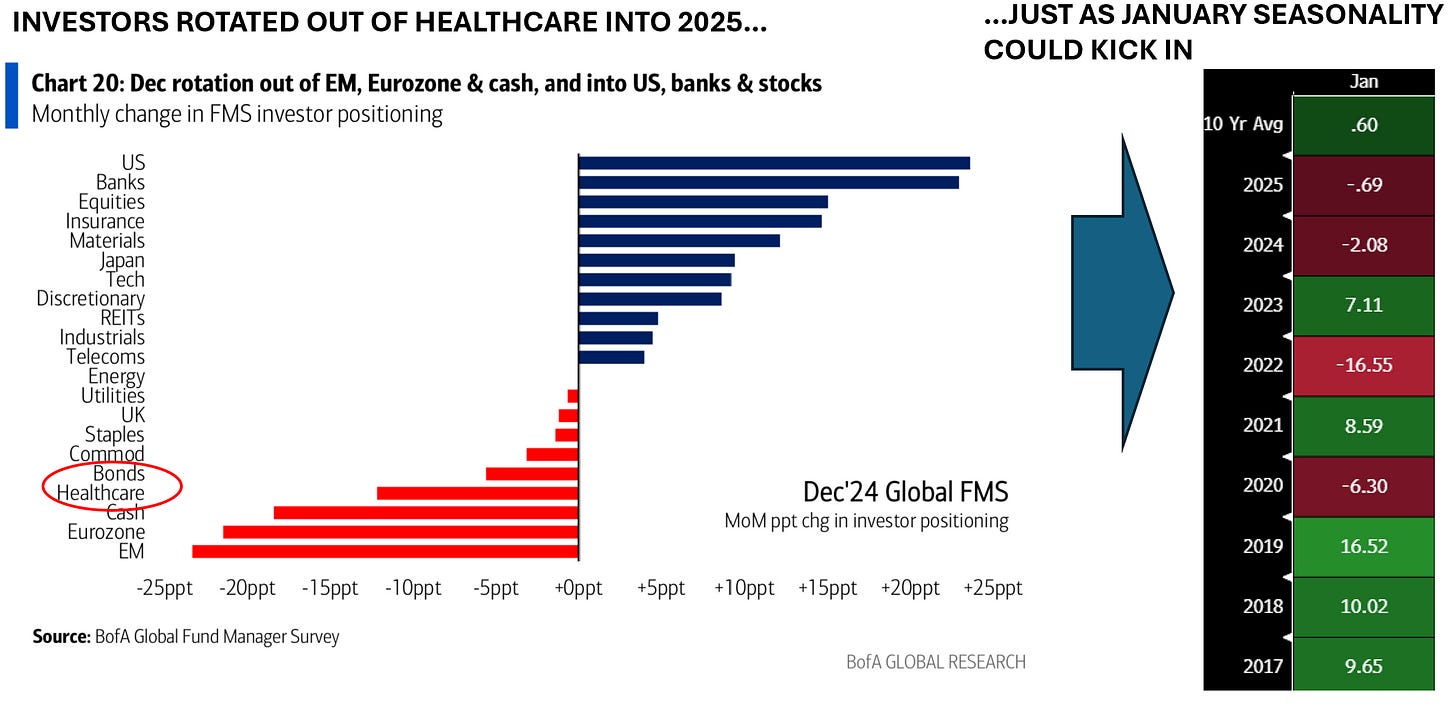

Healthcare has been amongst the worst performing sectors in 2024, and investors rotated OUT of Healthcare into 2025 (see chart below)

…meanwhile, Healthcare & Biotech exhibit some positive seasonality in January, most likely due to the infamous JP Morgan Healthcare conference, which takes place in mid-January. The conference provides a forum to present new data releases as well as M&A announcements. For example, Stryker just announced a deal with Inari at a +60% premium and 90x EBITDA. I would expect more deals to come.

M&A Revival - Miravai

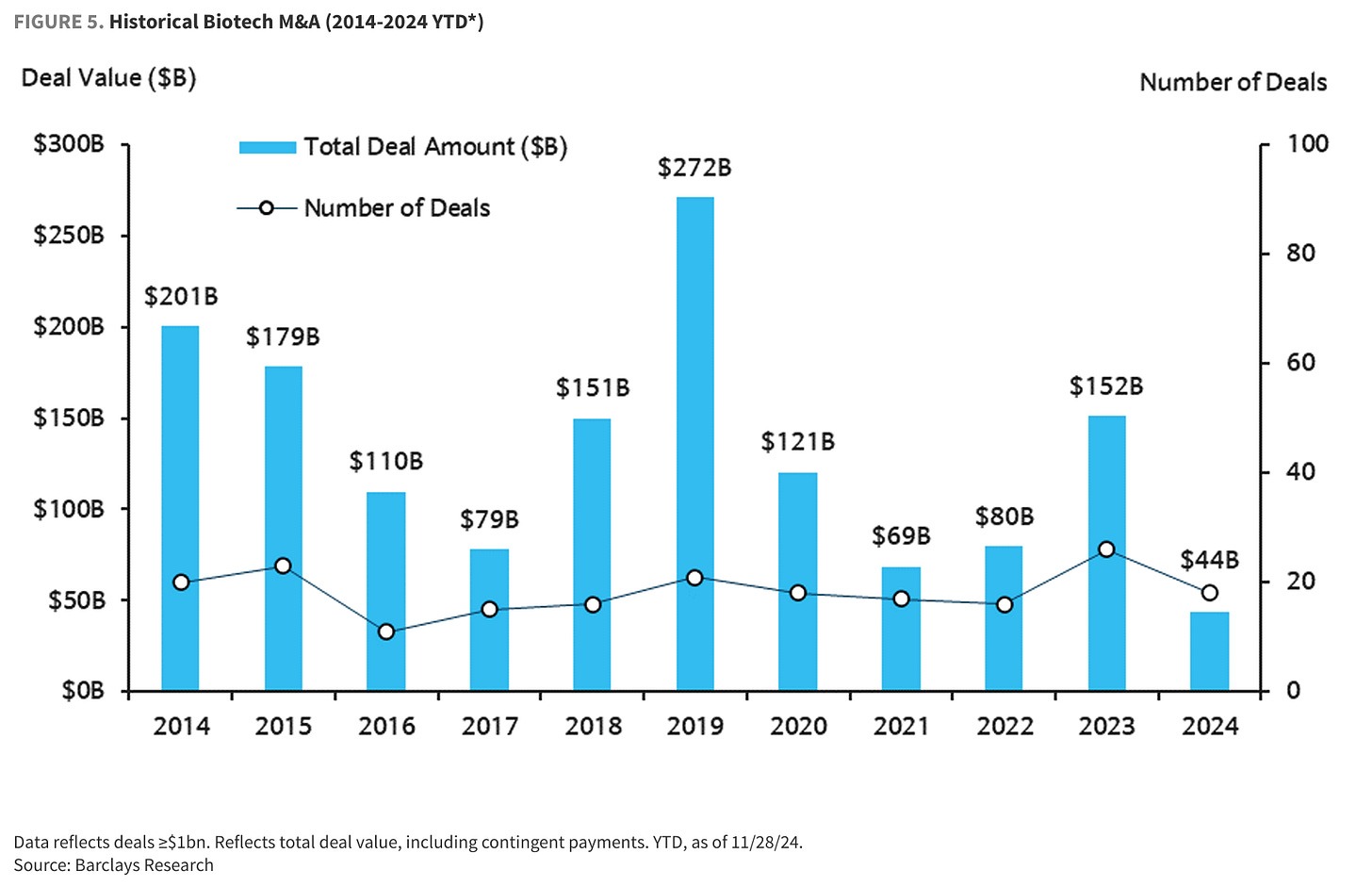

One of our key “Trump Trades” going forward is “M&A Revival”. M&A Deal Volume in 2024 was the lowest of the last 10 years, due to higher rates, de-globalization and the nonsense of Lina Khan.

Biotech M&A volumes were also at the lows, a fraction of years like 2019 and 2023.

The pent-up demand is there, and the key point is that Big Pharma has the cash to do deals.

One of the names I have flagged in the “M&A Revival” theme is Miravai (ticker: MRVI), a life sciences company with a focus on nucleic acids used for mRNA and cell and gene therapies.

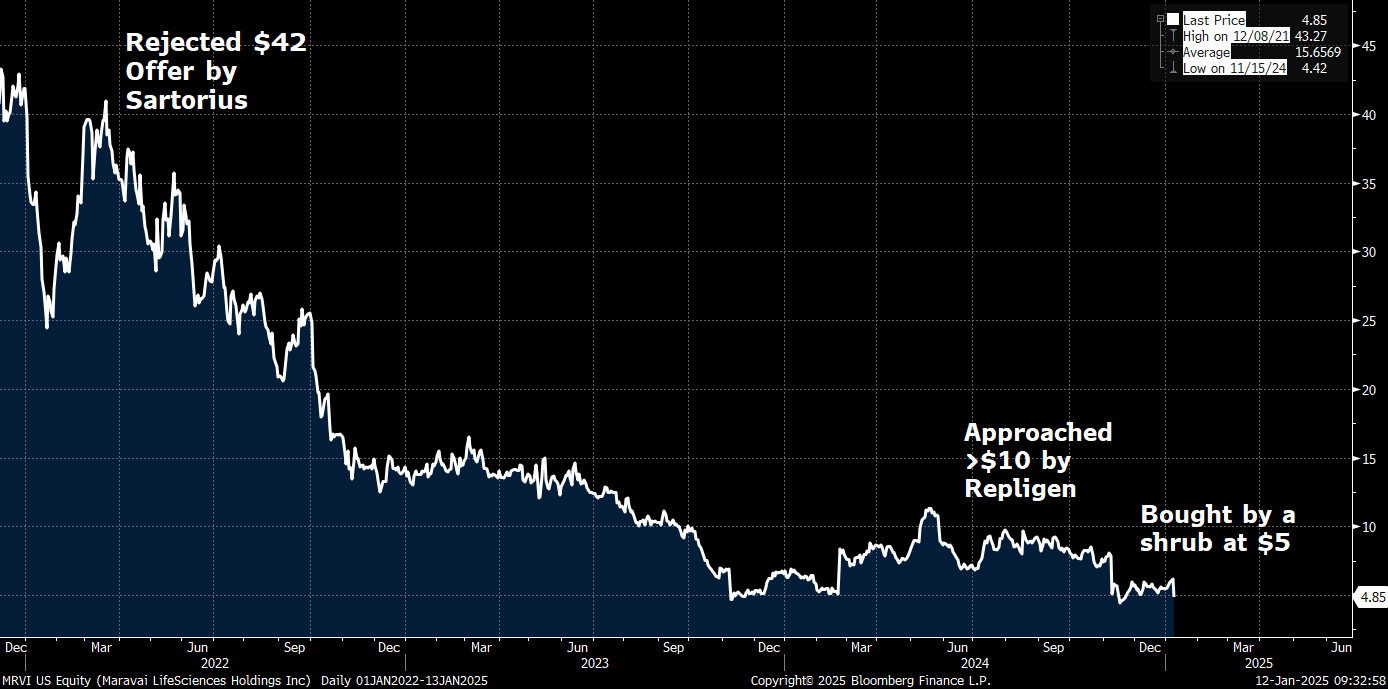

The background here is a bit ridiculous, as they rejected an offer at $42 by Sartorius back in 2022, then they were approached by Repligen in August 2024 above >$10, then they reported terrible results and stock puked by 37% down to $5. And that’s where we came in.

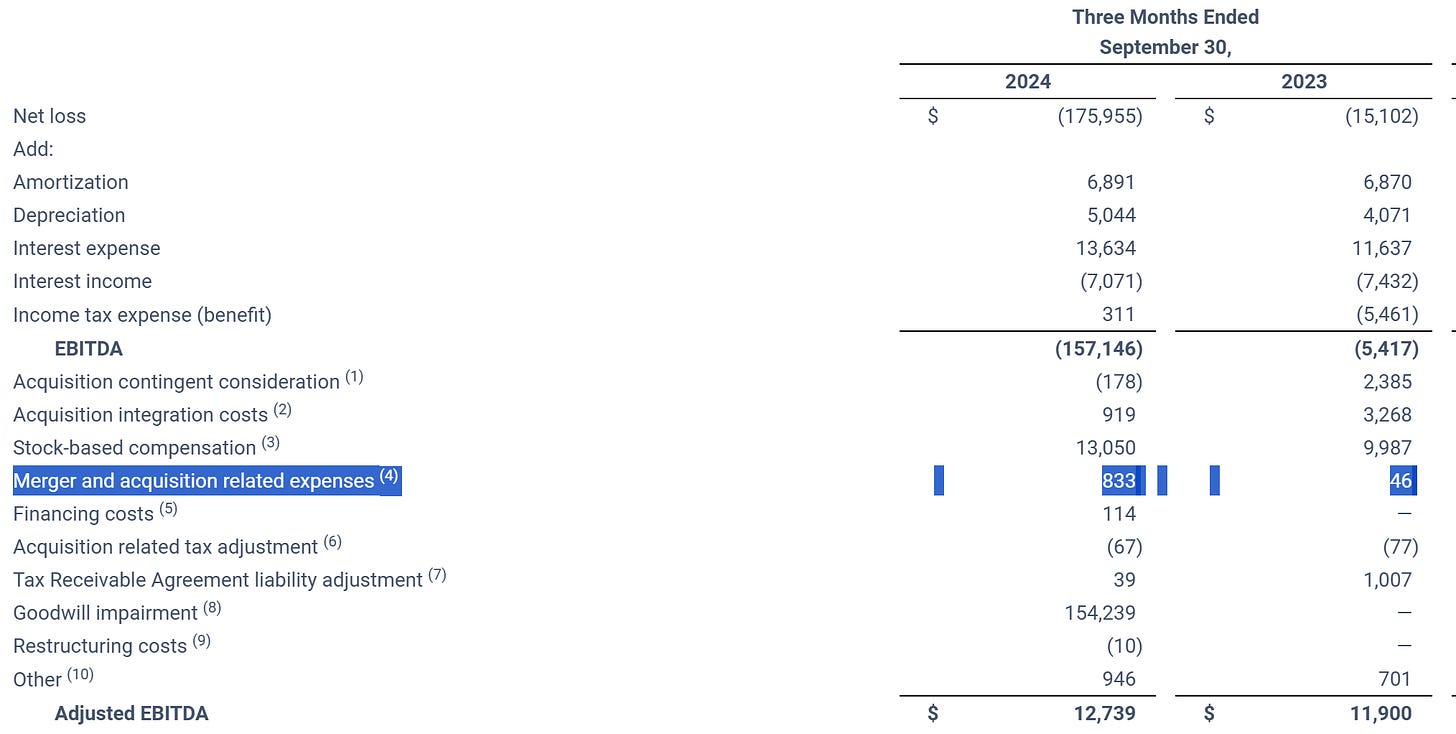

One little detail missed from the results was that MRVI spent $800k on M&A expenses, significantly more than usual. The footnote in the report said that it was for deals "pursued but not consummated". (h/t to my bud Peter Mantas!).

I went back and forth with a few readers as to the significance of this “M&A expense”, since I do tend to be a bit of a conspiracy theorist sometimes, and by that, I mean always.

Since it’s not clear whether those expenses were related to takeover discussions, the following data point is more interesting to me:

The Chairman and co-founder bought $1m in shares in November (pretty much the same time as us)

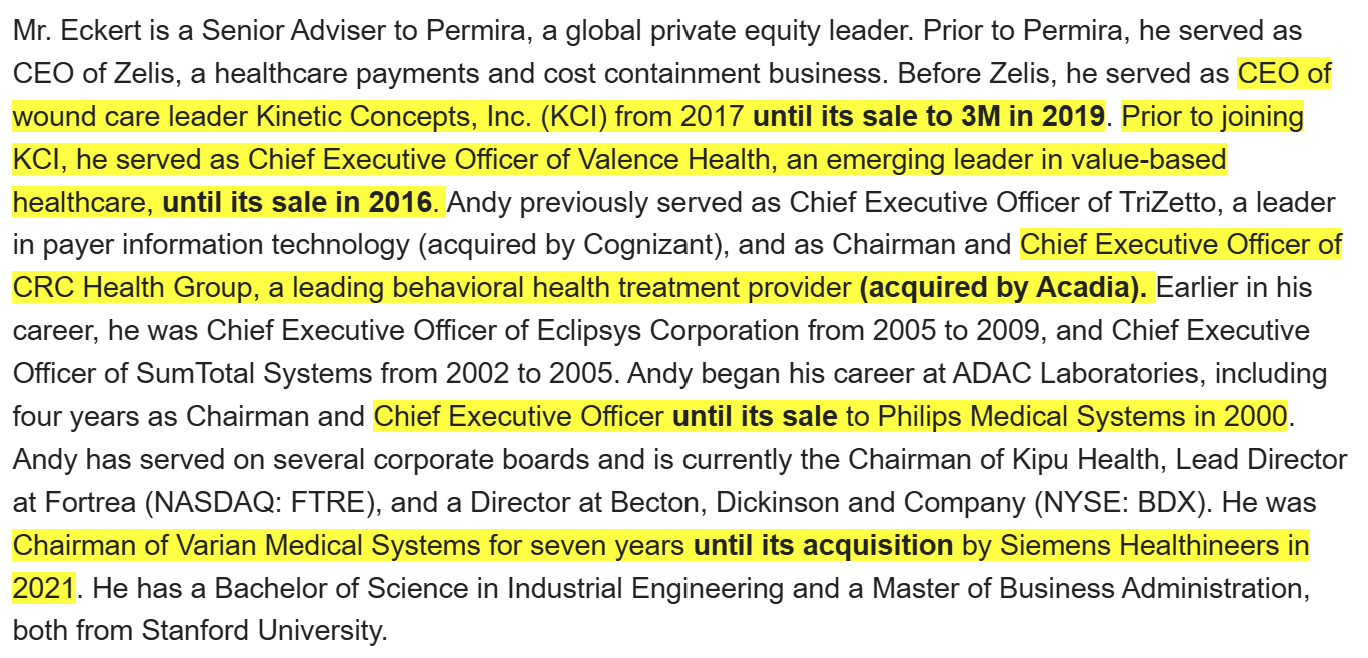

Then all of a sudden, in December, the Chairman was replaced by Andrew Eckert

MRVI’s main shareholder is private equity group GTCR with a 45% stake. “What if” the private equity group wanted to exit and the founder didn’t?

It’s the shrub crazy talk again. So let’s review the new Chairman’s CV, shall we?

This guy sold almost every company he worked at…I wonder why GTCR put him as Chair of MRVI?!

But my favorite chart on MRVI, remains the Goldman Sachs Price Targets on MRVI since its IPO: they were “Buy, Buy, Buy”, then “Hold, Hold, Hold” and then they finally gave up and switched to “Sell”. Performance Art!

In any case, I’m not sure what happens with this one, but I do like buying a beaten-up name with M&A optionality on top.

There are quite a few more of these out there!

The Bright Side of GAG

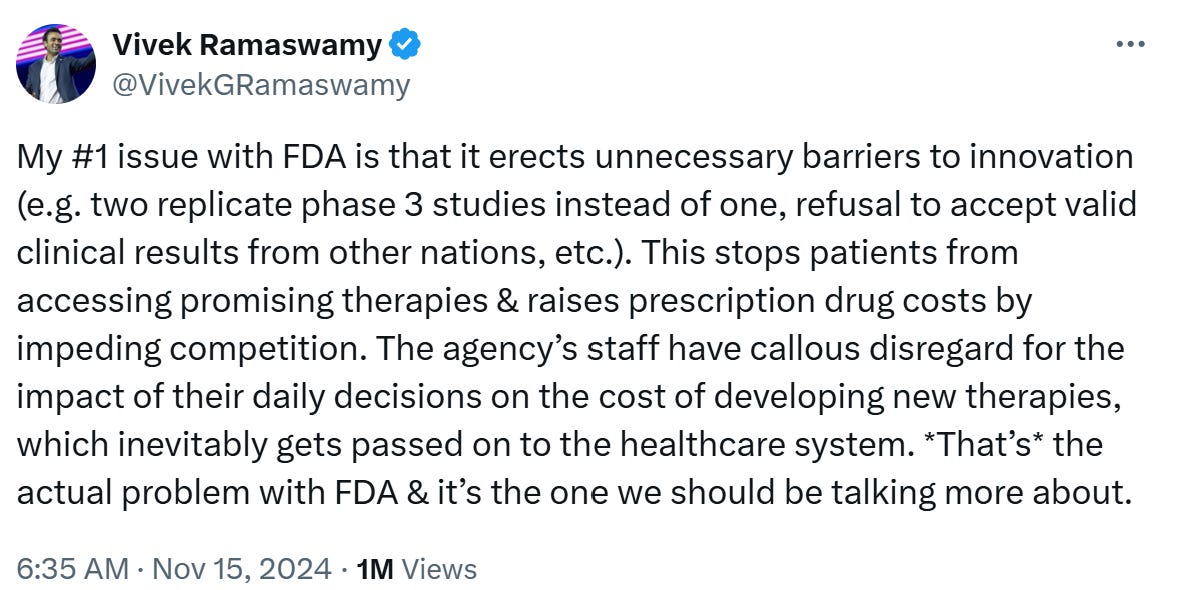

While everyone was panicking about the appointment of RFK, we were more excited about the involvement of Vivek and DOGE with the FDA. Recall this tweet of his:

and then recall this study we previously cited that puts the cost of development of a drug at $1.8bn per drug! Below is the rough breakdown of the costs:

The red tape and regulatory cost for new drug development is massive. This is one area were DOGE and GAG would make a positive difference for the World as a whole.

Green Shoots - Clearpoint & UniQure

I didn’t expect change to come quickly, but there were some Green Shoots in FDA policy last month and most people slept on it.

Time for a little story:

I’ve owned shares in Clearpoint (ticker: CLPT) for a while now. It’s a wonderful little company that offers precise navigation to the brain and spine. I will skip the photos in case some of you are skirmish. I considered CLPT as an interesting way to get exposure to Biotech without the same downside as it’s basically a picks-and-shovels play. CLPT works with 50+ biotech companies to help with drug navigation. Therefore, one doesn’t wake up one day with a -90% drop in the share price as is so often the case with single drug biotech investments. One can still wake up one day with a share offering, as is typical in space. In fact, I wouldn’t be surprised if CLPT raises more capital soon given its growth trajectory so buyer beware (though could prove to be a good entry for new money).

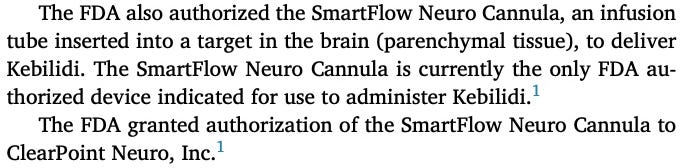

People really misunderstand the importance of this delivery mechanism. New gene therapy treatments are so expensive and precise, that CLPT’s delivery mechanism is part of the FDA approval process. See as an example below, the FDA approval of PTC Therapeutics’ Kebilidi, one of CLPT’s partners:

i.e. CLPT is the ONLY device that can be used to administer this drug, per the FDA.

Therefore, CLPT effectively becomes a "Royalty” stream on the drug going forward throughout the drug’s life (h/t to my buddy Peter Mantas again for the framing).

It’s been heart-warming, as well as profitable, to sit on this little company as it expands its portfolio of drug approvals. You just watch this video of how life-changing the gene therapy treatment of PTC + CLPT has been for kids with AADC deficiency, and you will quickly realize that this is much more important than markets…

Back to our story:

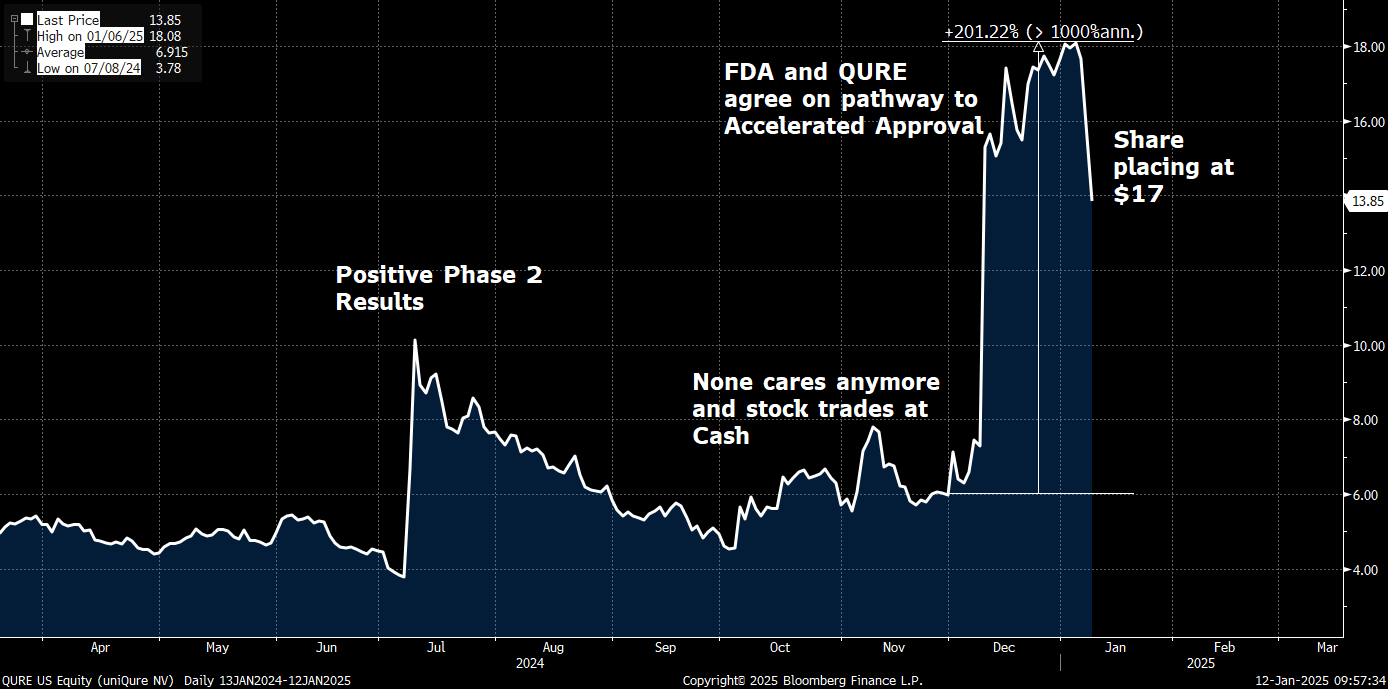

One of CLPT’s Partners, was another little company called UniQure (ticker: QURE), which focuses on treating Huntington’s Disease, with a one-time administered gene therapy using CLPT’s delivery mechanism.

I had a look at it a few months ago and the company was trading at ZERO Enterprise Value, around $6 per share i.e. it had as much cash on its balance sheet as its market cap. The company was soon going to meet with the FDA, so I took a bet and bought some shares.*

*FYI, my Biotech portfolio consists of a diverse group of “bets” in single names, treated as options. I don’t discuss them, given most are too small and too speculative for even the most hardened investors. I’m using QURE here as a case study.

Following the meeting, the FDA and QURE agreed on a pathway for Accelerated Approval. The stock then TRIPLED.

Why is that? Refer to the table above. A Phase 3 process would have cost the company probably $500m and 5 years to achieve. Instead, the company, with a market cap of $300m, now has a path to get early approval based on its Phase 2 data.

The Key point is that the FDA demonstrated flexibility, and for good reasons:

Huntington’s disease has ZERO alternative treatments available to slow its progression

There is therefore a significant unmet need, with 70,000 people diagnosed in US and Europe

QURE’s Phase 2 data were good enough to warrant this flexibility

Interestingly, on the SAME DAY, another small biotech company, Chimerix (ticker: CMRX) ALSO announced plans for Accelerated Approval, following discussions with the FDA. CMRX’s drug was also addressing a significant, unmet need.

So the FDA was “flexible”, TWICE in one day…this can no longer be a coincidence. Something changed in the FDA, and for the better. It’s important to highlight again, that these are a) rare cases with b) supportive data. But still. This is The Bright Side of GAG!

There is another takeaway from the story.

Pause for a second and consider that QURE was trading at ZERO Enterprise Value before the news. The Market, in all its efficiency, was giving you a FREE option to make 2-3x your money.

It’s actually quite ridiculous: In this Golden Age of Grift, where everyone is so focused on buying overhyped Ponzis, here we have Biotech companies with potentially lifechanging drugs, trading at ZERO Enterprise Value!

The opportunities abound.

Maybe Rosemary’s Baby goes GAGA during GAG!

Summary for Traders with ADHD

Biotech is a better way to play a bounce in Bonds

There are Green Shoots of change in the FDA

“Rosemary’s Baby” could go GAGA during G.A.G.

“Conservative” Investors could just look at the Biotech ETF (ticker: XBI) and pick spots

“Inquisitive” Investors could look at platform plays and “picks-and-shovels like MRVI and CLPT and pick spots

“Psycho” Investors could look at single names and pray

And remember:

Always look on the Bright Side of…GAG!

Good luck out there!

🌳

Disclaimer:

This isn’t financial advice. This is the equivalent of Monty Python for finance but worse: This is the trading blog of a shrub.

Don’t be Stupid. Seriously. How many times do I have to repeat this ….

Of course it’s happened before. I suspect the point is that “investors” (haha) would rather buy outright quantum ponzi’s or potential AI frauds instead of doing some work and sourcing rare disease sole treatment candidates trading at cash and wait for the FDA to actually wake up.

From the DYOD perspective, GTCR has been involved with Maravai since co-founding the company. I'm trying to think through why they wouldn't have wanted to exit twice before but now want to at the bottom.