The "Anti-Crypto Treasury" Trade

Introducing a stock trading at 53% of its Cash!

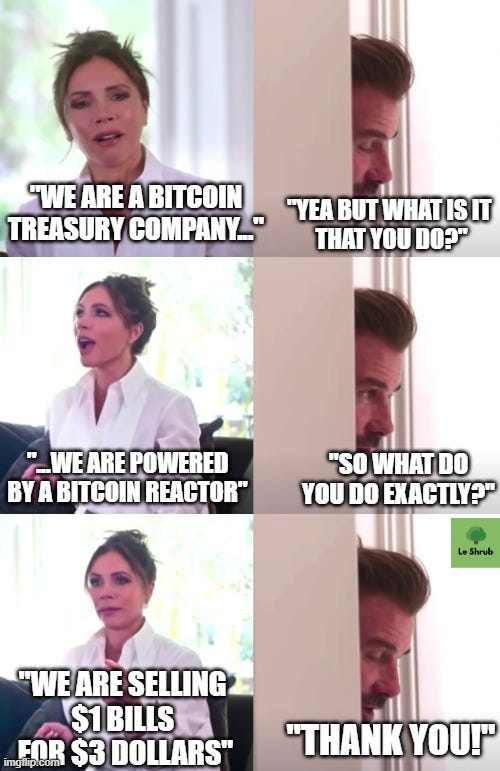

Crypto Treasury Companies are all the rage nowadays, clearly a sign of the times we live in. We discussed these abominations in “Grift Arbitrage II” but, in summary, the idea is that a promoter puts a cryptocurrency in a “Box”, and the “Box” trades at a premium to its NAV. Some of these companies now trade at 2-10x their NAV value, so they issue more shares and buy more of their target crypto. Below is the “Meme Summary” of the situation, inspired by the OG of Crypto Treasuries, MSTR:

In my latest Shrubcast with “Forward Guidance”, I was trying to be imaginative and think “why” some of these companies COULD trade at a premium to NAV. My idea was that IF we transition to an alternative financial system, then these companies could transform to financial services companies and their “book value” could generate some sort of yield, in the same way that traditional Banks trade at a premium to their “Book Value” because they generate yield from this “Book Value”.

Lets be clear, this is Science Fiction, but it was interesting to brain-storm on it, nonetheless.

However, amidst this mental exercise, I arrived at an “Anti-Crypto Treasury” trade (acronym: ACT™️).

Whereas Treasury Companies trade at 2-10x their NAV, this company trades at 53% of its CASH BALANCE. It’s so stupidly simple, that the investment case fits in the “Corner of the FT” and leaves enough space to write a haiku too…