Sensible Risk

Quick note on sensible bets

As I've said yesterday (Oct 26th), I'm out of shorts and bought some $RTY and $XBI calls (I’m still at 80% cash and bonds).

I want to explain the thinking a bit more of why I’ve spent some money on upside on the 26th of October. The way I see it is this:

On one hand, it's too late to be outright short at the index level.

On the other hand, it's too early to be outright long at the index level.

“Why” you may ask. It’s elemental dear Watson:

It's Halloween next week and we also have the QRA announcement AND the BOJ! You wanna get Gothilocked right before year end???

So I like to pick my battles with good risk / reward using options in times like these.

Hence why I went with $RTY calls and $XBI calls. Both are beaten up charts and setting up for a good move up IF it works.

Lets take Russell (RTY) as an example: it bounced off this level twice in 2022 for a +20% rally. Now I have to be honest. I really really hate $RTY. It’s a crappy index with really crappy stonks.

BUT: If I buy a call here at least my risk /reward is really obvious. I have a couple of % downside and I’m playing for a 5-10% move If I’m lucky.

Now lets do the $XBI. I refer to the XBI 0.00%↑ as the bastard child of Cathie Wood and that pesky TLT (ultra-long bond ETF for those fortunate enough not to know what that is). It’s really an obscene equal-weighted index, which doesn’t reward the best stocks like the Nasdaq or the S&P.

Lets do the same risk / reward though. XBI is at the Covid lows and it bounced off the same level in the summer of 2022 for a >50% rally :/

Now, even a shrub can figure out the risk / reward profile for a trade like this.

What I like about the XBI is that there are catalysts that will get some momentum going: for example, Vertex and CRSP Therapeutics are expecting approval for the first ever crispr therapy which will be on sickle cell disease (there’s an adcom on Oct 31st for those who care to follow).

Furthermore, most biotech stocks are now trading near their cash balances so that helps with the risk / reward (You can mention your favorite biotech stonk in the comments: don’t be embarassed, everyone has a biotech bag … eventually!)

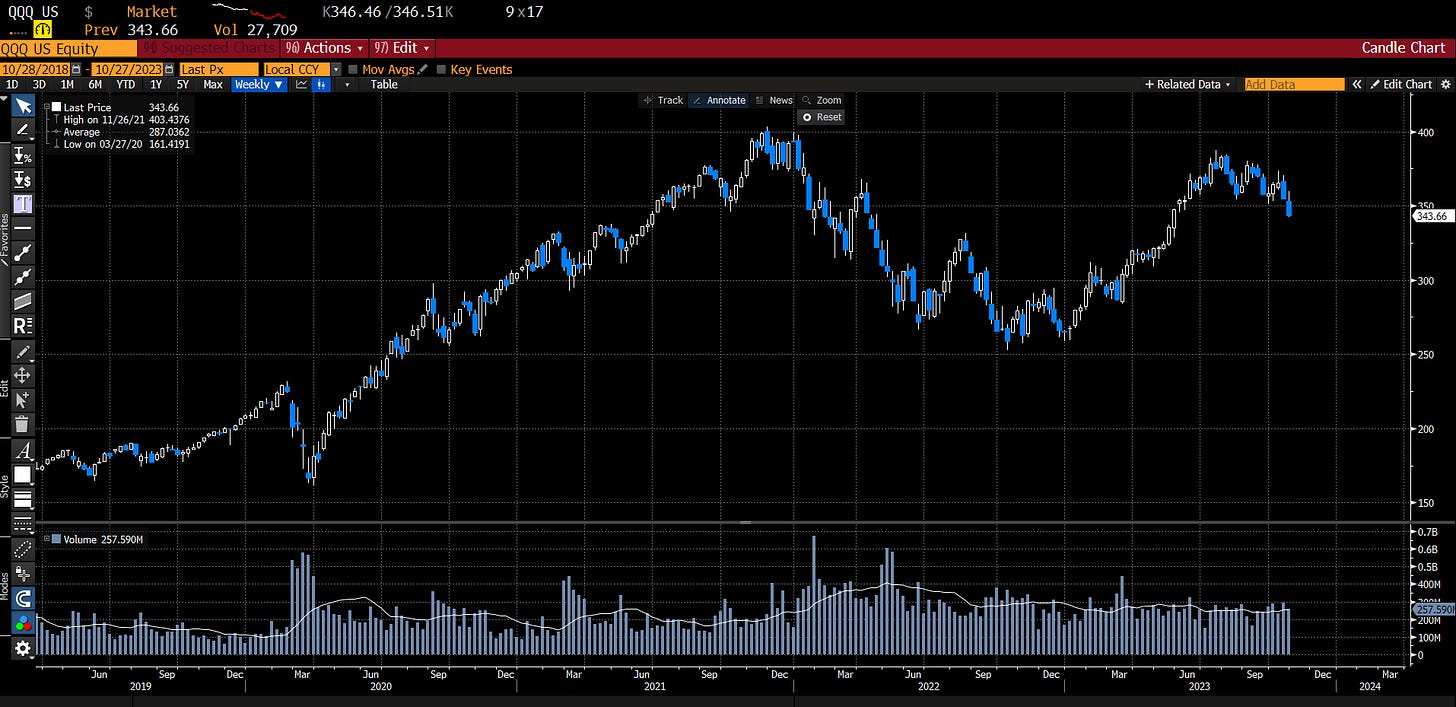

And now compare with the Nasdaq QQQ 0.00%↑ , dominated by the beloved Tech Giants. Not quite the same risk / reward is it?

Now what are the risks? Well there’s many:

QRA can spook people

BOJ can blow up the market

Nasdaq is still too high and ca bring everything down

WW3 breaks out

tax-loss selling drives the XBI down to zero

Gothilocks does all of the above

But the whole point of this impromptu post was to explain why I took the bet.

I’m playing for 10 up 1 down. Even If I’m wrong, I won’t feel bad about it.

And If I’m wrong, I’ll be out before you finishing reading this sente….

Risk reward

Love the shrub posts

Keep it coming

dumped my biotech bags a long time ago but really considering dipping a toe again with GLPG!