Quant-Monkey-eddon ™️

"What if" the Quants are Monkeys too?

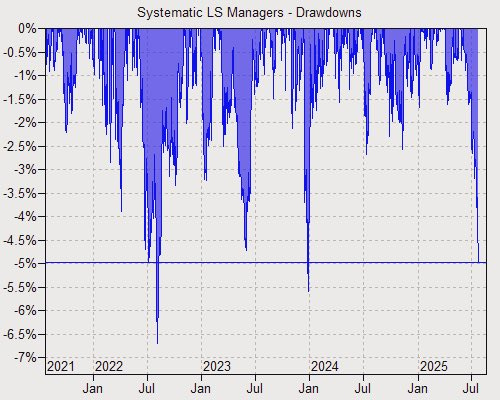

There’s been a type of “Quant-mageddon” recently, where algo-driven strategies experienced one of their largest drawdowns ever, as can be seen from the chart below:

The GS Long/Short Index of Crowded Longs vs Crowded Shorts just had its worst June-July streak ever (h/t JaredKubin):

This “Quant-mageddon”, which caught off-guard the biggest quant funds, has partly been attributed to the “Retail Meme Mania”.

I think it’s too convenient for the “smartest guys in the smartest funds” to blame “retail investors” for their losses.

“What if” it’s the Quants who got their inputs and outputs wrong? “What if” their models suck? “What if” their AI isn’t actually Intelligent, just Artificial?

“What if” the Quants are Monkeys too? In which case, “What if” we just experienced, not Quant-mageddon, but Quant-Monkey-eddon™️?

Here’s the funny part: I didn’t really feel this Quant-Monkey-eddon in my Portfolio. Or so I thought. Then this happened, which triggered this article: