Iron Maiden and the Jell-O Lady

+ PGMs, Tin, "Corner of the FT" update, Miners, China, Addicted to Rolling Ponzis, Shrubvana, Law of Big Numbers & "SPOO 6K" Hats!!!

“Wherever you are, Iron Maiden's gonna get you, no matter how far” - Iron Maiden

“Wherever you are, Jell-O Lady’s gonna pump the deficit, no matter how far” - Le Shrub

Paul Di’Anno, the original singer of heavy metal band, Iron Maiden, passed away this week. End of an era.

In close resemblance to “Iron Maiden”, “Iron Lady” was the nickname given to Margaret Thatcher after her visit to the Soviet Union. Margaret Thatcher was, of course, the epitome of fiscal prudence. Maggie’s policies were characterised by a “belief in free-markets, an effort to reduce state intervention in the economy, reduce the power of trade unions and tackle inflation”. End of an era.

This week, Yellen made this wonderous statement:

Yellen: “FISCAL DEFICIT REDUCTION IS REQUIRED OVER THE COMING YEARS”

Amazing. On her last month in office, Yellen saw the light and invoked the spirit of Margaret Thatcher…

Back in December 2023, we affectionately nicknamed her “Tamagotchi Yellen”, once we realized that her reaction function was as simple as that of a Tamagotchi: Do everything possible to get her guy (now lady) re-elected.

Seeing her flip-flop on this narrative just before the end of her term, makes me want to re-name her to “Jell-O Lady”.

But I don’t want to be too harsh to my favorite Tamagotchi. I know I know. She’s letting the next guy deal with the deficit. But guess what. The next guy will do the same. Rinse and Repeat.

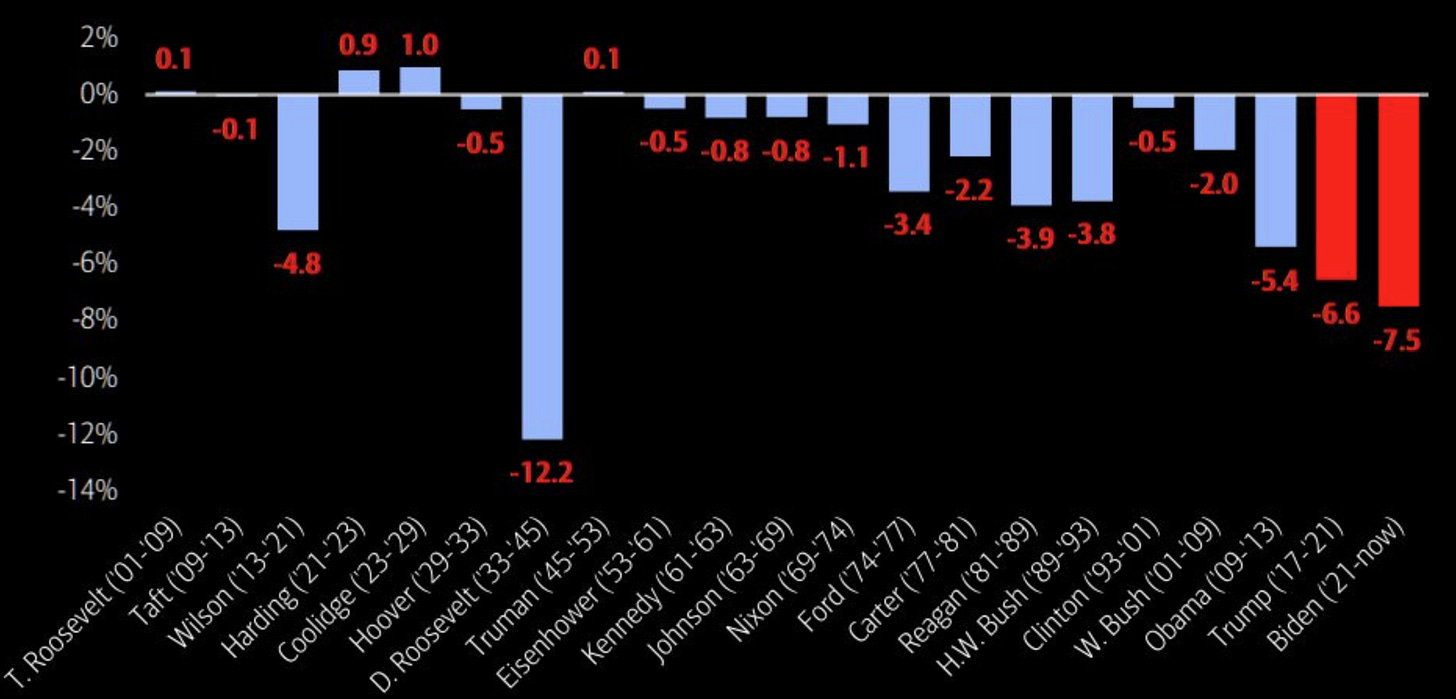

Just look at the deficits under Trump and under Biden: both were spending like they were Wartime Presidents!

At some point, this can end badly. Who knows when. But the Endgame is looking more and more likely. As Paul Tudor Jones said in his latest interview:

“All Roads lead to Inflation”

The Bonds are smelling it, the Precious Metals are smelling it, even the Monkeys are smelling it.

A couple of months ago, my buddy Eliant and I wrote a thought-provoking piece on Policy Pivots titled “What if?”. Still relevant and a worthwhile read <Spoiler Alert: Paul Tudor Jones would agree with it!>

PGMs, Tin & “Corner of the FT” Update!

Speaking of Precious Metals, Platinum and Palladium are setting up for a break-out. Platinum has Costco on its side, whereas Palladium was aided by talk that the US is pushing for sanctions against Russian Palladium. Russia produces c.40% of the World’s Palladium so there could be fireworks if the sanctions actually take place.

This collaborative piece with Eliant and Last Bear Standing is worth a re-read: “Platinum Group Metals: An Asymmetric Setup”. Some things take time to play out, but when they do… <insert rocket emojis>. Below is the chart of…