"Innovation" Week!

American vs EU Innovation, Bonds vs Biotech, Chip Wars, Inverse Pelosi, Platinum, the "Woke" Gap

Major movers this week: S&P +0.9%, Nasdaq +0.3%, Russell +1.9%, TLT +0.2%, Crude -8.4%, Gold +2.4%, Platinum +2.8%, China (HSI) -2.1%.

Meanwhile, Quantum Computing stocks closed up +25% for the week, validating the “Theory of Rolling Ponzis” we recently presented.

We missed the slot for this year’s Nobel Prize Awards, so we were planning to submit our Theory for consideration in next year’s Awards…

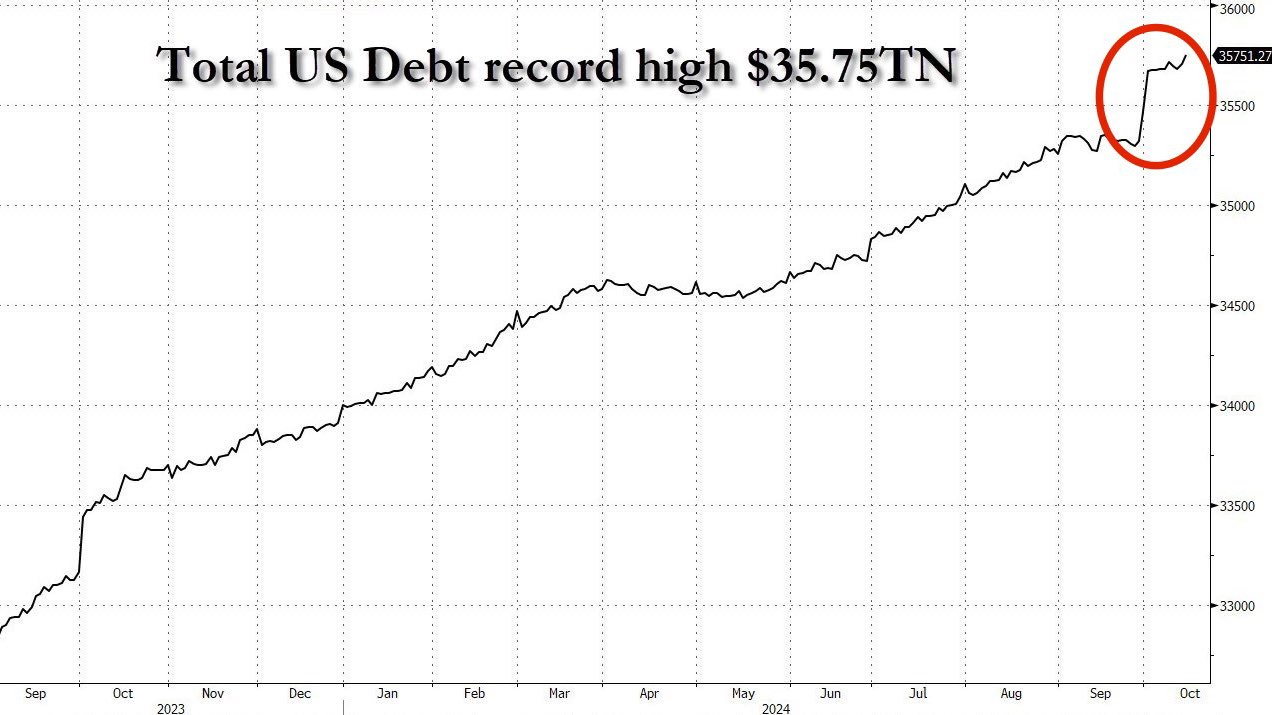

…that’s until we noticed that the US debt exploded by $500 BILLION in just a few weeks (h/t @Geiger_Capital). With Elections round the corner, “they” are really paying up for those swing votes!

As much as I enjoyed feeling like Cathie Wood for a week, one must consider whether their stock returns could be aided by reckless monetary & fiscal policies instead of sound fundamental reasons. After all, in a Bull Market everyone looks like a genius! A meme is in order:

In any case, in order to celebrate our Quantum Computing profits, we have called today’s piece “Innovation Week” … and by “Innovation” we really mean Ponzis…but we give thanks anyway!

American vs Europoor Innovation

When it comes to Innovation, our Americans friends like to make fun of us Europoors and rightly so. After all, in Europe, “Innovation” basically means “Regulation”.

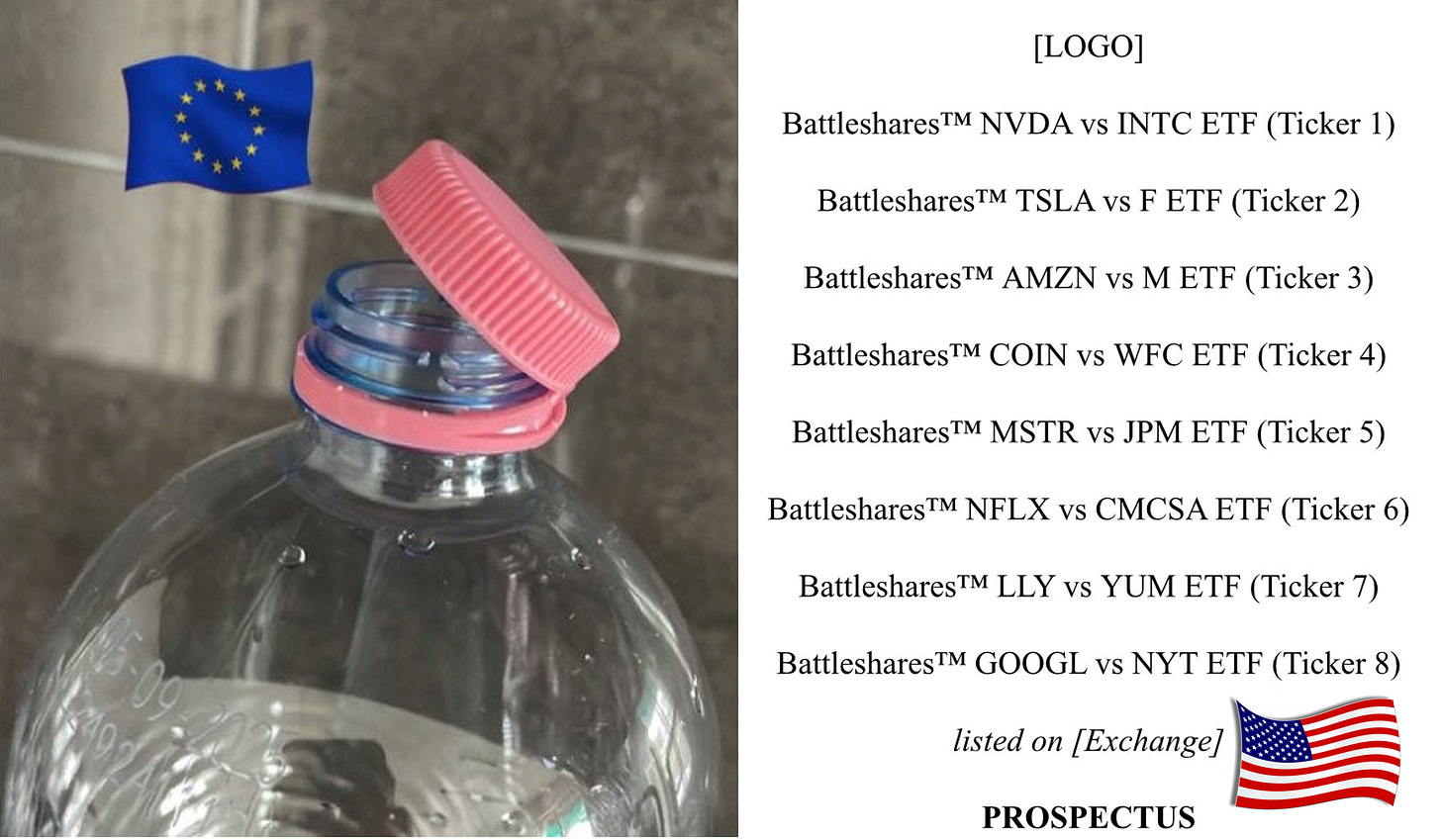

For example, whereas recently Space-X caught a rocket with chopsticks, the EU mandated an abominable device as a bottle cap. They probably spent years debating it and billions developing it. Such monkeys…(= “Singes” in French, “Affen” in German, “Moonkees” in Scottish).

This week, it’s time for us Europoors to make fun of our American friends, given the latest financial innovation of Wall Street. Following the roaring success of 0dte options, they now came up with … long / short pair trades wrapped in an ETF! That’s the equivalent of the European bottle cap, but in a way that you can lose A LOT of money.

Like, who wouldn’t want an ETF that’s long Nvidia / short Intel, or long Eli Lilly / short Yum Brands?! Well done Wall Street…well done…