How to get the Market Gods on Your Side

Risk / Reward

Just 2 days ago, I wrote the "China Quickie" piece where I argued that the market misunderstood that the CCP's 5% growth target was bullish commodities.

Furthermore, the mining stocks were beaten up and at level where they provided a solid risk / reward level to buy in, while the monkeys were sleeping on it.

I used Anglo American as an example, but frankly any company would do: Glencore, Teck, Freeport, you name it. It’s almost the same trade at the end of the day.

I expected that the market would interpret correctly the CCP’s intentions to boost growth, and that mining stocks would catch a bid from these oversold levels.

And it did happen, to a degree.

But the real boost to commodities came from JPow when, during his testimony on Capitol Hill, he pretty much said that they will start cutting rates when they have the confidence that inflation will get to 2% i.e. they don’t have to wait for inflation to actually hit 2%, just their “confidence” will do.

This is the same Fed that was confident that inflation is transitory during 2021 so one can be forgiven for getting a wee bit concerned about their intentions!

The Dollar took a hit and is now below its 200dma. That chart looks like it wants to break down.

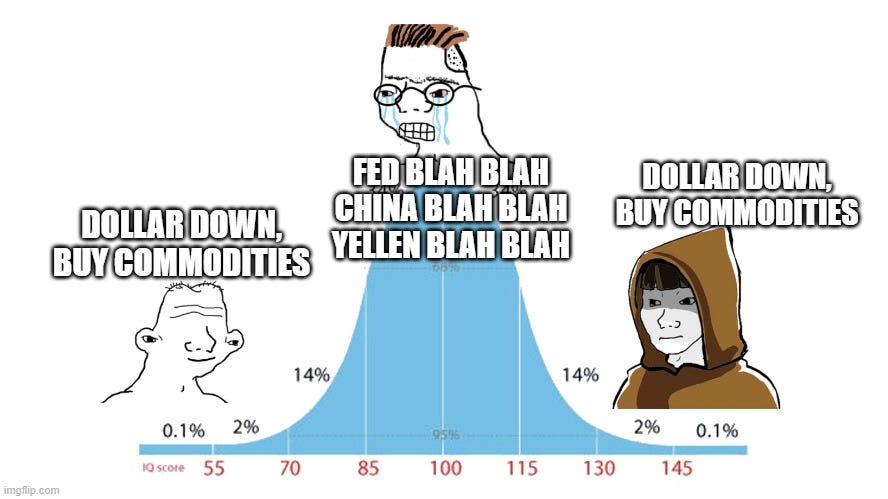

We keep things simple around here at Shrubstack: dollar down, bullish commodities and rest is noise.

What’s the lesson here?

When you have a good entry in a sensible trade, the Market Gods sometimes smile upon you.

(Or just buy Nvidia and be done)

Disclaimer:

This isn’t financial advice.

This is the trading blog of a shrub.

Don’t be Stupid.

So if I understand correctly, buy stocks at important support zones when you can put or anticipate a reasonable near catalyst behind the stocks. Sounds simple but requires a lot of skill to do it consistently.

The more KISS the better!