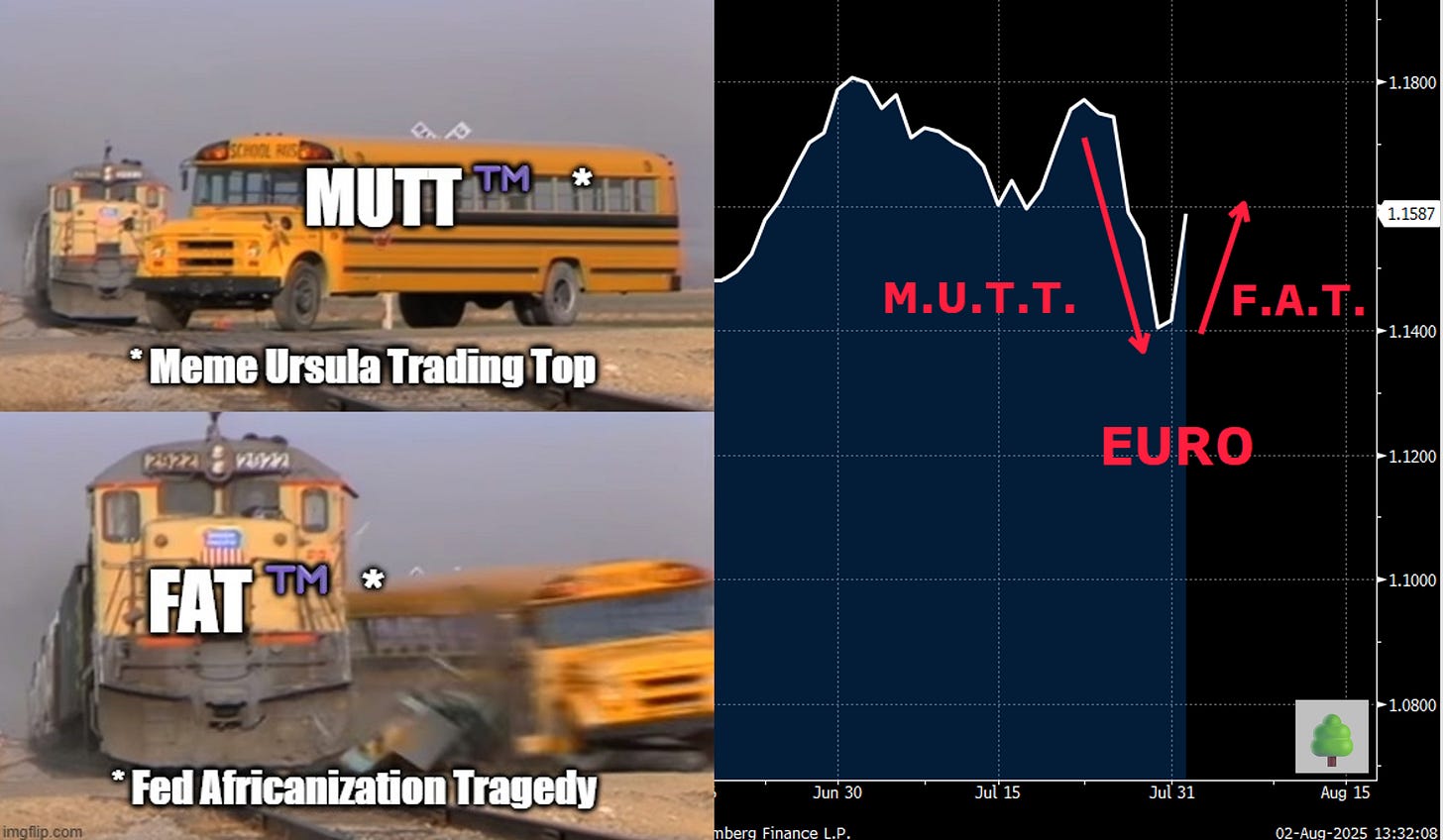

FAT™️ trumps MUTT™️(Pun intended!)

Plus : PORTFOLIO REVIEW

Such is this Market that, just as one narrative starts taking shape, another one comes and blows it out of the water.

Last week, when Ursula capitulated to Trump’s deal-making skills and settled for a lukewarm EU trade deal, we called for the "Meme Ursula Trading Top" (MUTT™️) for the Euro, though we did warn that:

“To be clear, I’m not calling for a USD Bull Market and I don’t really want to go full-on “Long USD”. Au contraire. I think we are in a Global Debasement Regime, as is appropriate in the Golden Age of Grift. By the end of this cycle, all paper currencies may end up worthless, as Nature intended.”

Well, by Friday the Dollar weakened again, as another Meme emerged that trumps the previous Meme (pun intended):

the “Fed Africanization Tragedy”, aka FAT ™️

Here’s why the Dollar weakened on Friday:

Weak NFPs: Non-Farm Payrolls came at 73k vs 104k estimated

Shockingly Bad Revisions: NFPs for May and June were revised DOWN by 260k (!), on par with past recessions in 2008 and 2020.

…which highlights a Weak Jobs Market: In the past three months, employment growth has averaged only 35,000 — the worst since the pandemic.

Trump then fired the Head of the Bureau of Labor Statistics (BLS), accusing her of “faking” the Jobs data before the Election.

Then Fed Governor Kruger unexpectedly resigned, leaving an empty slot in the Fed for a Trump appointee who is aligned with Trump’s view on interest rates.

Pretty busy Friday!

I’m somewhat sympathetic with Trump’s view on the BLS, since I’ve spent the whole of 2024 making fun of the previous administration for “cooking” the data so well that they could give cooking lessons to Gordon Ramsey.

To be clear, the data MAY have been cooked, or the data may have just been … bad! e.g. the response rates by businesses have plummeted, rendering the data less reliable.

Thing is, I can joke about these things, because I’m a shrub and this is parody.

But when the President says it and fires the head of the BLS, then … well, sorry, this is when Developed Markets turn to Emerging Markets, hence the “Fed Africanization Tragedy” (FAT™️) monicer:

As I said many times, while I commend President Trump for transparency, sometimes the Plebes are better off not knowing how the Sausage is made, so just keep the doors of the Sausage factory closed. I mean, if it’s for the best that the Plebes don’t know about the Epstein List, then cooking economic data should be in that category too.

Unfortunately there is a precedent of a US President firing the Head of the BLS and that was Hoover in 1930, because he challenged the administration’s false claims about employment. That’s the same Hoover that didn’t listen to Ford and JP Morgan when they advised him against implementing the Hawley-Smoot Tariffs, again in 1930. History rhymes. Sadly what happened next was no good… (h/t Citrini)

Back to 2025.

After Friday’s news, I had a discussion with two of the smartest traders out there:

One was Bearish Dollar: “Firing the head of the BLS? We are turning into Africa”

The other was Bearish Euro: “US is about to re-accelerate. Europe is the one slowing down.”

For me, the answer once again lies in the Memes:

Indeed, “Why not Both?”. Between Ursula caving in to Trump (MUTT™️) and Trump firing the head of the BLS (FAT ™️), I really can’t see why we should be bullish on either paper currency. By the end of this cycle, they will both end up as toilet paper.

Therefore, keeping a Barbell Approach, as we’ve done all year, remains the only sensible allocation strategy.

More on that later.