Downgrade

On Friday, Moody’s stripped the US of its AAA-rating, becoming the last major Rating Agency to do so and making them the ultimate “Johnny-come-lately”.

Moody’s warns of “rising debt levels” and expects deficits to rise to 9% by 2035…which is clearly unsustainable, though by 2035 we may not have to worry about the US Deficit since there’ a good chance that by then Elon’s Robots and / or Altman’s AI will destroy humanity.

The rising US Debt does remind me of Taleb’s “Life of a Thanskgiving Turkey”…everyone is having a great time until the inevitable day of reckoning.

Reminiscences of the August 2011 Downgrade

On August 5th 2011, S&P was the first agency to downgrade the US below AAA, four days after Congress voted to raise the Debt Ceiling.

The S&P was down 6.5% the next day.

But, in what is probably the first major “Meme” macro moment I can recall, Bonds ended up having a massive rally, with 30-year Treasuries rising by +20% in a couple of months.

2011 was VERY different to today. Back in 2011, the Eurozone Crisis caused flight to safety to US Assets, and US Treasuries were seen as the ultimate safe heaven. Sounds crazy today, right?!

In 2011, just coming out of the GFC, there was a strong case of Recency Bias at play:

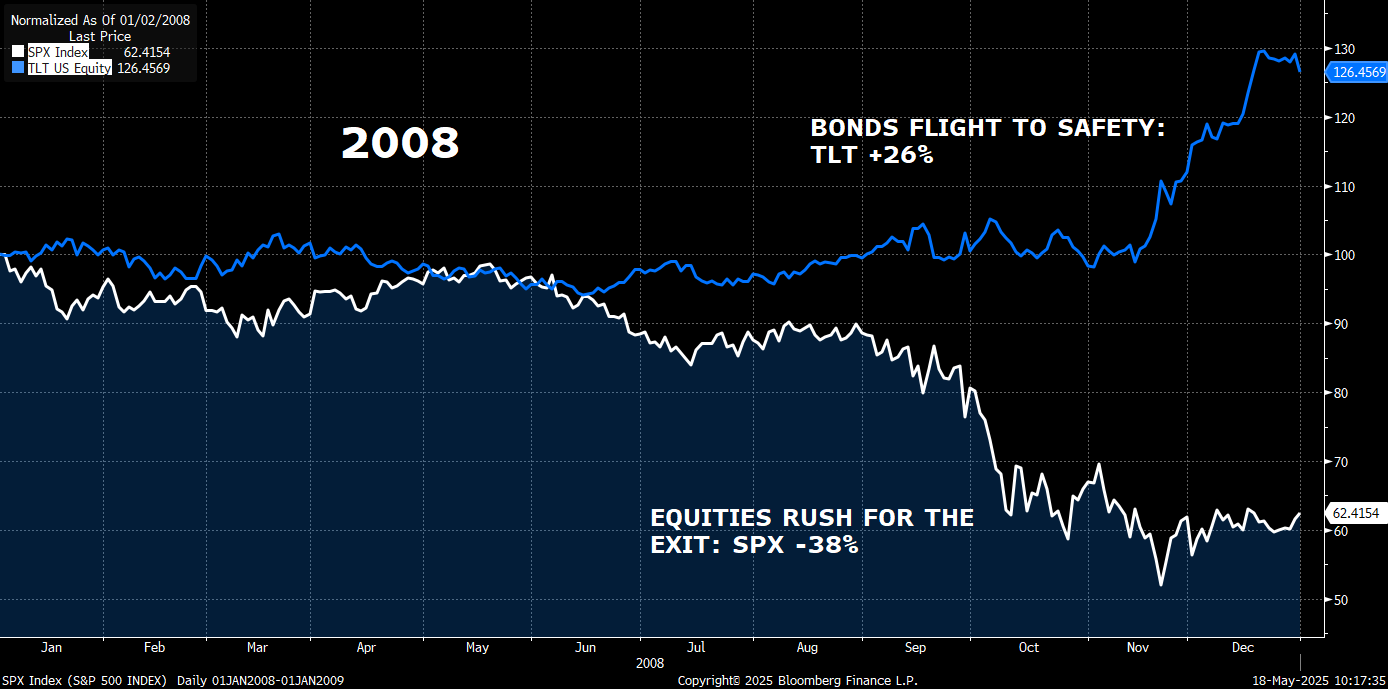

In 2008, you would’ve made +26% holding long-dated Treasuries vs losing -40% being long the S&P!!!

Back in 2011, I was actually dumbfounded that Bonds rallied on the S&P Downgrade, and I wish I had known back then what I know now:

“Recency Bias is strong”: Investors recalled the playbook that worked in 2008 and used it in 2011 —> Buy Bonds as Flight to Safety

“The funniest outcome is the most likely”: This was the first time I recall a “meme” reaction of such scale. I kept it in mind since!

Readthrough to 2025: In 2025, the Recency Bias is to “Buy Equities” … as everyone has figured out that Equities actually go up whereas Bonds are just “financial repression”. The playbook worked during Covid, during 2022, during Liberation Day.

It’s one of those things. It works until it doesn’t! A bit like Nasem’s Turkey!

Reminiscences of the August 2023 Downgrade

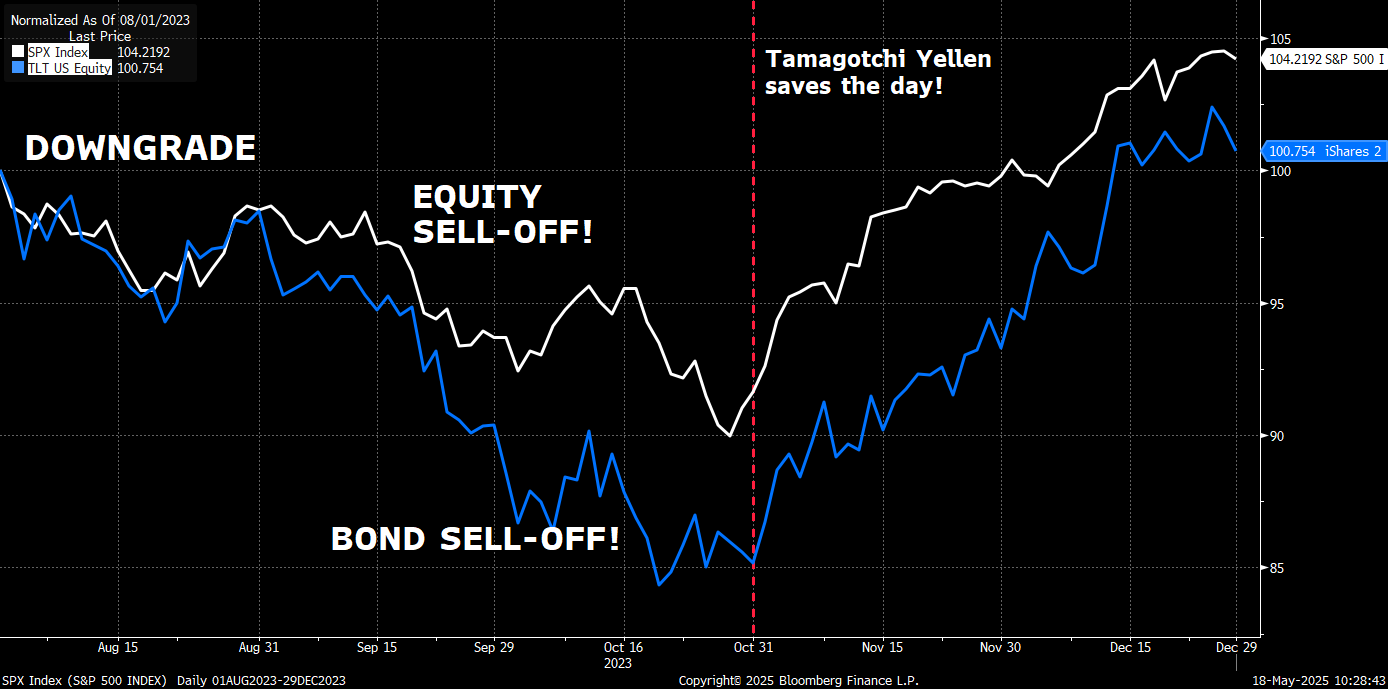

I think we are all old enough to remember the August 2023 downgrade by Fitch, which took place after the QRA was announced.

The S&P sold off 5% over a month and >10% over 3 months. But, unlike 2011, Bonds also sold off by >15%, more than Equities!

I wouldn’t attribute much of that move to the Fitch downgrade, but more to Yellen’s QRA, which increased the coupon issuance significantly and shocked the market.

We were only “saved” when Tamagotchi Yellen (remember her?) flipped and started issuing Bills again in a rate that would make Evita Peron blush.