Commodity Meme Top?

GAG™️ Phase 2 Update

As we laid out in our latest Portfolio Review, we are now in Phase 2 of the Golden Age of Grift aka GAG™️, where a key feature is Currency Debasement.

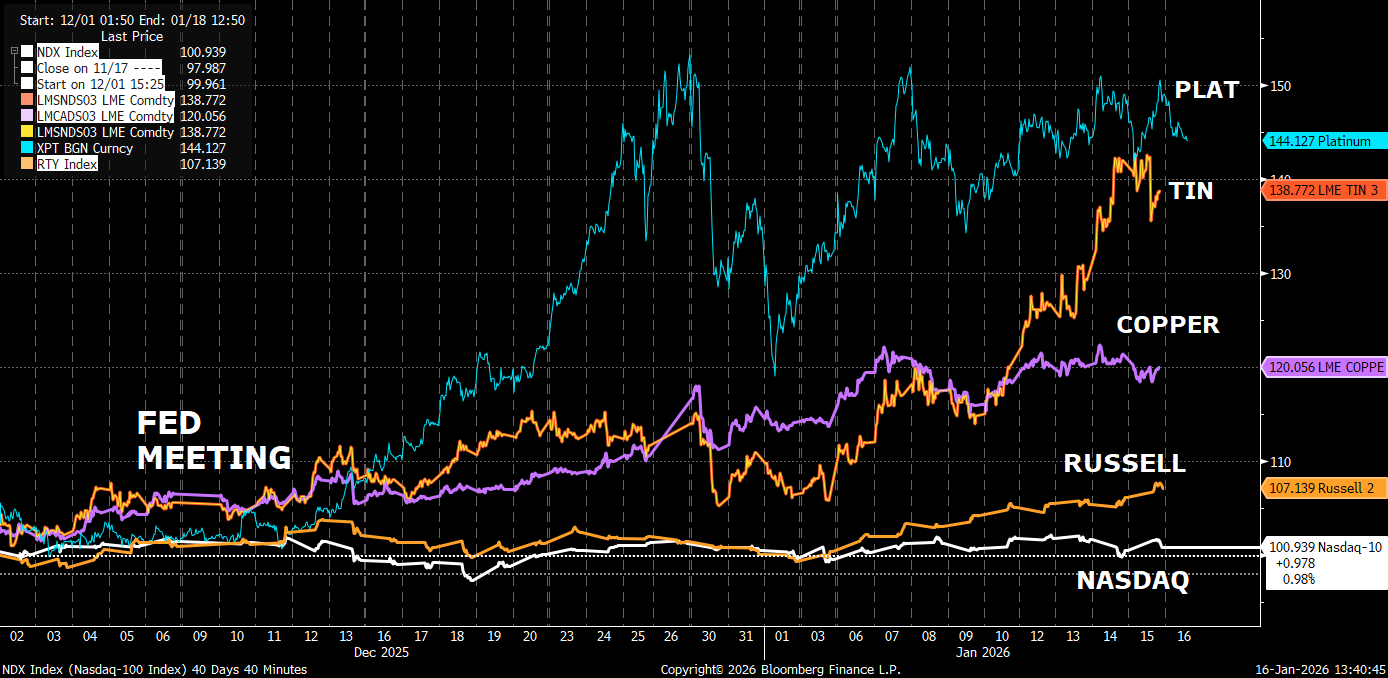

Those who listened were handsomely rewarded, as Commodities have been screaming higher. Since December’s Fed meeting, Tin & Platinum enjoyed a +40% rally and Copper +20%. What did Nasdaq do? FLAT as a Pancake…

… which of course is exactly the scenario we described in our aptly titled piece “The Pain Trade” back in November. Here’s what we wrote at the time:

“Is there a bigger Pain Trade for Market participants and Policy makers alike than Commodity Inflation? Lets answer this with a recent example:

The US wants to spend $3-4 trillion on AI so that I can make better Memes…

…whereas the Chinese nearly ground to a halt the global supply chains by restricting exports of rare earths, which is a tiny $4 billion market!

…then I look at this beautiful chart of the Bloomberg Commodity Index about to take off …..and by the end of writing this, I want to add more to Commodities & Mining stocks!

We give thanks for the great performance of our mining portfolio, our largest sector allocation, where even our “Boomer Mining Stock” is up >30% in under two months.

However, at Shrubstack we are vigilant when we see too many “high-fives” and exuberance across any of our holdings.

Therefore, we need to ask:

Could this be a Top in Commodities?

When will we know to call the end of “GAG Phase 2”?

Since this is a parody publication, we shall leave the “traditional” indicators to others and focus on our own proprietary signals.