Chinese Stonks and Bongs

What goes up goes up, What goes down goes down

I saw a few headlines that got enough of my attention to write a Shrubstack during Boxing Day. Either that or I missed the markets after 3 days off already ;)

Headline 1:

“China Bond Inflow Surprise May Be False Dawn as PBOC Hands Tied: Last month’s rise in foreign holdings was second-largest ever” - Bloomberg

Global investors boosted their holdings in the China’s debt market by 251 billion yuan ($33 billion) last month, the second most on record according to China’s foreign exchange regulator. The increase was nearly six times October’s amount and puts yuan bonds on track to reverse last year’s record outflows of 616 billion yuan.”

Ignore the subjective comments by Bloomberg. The fact is that China’s bond market just had its second biggest monthly inflow ever. $33bn isn’t much but it’s still real money.

We can readily conclude that Yellen’s liquidity tsunami and subsequent yield compression would eventually reach China and benefit the Chinese bond market too. This is a very fair conclusion straight away (chart below: Yellow is the US 10yr yield, White is the China 10Yr yield).

Then the second obvious observation is that Global Stock Markets also benefited immensely from Tamagotchi Yellen’s liquidity tsunami and exhibited a positive Bond / Equity correlation (Bonds up, Stocks up).

The sole (?) exception was China. When we plot the Shanghai Composite Index (SHCOMP) against the Chinese Sovereign 10-year yield we notice that China was the one market where Bond and Equity Correlation remained negative, as per the typical dream-scenario of the 60/40 risk parity portfolio.

We can make a few assumptions why that is:

a) None trusts China

b) China is the number 1 tax-loss selling ‘victim’

c) China is going through a deflationary bust

d) All of the above

Let’s go through these points.

“None trusts China”: Well, I don’t either. I’m tired of saying that I don’t own China equities and only “play” with options, as I don’t trust the system. BUT: we just saw that China’s sovereign market had its SECOND biggest inflow EVER, while its stock market is near its decade lows. So the Equity Investors sold the China Equity Market to the lows because they don’t trust the System but the Bond Investors are buying the China Bond Market in droves only to get a measly 2.5% from a super risky untrustworthy jurisdiction? Hmmm mkay.

“Tax-loss selling”: I have a whole 1% NAV in call options on the Chinese Indices because I think there is some tax-loss selling taking place and that China is beaten-up and “cheap”.

So why do I spend so much time on China if I only have a 1% NAV exposure? Because since the Powell Pivot that was laid out in “Save the Ponzis, Save the Plebs - Part 2”, I have >20% of my portfolio in commodities and commodity-related stocks. And China is the driving force of commodity demand still. Therefore, if the answer to the above is “China is going through a deflationary bust”, then 20% of my portfolio could be in trouble.

Which brings us to Headline 2:

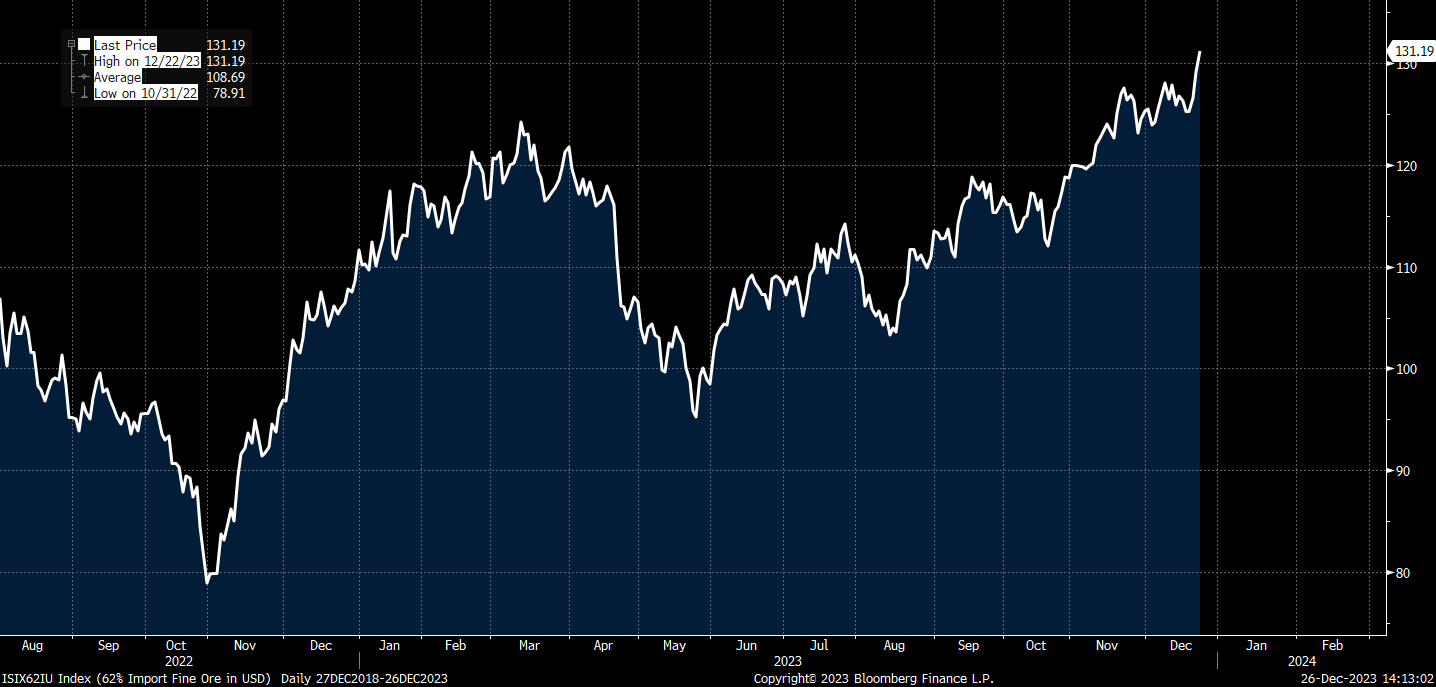

“Iron Ore Surges Past $140 to The Highest Since June 2022”

“Iron ore rallied to its highest since June 2022, showing Beijing’s efforts to stem the property market’s decline in recent months may be paying dividends .. Optimism is building that China’s economic recovery and its steel-intensive property sector are finally gaining momentum”

Iron Ore is the ultimate “China” commodity, given its dominant role in infrastructure and housing demand. And that looks….ok. This may well be a last bout of strength into Chinese New Year and then it may fizzle out. But for now it looks fine, especially given potential for any further stimulus measures in the New Year.

I will take the iron ore chart as “confirmation bias” that the commodity portion of portfolio will be fine for another month at least. I also have this false (?) sense of security that both Xi and Tamagotchi Yellen are working together in my favor at least momentarily.

What about the Chinese Bond Market outperformance vs the Chinese Equity market?

I think the simple answer is that Wall Street likes to make money the easy way:

If it goes up, Wall Street buys. If it goes down, Wall Street sells.

China Stonks go down: sell sell sell

China Bongs err Bonds go up: buy buy buy

Evident deflationary forces re-inforce this trade too.

But as long as they stay away from my commodity stocks for a wee bit longer, I’ll be ok … maybe :/

Disclaimer:

This isn’t financial advice.

This is the trading blog of a shrub.

Don’t be Stupid.

Le Shrub, well reasoned as always. Any chance this is an intra Asian rotation? Japan, Korea for example. India? even.

🤣 Great piece as always! I laughed at the "None trust China" with the Hmmm mkay...that's the only sane way to look at this Circus...