Brazil, "Bro Hugs", Uno Reverse Cards, Meme Tops & Blood Sacrifices

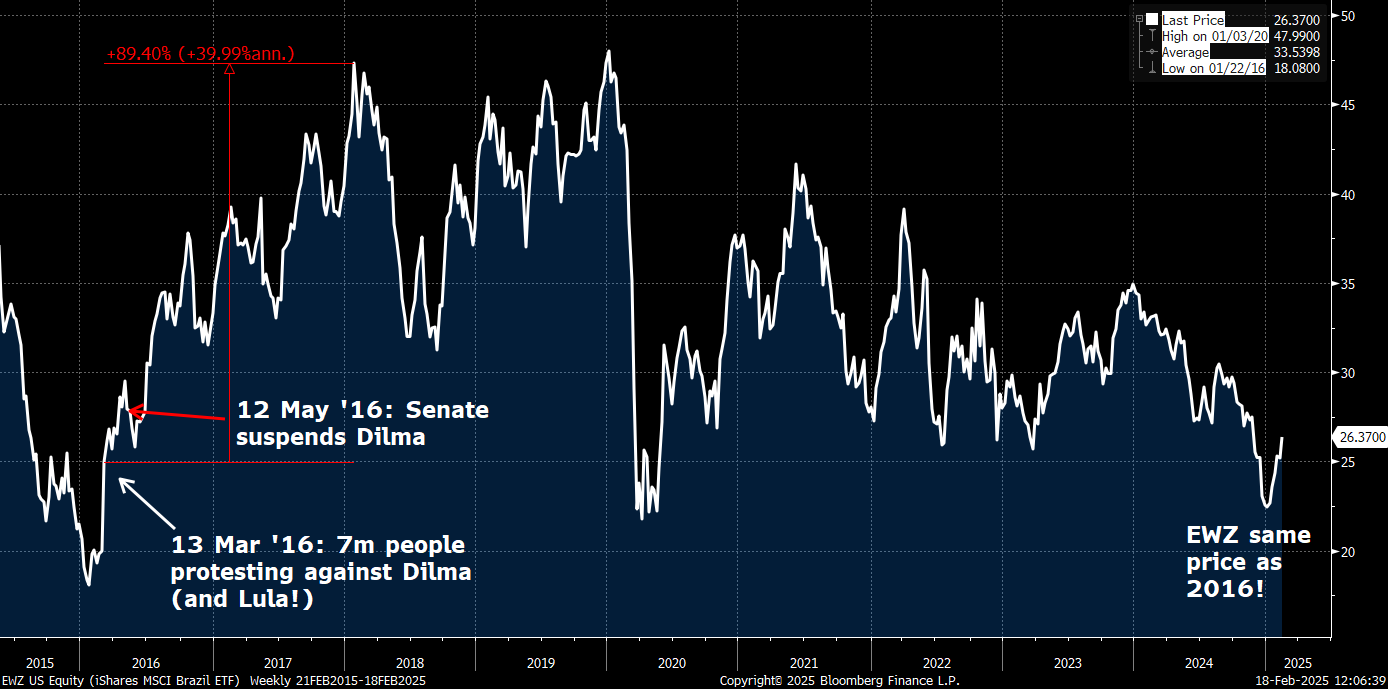

We had “Long Brazil” as a “Trade for 2025”. EWZ, the Brazil ETF, is now +16% YTD.

One of the most common questions I was getting was: “Why long Brazil and not long Argentina?”

The answer was quite simple:

The Brazilian Equity Market is trading at 9x PE and 8% dividend yield and near Covid lows. Brazilian equities are cheap, not priced for recovery and not pricing in the possibility that Lula will get kicked out after the 2026 Elections.

On the other hand, everyone loves Argentina thanks to Milei.

Being “Long Argentina vs Short Brazil” has been a good trade so far:

since 2022, ARGT, the Argentina ETF, is up +170% whereas EWZ, the Brazil ETF, is flat.

But now, every Emerging Market Monkey Fund is long Argentina vs short Brazil as their way of expressing “long Milei Vs short Lula”. 2000-late as always…

The events of the last few days, could be shaking up this consensus view:

On one hand, Milei rug-pulled the crypto community by promoting a memecoin called LIBRA. He later denied responsibility, but boy… he really messed up (article here). The opposition will go after him, though I reckon he will get away with it because the opposition is far worse. So don’t take this as a call to go short Argentina. Not at all.

On the other hand, Lula’s popularity dropped to 24%, his lowest EVER, according to pollster Datafolha (Reuters article here).

Furthermore, a nationwide wave of protests is scheduled for March 16, 2025 across Brazil to demand the impeachment of Lula.

These protests will bring bad memories to Lula and his minions: back in 2016, there were mass protests against then-President Dilma, which were linked to corruption allegations against … Lula! Dilma was kicked out a couple of months later.

Back in 2016, the EWZ ETF staged a +90% rally from the day of the protests and finished 2016 up +60% …

Incidentally, the EWZ is now back at its 2016 level, just as a fresh wave of protests are about to start!

This is all to say that current events, coupled with a cheap valuation, could be setting up for an “Uno Reverse Card” in the Argentina vs Brazil trade:

As I said earlier, I do hope Argentina keeps working and Milei keeps succeeding, so I have no interest in shorting ARGT. But it would be nice to see the same excitement shift to Brazil soon. The March Protests could serve as a catalyst to speed up the eventual fall of Lula before the 2026 Elections, though I doubt it: communists tend to be as resilient as cockroaches. Regardless, Lula will end up severely weakened by the time of the Elections.

In the meantime, we get paid to wait, with the EWZ paying out a 8% dividend…

BABA’s Bro-Hug (ok more of a “Bro-handshake”)

Meanwhile in China:

In a symbolic move, Xi hosted a symposium with Chinese tech entrepreneurs to show his support for private enterprises. This helped continue the momentum in Chinese Tech Equities, partly fuelled by Deepseek.

From our perspective, this historic “bro-hug” between Xi and Jack Ma should be worth at least another +$50 to the BABA share price. Ok, it was more of a “bro-handshake”, so maybe another +$10 will do (can I call it “bro-shake”?).

Westerners sometimes underestimate the importance of symbolism in other cultures. Do recall that BABA’s share price topped out in October 2020 near $320 per share, after Jack Ma publicly criticized state-owned banks at a financial summit. At the time, BABA was looking to launch the IPO of Ant but it was abruptly halted, a decision taken personally by Xi himself.

Therefore, this latest “bro-hug”, or rather “bro-shake”, is an important one:

BABA topped out in October 2020 at $320 per share when Jack Ma dropped from the grace of Xi. BABA’s share price is still down 60% since then

Today, BABA is at $127 and Jack Ma is back in the grace of Xi.

It’s as if Xi handed Jack Ma an “Uno Reverse Card”. I hope Jack knows how to play Uno and uses it wisely this time…

Blood Sacrifice & The Ackman Meme Top™️

People seem to have forgotten that the “March 2020 Covid Low” was marked by Ackman appearing on CNBC in tears and warning that “Hell is Coming”. He subsequently closed all his hedges, pocketed $2bn and moved on to better things.

Then, the “July 2024 Top” was marked by Ackman trying to IPO a $25bn closed-end fund. He subsequently had to pull the IPO after the market suffered a 15% drop (remember Yen-mageddon?).

Bill is back again, this time trying to become a mini-Buffett by turning Howard Hughes (ticker: HHH) into a mini-Berkshire Hathaway, while charging investors 1.5% fee per year, something that Buffett would obviously never do.

Thanks Bill, but I’ll pass.

If anything, I consider this a contra signal: The Ackman Meme Top ™️could be upon us!

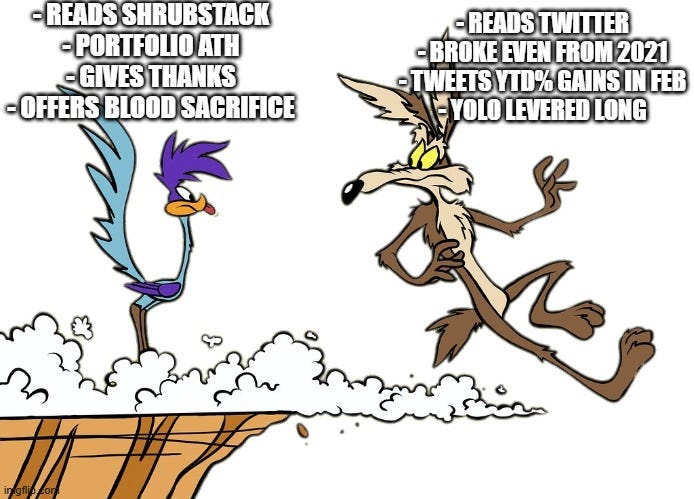

In any case, the Index is quite stretched here and, as is customary, when we are doing well (and we are doing very well!), then we offer tribute to the Gods in the form of a Blood Sacrifice.

I have chosen the following hedges, as I have previously detailed in the Shrubstack threads:

Short Nasdaq NQ futures outright at 22,260 (stop a couple hundred points higher)

Feb 28th NQ 21800 Put for $100 (QQQ equivalent is $530)

March 21st NQ 21200 Put for $145 (QQQ equivalent is 515) for more sensible duration

(Note: Put allocation is 50bps on average and my max is 100bps)

In case you need explaining as to these actions, here’s a Meme to go with it:

Good luck out there!

🌳

Disclaimer:

This isn’t financial advice. This is Parody. This is the equivalent of Monty Python for finance but worse: This is the trading blog of a shrub.

Don’t be Stupid. Seriously. How many times do I have to repeat this ….

Shrub, excellent piece, as usual. As a Brazilian, I remain hopefull that we are close to turning a corner here. You and Paulomacro have written extensively about the opportunity, and I want to thank both of you for helping to add "color", and an outsider´s perspective, to my (biased) analysis. Cheers!

I know I keep repeating myself here, but your meme game is so damn strong. The Roadrunner meme to end this note is just chef's kiss.