2 in a row!!!

At some point it's no longer a coincidence!

Following yesterday’s debacle with NYCB’s dividend cut + loan losses + credibility hit (discussed here), it felt like many punters were quick to call this a one-off and move on with their lives to better things (like buy AIAIAIAI)

In a way, some of NYCB’s woes were idiosyncratic (e.g. capital hit from transitioning to a higher category bank). In another way, it was a reminder that there are still losses to be taken by someone somewhere in the system.

Remember all those sell-side and media reports after SVB / Signature blew up, about the trillions of CRE losses that were to be taken by the financial system? Or the gazillions of mark-to-market losses that remained unrealized on Banks’ balance sheets? (My personal favourite was that Bank of America was insolvent on a mark-to-market basis! Good times). I’m sure there were quite a few banks analysts last night trying to dig those reports out (probably piled in shame in a corner, covered in spider webs!).

Anyway.

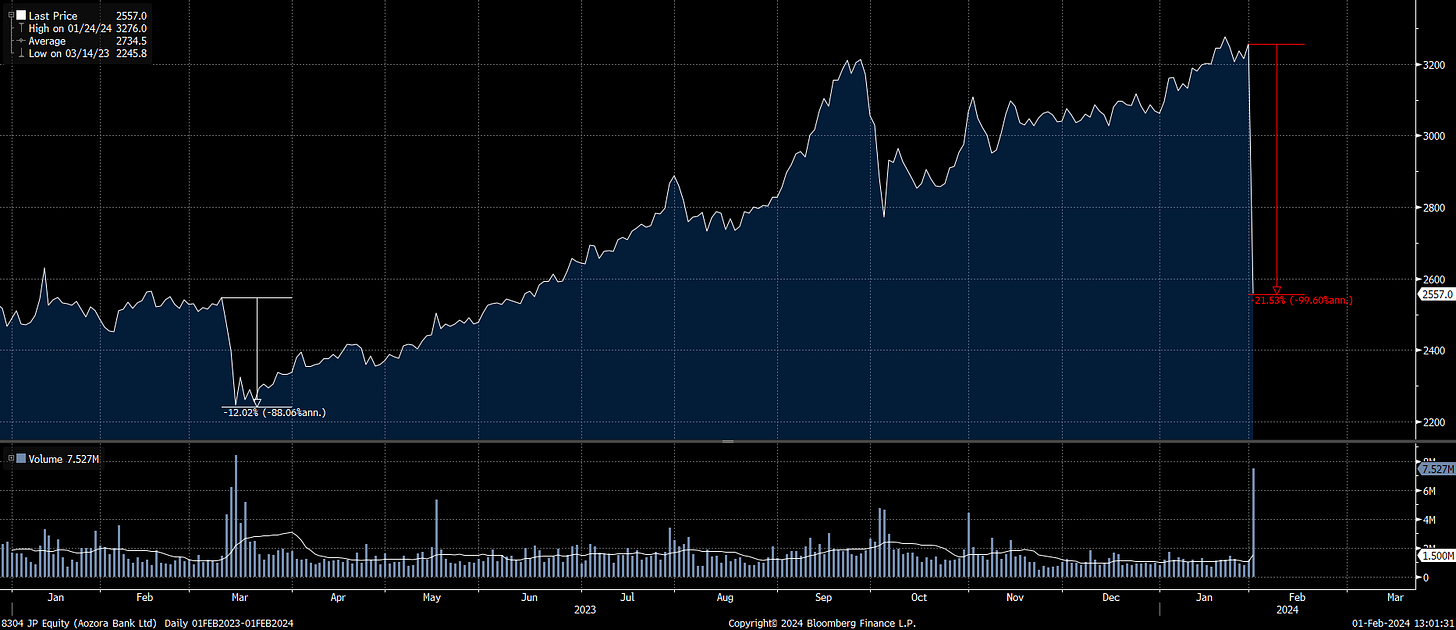

This morning in Japan, Aozora Bank dropped 20% after taking a hit on its US Commercial Real Estate exposure, even though they were saying back in November they didn’t need additional reserves. They cut the value of some of their US CRE loans by up to 50%! Incidentally, this is their first full year loss since … 2009! What happened between now and then?

I tell you what. It’s not those 2 months that screwed them. It’s the 20 years of low rates that made them buy some crappy loans in the US.

This story of a Japanese Bank losing money out of nowhere in US CRE Exposure, brings memories of the German banks that were loading up on subprime in 2008 because the yield was so good ;)

And speaking of Zee Germans, how can the Germans be absent from this latest round of credit losses? Deutsche Bank reported this morning a 4x increase in provisions for its CRE portfolio. At least it’s a small part of their book so thank goodness we won’t have the usual nonsense that “Deutsche is next!”.

All this makes me conclude we will be seeing casualties again. And it will be small and obscure ones, not household names, so if you hear anyone mentioning “Bank of America”, kindly mute them or keep them close as a reliable “contra” indicator.

One such obscure stock is Arbor Financial (ticker: ABR), a provider of multi-family residential bridge loans. Reminder that NYCB’s credit hit was due to 2 loans, one of which was multi-family residential. So this puts ABR in the spotlight.

I don’t like talking about single name shorts, but this is a name that was well-covered by Viceroy Research and they are very public about it, with all the information available on their website (Disclaimer: I’m short, this stock has a 30% short-interest, this can “GME” in your face, don’t be stupid, this is extremely high risk, this isn’t investment advice, this is parody etc etc etc).

What I found interesting is that Viceroy tracks the underlying performance data for ABR’s various CLOs on a monthly basis, from information provided by the CLO trustees. And the latest data shows a pretty quick deterioration in the performance of these CLOs with delinquencies jumping sharply in the last couple of months.

I would like to see more CLO data from other CLO lenders too because this can’t be just another “idiosyncratic” problem. Because If we keep calling every problem “idiosyncratic”, at some point it becomes a trend …

PS Below is the Fed Statement from yesterday. Notice how in the second paragraph they removed: “The US Banking System is sound and resilient”. So of course, this mini “storm-in-a-teacup” banking crisis is playing in the hands of Tamagotchi Yellen as she can now issue as much 10yr paper as she wants at below 4% rates! Yellen wins again!

Disclaimer:

This isn’t financial advice.

This is the trading blog of a shrub.

By now you should know: Don’t be Stupid.

Like, seriously … Don’t be stupid …

I work at a small midwestern CRE investment and development firm with locations in Chicago, Indiana, Nashville, Florida. Overall, credit has been tighter, but not screaming apocalyptic. We still have access to capital and relationships are solid. My guess is the focus on regional banks in total is the wrong lens. CRE is working great in the right geographies and asset classes because low supply, high demand. The problem will be big city financiers of multi-family/office and any fund that simply buys/sells CRE post-development/secondary market. So I guess my opinion is that you need to find the problem companies, and hope that it doesn't set off contagion. If not, regional banking sector will be fine once the bad companies are wiped out.

I posted it at Eli’s chart last week: “Just talked to a buddy of mine, he does private equity, non-traded. Some of the funds stop distributions and there is first “canary”, where fund NAV dropped almost 70% (given they do mostly offices) and they start hitting maturities later in the year and nobody want to refi. I talked to him back in March of last year and generally non-traded have 18 month of distributions on hands and maturities start later this year. And a lot of them will have to refi in 2025. It’s quite possible KRE got a head of itself and JP Diamond will just buy all those small banks for pennies on a dollar financed by US tax payers”