13-F(olly)

Trade ideas can still come out of nonsense filings!

Aaaaah! ‘Tis the season of 13-Fs, where we celebrate stale information about the trades of the Great & Good of the fund management industry.

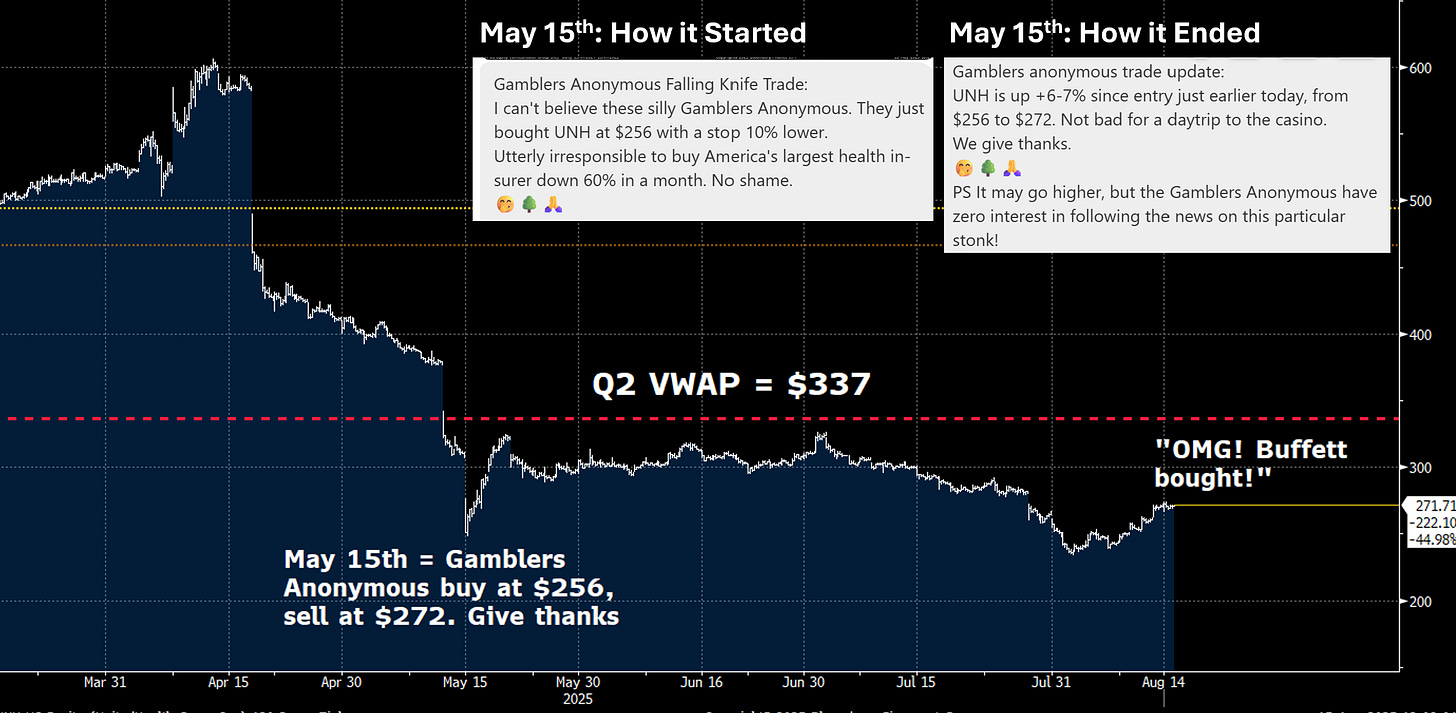

The latest excitement revolves around the disclosure that Buffett bought $1.3bn in UnitedHealth (ticker:UNH), placing him firmly at #32 on the shareholder list, as he allocated the princely sum of 30bps of his total AUM in this trade. Sounds like a Gamblers Anonymous trade to me!

Other prominent investors also disclosed new positions in UNH, including Michael Burry and David Tepper.

On the back of these disclosures, UNH enjoyed a +13% rally in the pre-market.

The irony is that everyone who bought UNH in Q2 is likely underwater in their position as of yesterday’s close of $271, given the Q2 VWAP is $337. (Well, everyone except the Gamblers Anonymous who bought and sold UNH on the same day in May 15th for a nice +6-7% gain!).

Maybe I’m just being bitter for not participating in this latest rally of UNH, or maybe I don’t want to incur the wrath of Luigi. But what I do want to figure out is if there is a trade on the back of this. Luckily, there are a couple!